No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Salesforce’s first half 2023 survey of 6,058 financial services institution (FSI) customers worldwide provides key insight into sentiment surrounding artificial intelligence (AI), cryptocurrency and the digital shift in the financial services industry. rice field.

according to Salesforce Financial Services ReportThe survey will be conducted from March 7 to April 12, 2023 and included respondents from 12 countries on five continents.

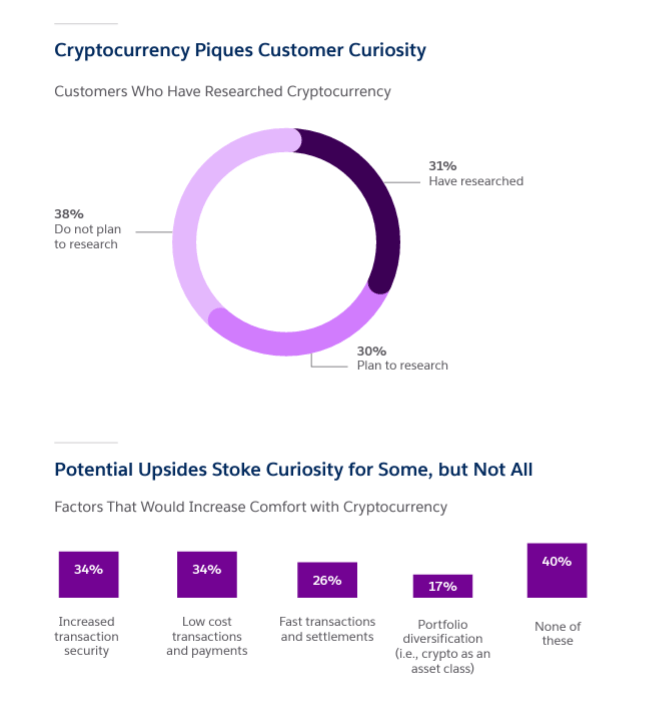

A notable survey finding highlights the growing interest in digital currencies, with 61% of customers having or planning to explore cryptocurrencies. Only 29% of his customers want blockchain digital currency services from financial institutions, even though two-thirds of his customers express interest in digital currencies.

This may be due to perceived gaps in current FSI services, discomfort with emerging technologies, or perhaps a real desire for self-management, as the report indicates that 60% of customers are happy with cryptocurrencies. It may be emphasizing that there is

The survey also revealed that 31% of clients are considering diversifying their portfolios to include cryptocurrencies as an asset class, and 30% plan to diversify their portfolios. Despite the volatility, the data suggests that there is growing interest in cryptocurrencies and their acceptance as a valid part of diversified portfolios.

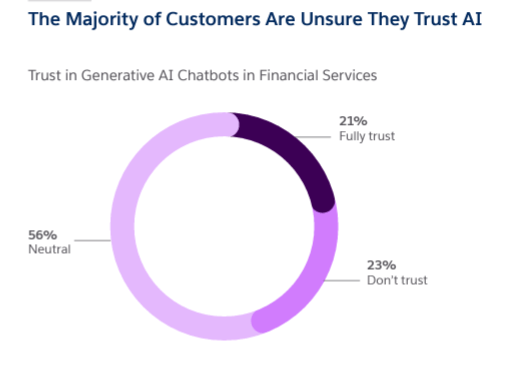

Generative AI has become a hot topic, and consumers are concerned about trusting AI, especially financial services chatbots powered by generative AI. This leaves room for improvement in chatbot integration and intelligence, with chatbots now becoming a major area of digital friction, according to the report.

Only 21% of respondents completely trust AI chatbots, while 56% are neutral. To give context to this data, many experiences will be based on older AI models rather than groundbreaking LLMs such as the GPT-4 API recently released to all customers. It will be interesting to see if the arrival of the next wave of chatbots improves this metric and increases customer trust in chatbots powered by the latest generative AI technology.

The survey also revealed expectations that AI could enhance financial transactions, with a significant proportion (46%) of respondents expressing optimism about AI’s time-saving potential. However, 40% neither agree nor disagree with this statement, suggesting that more needs to be done to get the benefits of AI into consumers’ minds.

Overall, the Salesforce report provides a snapshot of the changing financial services landscape, with consumers increasingly interested in blockchain technology, cryptocurrencies, and AI. This highlights the challenges and opportunities FSI faces as they navigate the intersection of emerging technologies.

Most of the respondents were millennials, with 43% of respondents, followed by Generation X at 25%, Baby Boomers at 20%, and Generation Z at 12%.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024