No products in the cart.

- Latest

- Trending

ADVERTISEMENT

According to June 29, the cause of current market volatility and liquidity issues for companies such as Celsius and Three Arrows Capital may be directly related to Ethereum (ETH) bet on Lido. report According to Nansen, an analyst on the impact of stETH / ETH Depeg on the crypto industry.

When Ethereum is bet on ETH 2.0 through Lido’s investors, they will receive an ERC-20 token named stETH. This token is redeemable and one stETH can be exchanged for one ETH after Ethereum has moved to Proof of Stake and merged with the Beacon Chain.

However, investors can also post stETH as collateral on sites such as Aave to borrow ETH. This borrowed ETH can also bet on Lido to receive more stETH. This yield loop increases ETH staking rewards, but puts investors at risk if 1st ETH is not equal to 1 ETH. Lido promoted this strategy through a Twitter post in March.

2) Leveraged ETH staking

With stETH on Aave, you can take advantage of ETH staking to maximize your staking returns.

1. We will provide stETH as collateral.

2. Borrow ETH to stETH.

3. Return the borrowed ETH to more stETH.Repeat this process as long as your risk profile allows.

Lido (@LidoFinance) March 1, 2022

Nansen emphasized that during the UST Depeg crisis, the bETH depositor (a wrapped bridged version of stETH on Terra) returned the tokens to the Ethereum mainnet for fear of network stability.The report states: The 615,980 bETH was bridged back to Ethereum during this time and unwrapped to stETH.

According to this, it was this stETH that Nansen claimed to have subsequently been sold back to Ethereum, and began to put pressure on the stETH / ETH pegs. Available data On that platform. An increase of 567kstETH was added to Curve’s stETH / ETH pool, creating an imbalance that forced Lido to take steps to attempt to restore the pegs.

As investors became worried about the situation, a large net outflow occurred, and Nansen said Three Arrows Capital was one of the largest recipients of stETH from the curve.The outflow of three arrows is reportedly total 9724st ETH and 486WETH.

Nansen said as the prices of Ethereum and the broader crypto market generally began to fall.

“The addresses flagged as Celsius and Three Arrows Capital are the largest withdrawals, removing approximately $ 800 million worth of liquidity (236kst ETH and 145 kETH, respectively) on May 12.”

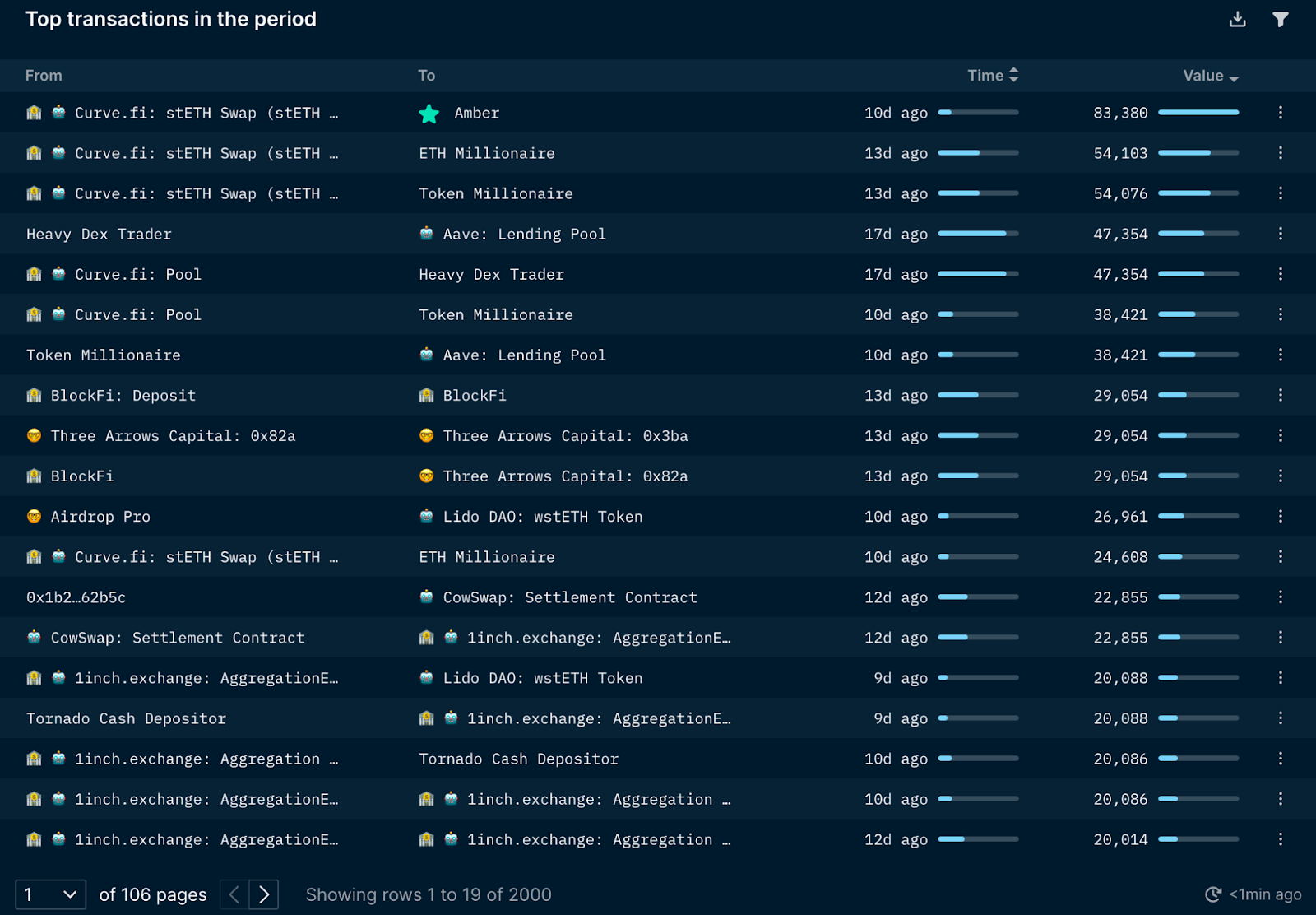

“These transactions are Most influential on the first deviation from the ETH price. The following transaction is the top wallet that transfers stETH between June 1st and 12th.

From the wallet above, Nansen analyzed individual transactions and revealed that Amber Group, Celsius, Three Arrows Capital, and some whale wallets all moved a serious amount of stETH during this period. .. The Amber Group and Celsius moved stETH to FTX with the possibility of OTC trading because FTX’s stETH liquidity was too shallow to sell tokens without causing a huge slip. Nansen also revealed that Celsius used a large stablecoin loan from the compound to “probably respond to redemptions.”

After Celsius suspended the withdrawal, 108.9 ETH and 9,000 WBTC were sent to FTX, originating from one of its major wallets. According to Nansen, the wallet is “the top lender / borrower of ETH (including WETH and stETH) and WBTC collateral in both Aave and Compound, with a total collateral value of approximately $ 1 billion.” is.

Three Arrows Capital “withdrawn a significant amount of 29,054 stETH from BlockFi” on June 7th and deposited it between Lido and Aave. Another 3AC wallet used some of the funds removed from BlockFi as collateral, borrowed 7,000 ETH from Aave and sent it to FTX. The following week, 3AC made several more transactions with a deposit between FTX and Deribit. Deribit is one of the largest options and derivative trading platforms in cryptocurrencies. Depositing funds on this exchange may repay your margin or open a new derivative contract.

Nansen announced on June 13 that 3AC has begun selling its assets.The wstETH was unpacked for stETH and sold for wETH via CowSwap. “Total 49,021st ETH. 3AC sold tens of thousands of stETH for ETH and Stablecoin in the next few days, resulting in the termination of the stETH position.

The report concluded that Celsius had liquidity issues and the need to sell and transfer stETH led to the domino effect. 3AC was a “victim of transmission” and was not the first cause of stETH / ETH depeg. Nansen said 3AC “is most likely to mitigate risk and accept losses.” In contrast, Celsius mitigated risk: “Unless the collateral price drops sharply by more than 30%, their health ratio is still decent in the context of things.”

Become a member of CryptoSlate Edge and access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

Price snapshot

Other contexts

Join now for $ 19 per month Explore all the benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024