No products in the cart.

More than 100,000 Bitcoins (BTC) have been transferred to self-custody storage since the beginning of the year, according to data analyzed by Glassnode. crypto slate.

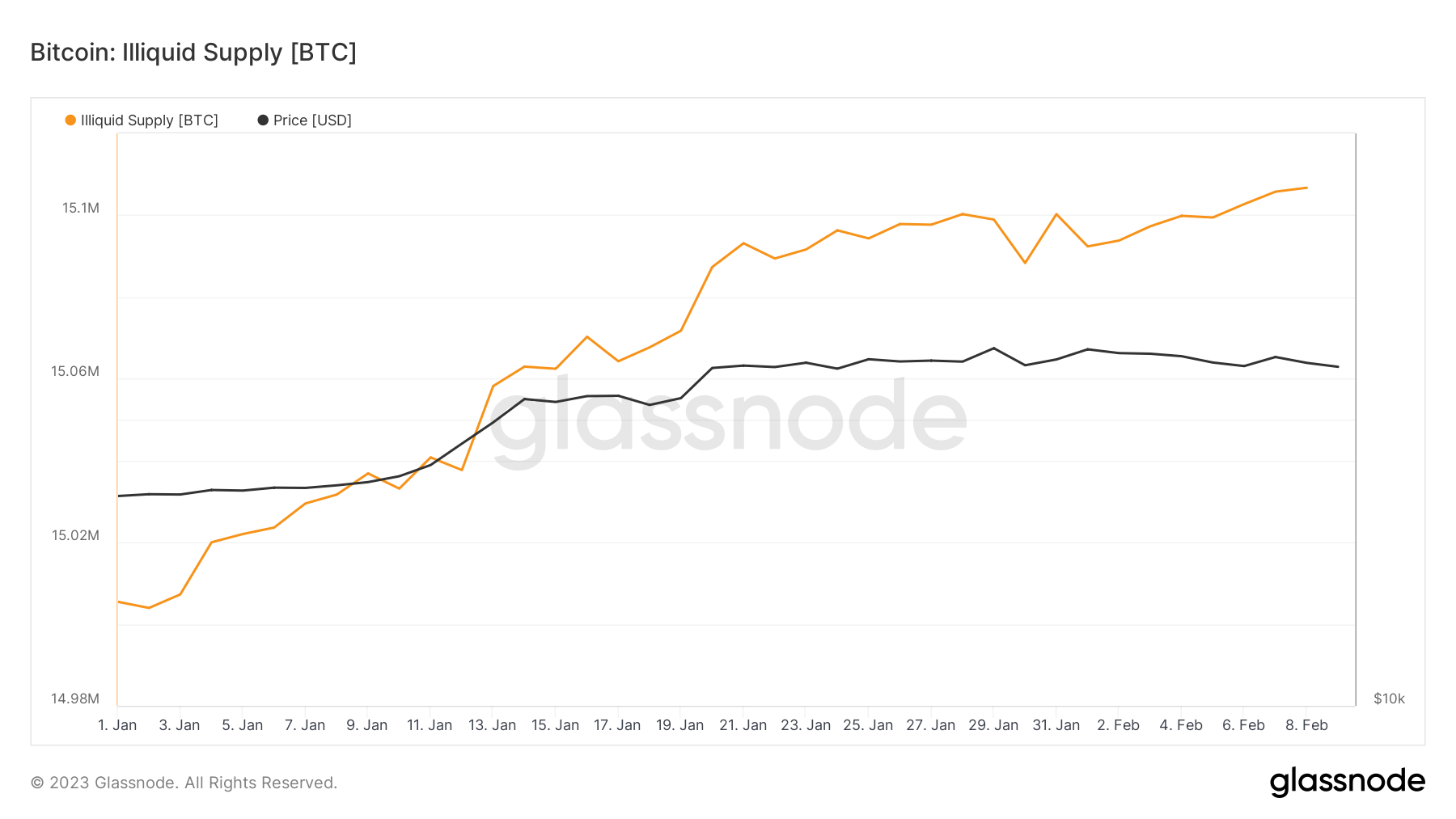

The chart below shows the amount of illiquid BTC in the orange line from early January.

According to the chart, the illiquid supply of BTC was around 15 million at the beginning of the year. Around 70,000 BTC were transferred to self-management during January. The move continued into his first few weeks of February, when his total illiquid BTC supply exceeded 15.1 million.

Change in illiquid supply

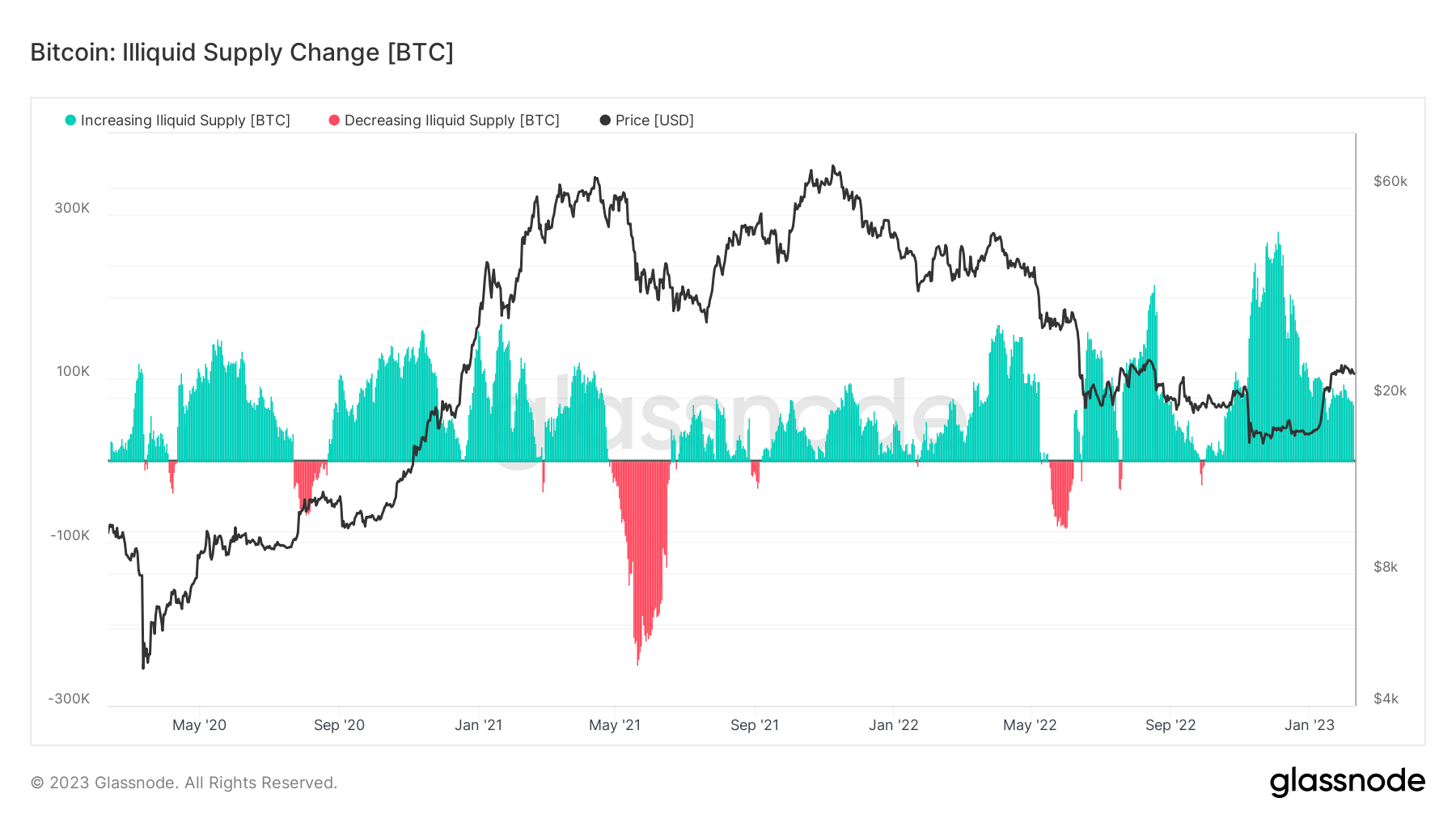

The chart below shows changes in illiquid BTC supply with red and green zones respectively. The green zone shows the dominance of the movement towards self-custody storage, while the red zone shows the opposite.

BTC has mostly moved to self-custody storage since early 2020, except for a brief period when the reverse trend was recorded. May 2021 marked the largest move in opposition, and May 2022 recorded his second most aggressive move to the exchange.

These moves coincide with a significant bear market in cryptocurrency history. In May 2021, BTC lost more than 40% of its value and an investor could move his BTC to an exchange and sell it. According to the chart, over 250,000 BTC were transferred to exchanges at that time.

However, during Terra’s collapse in May 2022, the movement to exchanges was much smaller in comparison.Although a certain number of investors brought BTC to exchanges, the amount was 100,000 BTC. was barely reached. This difference suggests that investors tend to hold positions rather than exit in moments of fear.

Posted In: Bitcoin, Analysis