No products in the cart.

- Latest

- Trending

ADVERTISEMENT

A new report from DappRadar reveals that growth in the metaverse is being driven by demand despite the current bear market conditions.

The report obtained data on land sales and transaction volumes from the third quarter of 2022. While the numbers are still declining, they were small compared to the cryptocurrency market as a whole. The report concludes that demand for Metaverse-related projects is still high enough to drive its growth.

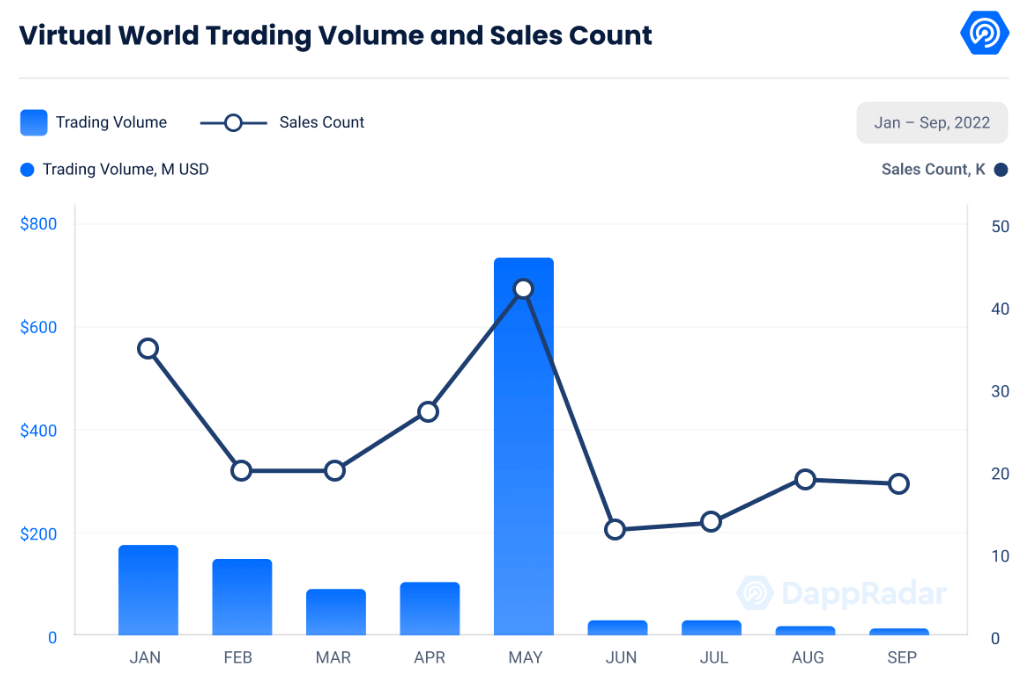

The figure shows that all virtual world trading volume fell by 91.61% in the third quarter of 2022, from $893 million to about $83 million. The report notes that the high transaction volume in the second quarter was largely the result of hype centered around the sale of land on the opposite side.

Meanwhile, the number of land transactions across virtual worlds in Q2 was approximately 52,224. This number he dropped 37.54%, reaching about 32,620 in the third quarter. The report claims that this indicates strong interest in the metaverse.

The report states:

The number of land deals fell 37.54% from the previous quarter to 52,224, indicating that the excitement surrounding these types of projects has not abated, but we are approaching a period of consolidation. .”

The report also examines the transaction volume of the top 10 Metaverse projects, revealing a nearly 80% decrease in transaction volume compared to Q2. However, on average, he appears to be down only 11% in sales volume, supporting the claim that demand for the metaverse remains strong.

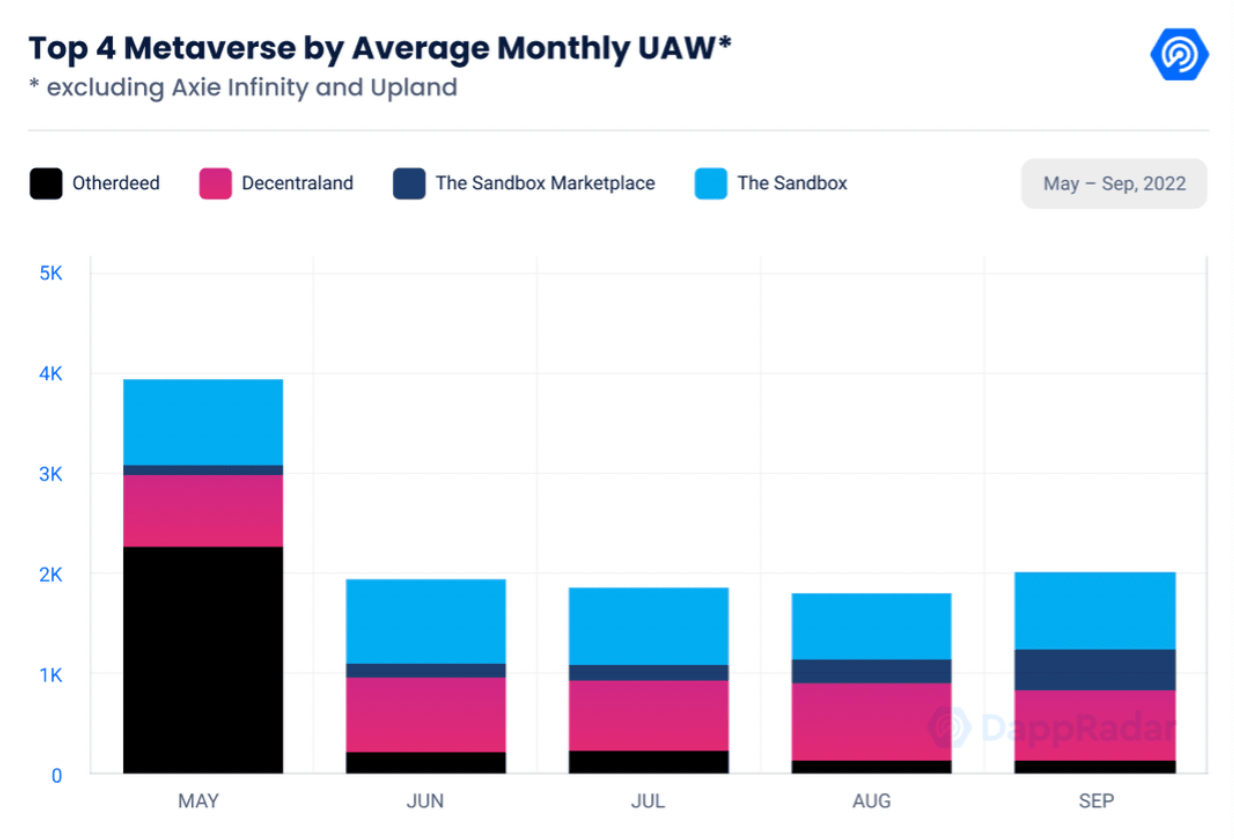

The report also determined the top four Metaverse projects, judging by the number of Unique Active Wallets (UAW) on the platform. The top four, excluding Axie Infinity and Upland, are Otherdeed, Decentraland (MANA), The Sandbox Marketplace, and Sandbox (SAND).

The chart above shows the number of UAWs in the top four metaverse projects. Based on the numbers, Otherdeed was the most popular metaverse in May, while The Sandbox and Decentraland remained in the top three.

Sandbox has maintained an average of 750 UAW per day since May, and activity in the Sandbox Marketplace has increased since then. Sandbox Marketplace UAW registered a 348% increase, reaching 395 in September.

Similarly, Decentraland also maintained the same average UAW number with 792. However, Decentraland also held a series of events in his September, attracting around 56,000 daily active users (DAUs) to the platform. This number increased by 6% compared to his DAU number in August.

Other highlights of the report show that demand for ENS domains, investment in building the metaverse, and adoption of large brands have also increased.

Through September, a total of 437,365 users registered new ‘.eth’ domains, an all-time high. The previous ATH he recorded in July was 378,805, which represents an increase of more than 13%.

In the third quarter of 2022, Blockchain Games and Metaverse projects received a total of $1.2 billion in funding. Blockchain Games and Metaverse received the most funding at $462 million, making up 38.5% of his total.

Metaverse infrastructure investments came in a close second, attracting $402 million, or 33.5% of the total.

Become a member of CryptoSlate Edge to access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

price snapshot

more context

Register now for $19 per month

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024