No products in the cart.

- Latest

- Trending

ADVERTISEMENT

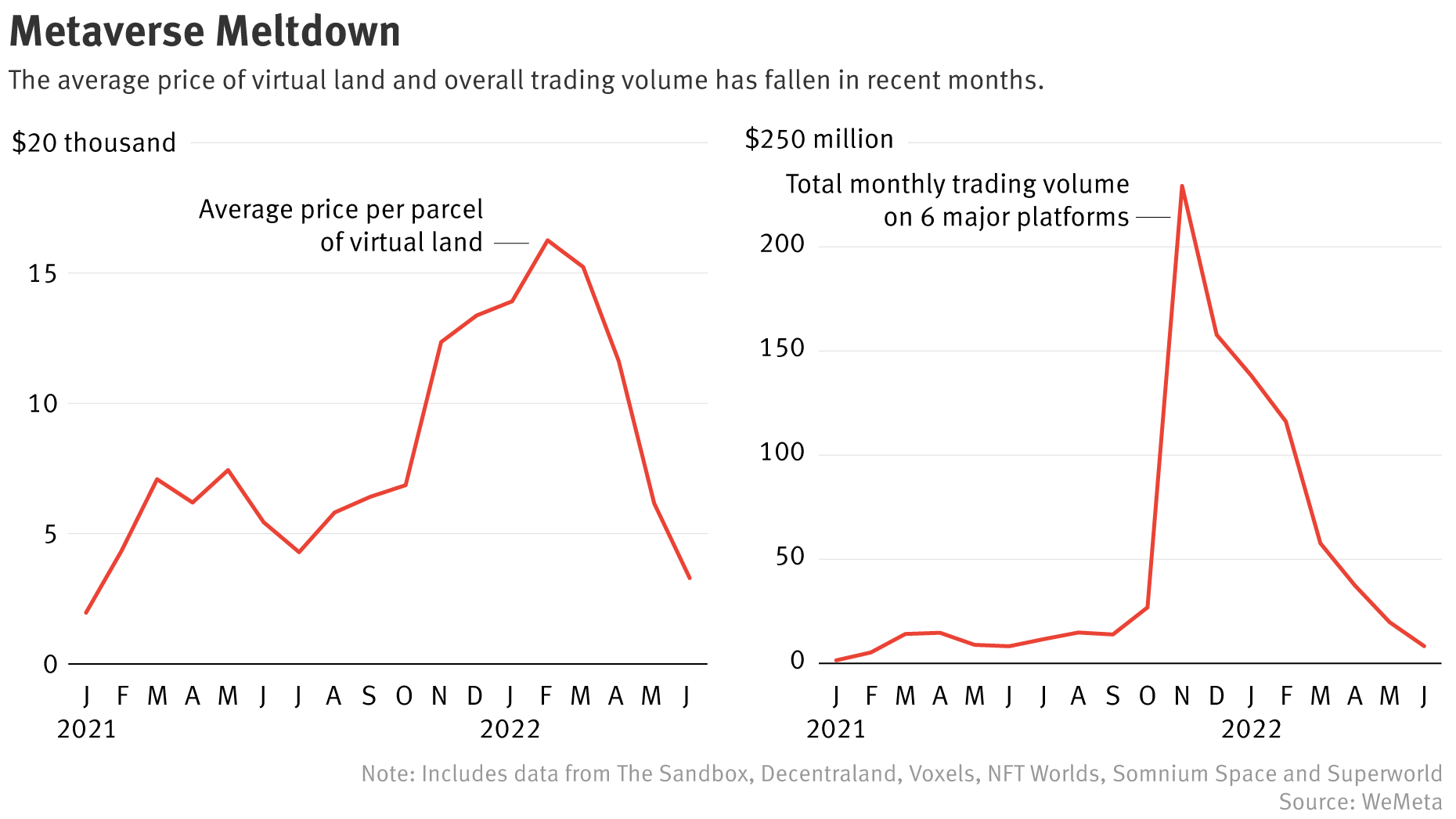

According to an analysis conducted by Metaverse, the average price and trading volume of virtual land in the Metaverse collapsed amid the broader recession in the cryptocurrency market. information.

Average virtual land prices have fallen by more than 80%. At the same time, trading volumes are down more than 90% from their November 2021 highs.

This information was provided by WeMeta and compiled from data from the Sandbox, Decentraland, Voxels, NFTs Worlds, Somnium Space, and Superworld platforms.

Not too long ago, the Metaverse virtual land was touted as the next big thing. The growing interest has sparked a rush to acquire prime locations, mirroring the real estate market.

For example, recently in February, an investor paid $450,000 for a virtual plot next to Snoop Dogg in Snoopverse running on a sandbox platform.

This push is largely due to Facebook’s rebranding as Meta in November 2021. Meta CEO Mark Zuckerberg has called the Metaverse the next frontier for connecting people. Specifically, he envisioned virtual worlds as fundamentally changing the way society works. Including innovative concepts such as metaverse businesses that provide employment.

However, as the crypto winter deepened, average prices and interest rates plummeted, leaving top buyers with heavy losses.

The crash has reopened the debate on whether virtual land is a true investable asset. As Fortune mentioned, the Metaverse incorporates instant teleportation to any location. Then, unlike the real world, there are few merits to buy in a prime location.

Additionally, Metaverse lands can be infinite, and virtual land ideas pay off as scarce resources.

However, the Metaverse Land Cooperative air dot Why isn’t the real world affecting the virtual world? They added that they are “patiently waiting” for things to pick up.

It’s all about planning.

Why aren’t macros affecting the liquidity of the virtual land market like they are in other markets?

In our opinion, the opportunity is not far off and we are waiting patiently.

I grabbed this chart from @macroalph#airdot #metaverse #NFTs pic.twitter.com/Ok7YU1dtAn

Airdot (@airdottdao) August 8, 2022

Over the past two years, real estate prices have risen furiously due to buyer demand. But some real estate experts now say the boom is over as rising inflation weighs on household budgets and threats that the central bank will continue to raise interest rates.

According to a recent article in The Guardian, sales of new homes in China are plummeting. At the same time, average home prices in the US market plummeted in his June.

Become a member of CryptoSlate Edge to access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

price snapshot

more context

Register now for $19 per month

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024