No products in the cart.

- Latest

- Trending

ADVERTISEMENT

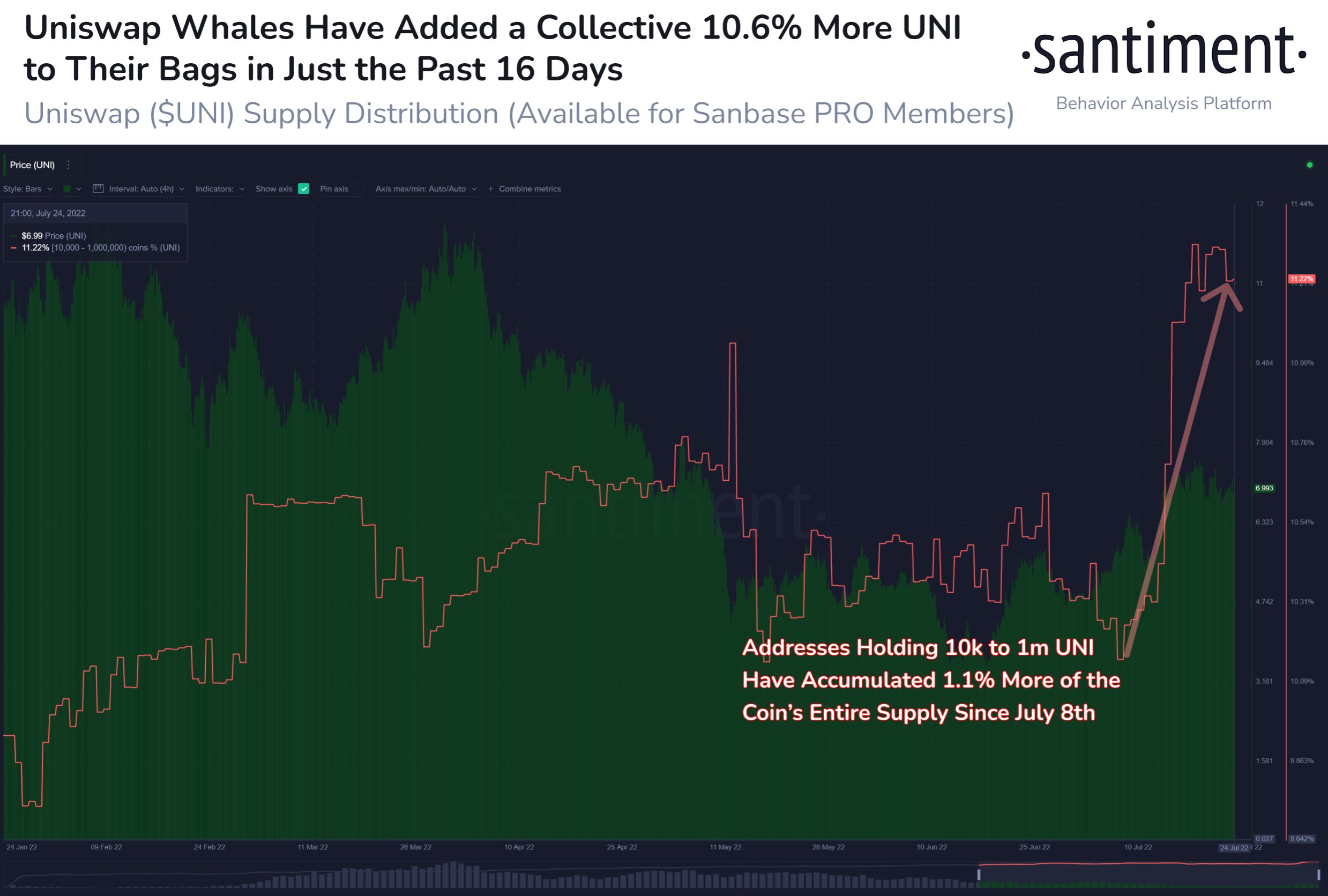

According to analytics firm Santiment, large Uniswap (UNI) holders are accumulating large amounts of crypto assets.

Santiment Note Addressing the holdings of 10,000 to 1 million Uniswap added 10.74 million UNIs to the holdings from July 8th to July 24th. This represents 1.1% of the total supply of assets.

According to analytics firms, the 16-day cumulative total of UNI’s key stakeholders represents more than $ 74.3 million in crypto assets.

Decentralized exchanges (DEX) are also competing with Curves (CRV)’s dominance over decentralized financial (DeFi) spaces.

IntoTheBlock Report Uniswap’s Locked Total (TVL) temporarily exceeded last week’s Curves.

According to analytics firms, Curve has been the top DEX for over a year from a TVL perspective.Since then Regained Although in the top spot, the race is very close between the two DEXs. At the time of writing, Curve’s TVL is $ 5.86 billion, while Uniswap’s TVL is $ 5.85 billion.

The blockchain TVL represents the total capital held within the smart contract. TVL is calculated by multiplying the amount of collateral locked in the network by the present value of the asset.

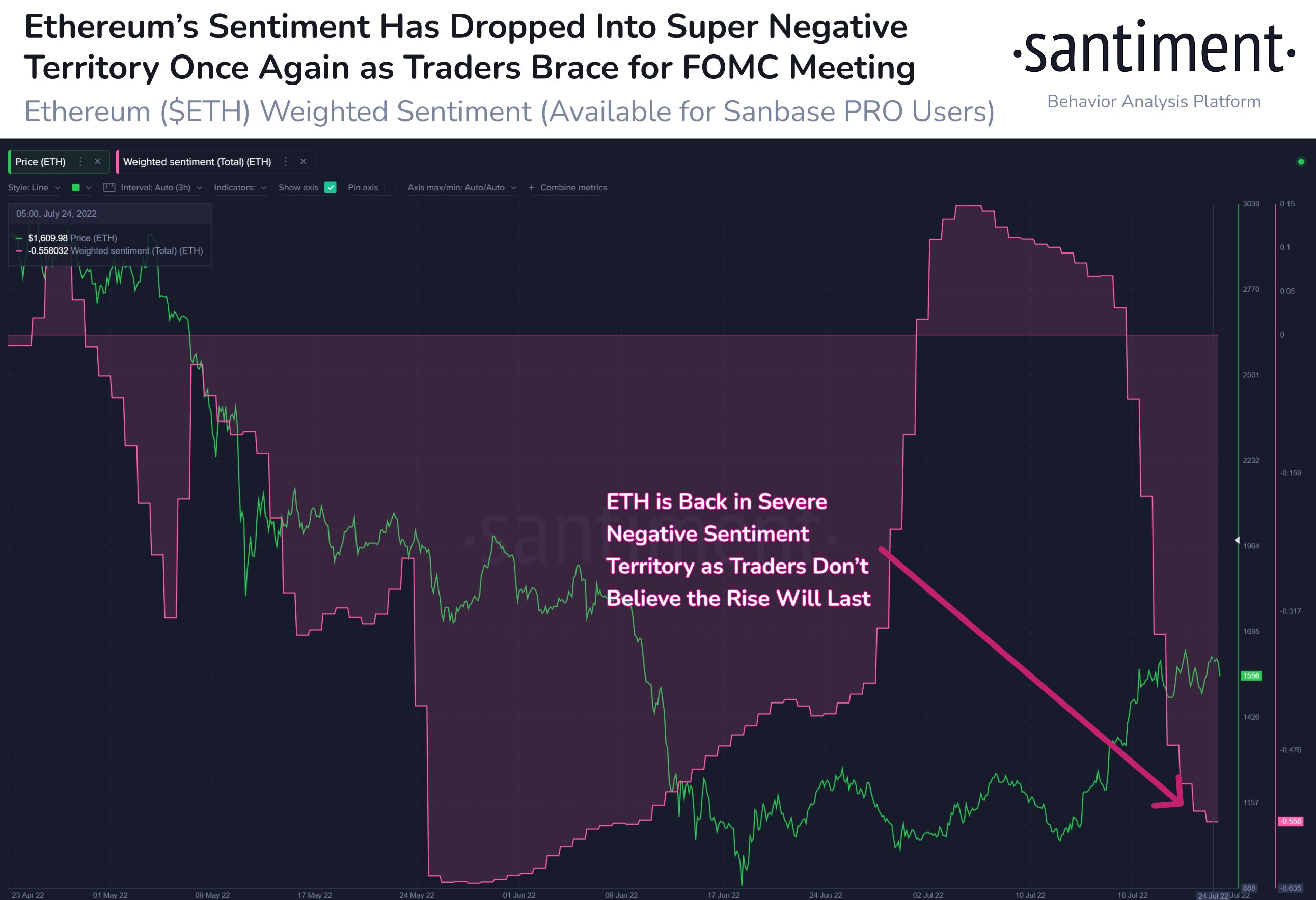

Santiment also predicts that Ethereum (ETH) prices will continue to fluctuate as traders prepare for the upcoming Federal Open Market Committee (FOMC) meeting today.

“Ethereum went up and down on Sunday, surpassing $ 1,640 and then falling to $ 1,540. The trading crowd does not believe in hype, and expects prices to fall towards the FOMC conference. ETH It should continue to fluctuate. “

ETH is trading at $ 1,424 at the time of writing. Cryptocurrency, ranked second by market capitalization, has declined by almost 9% in the last 24 hours.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024