No products in the cart.

- Latest

- Trending

ADVERTISEMENT

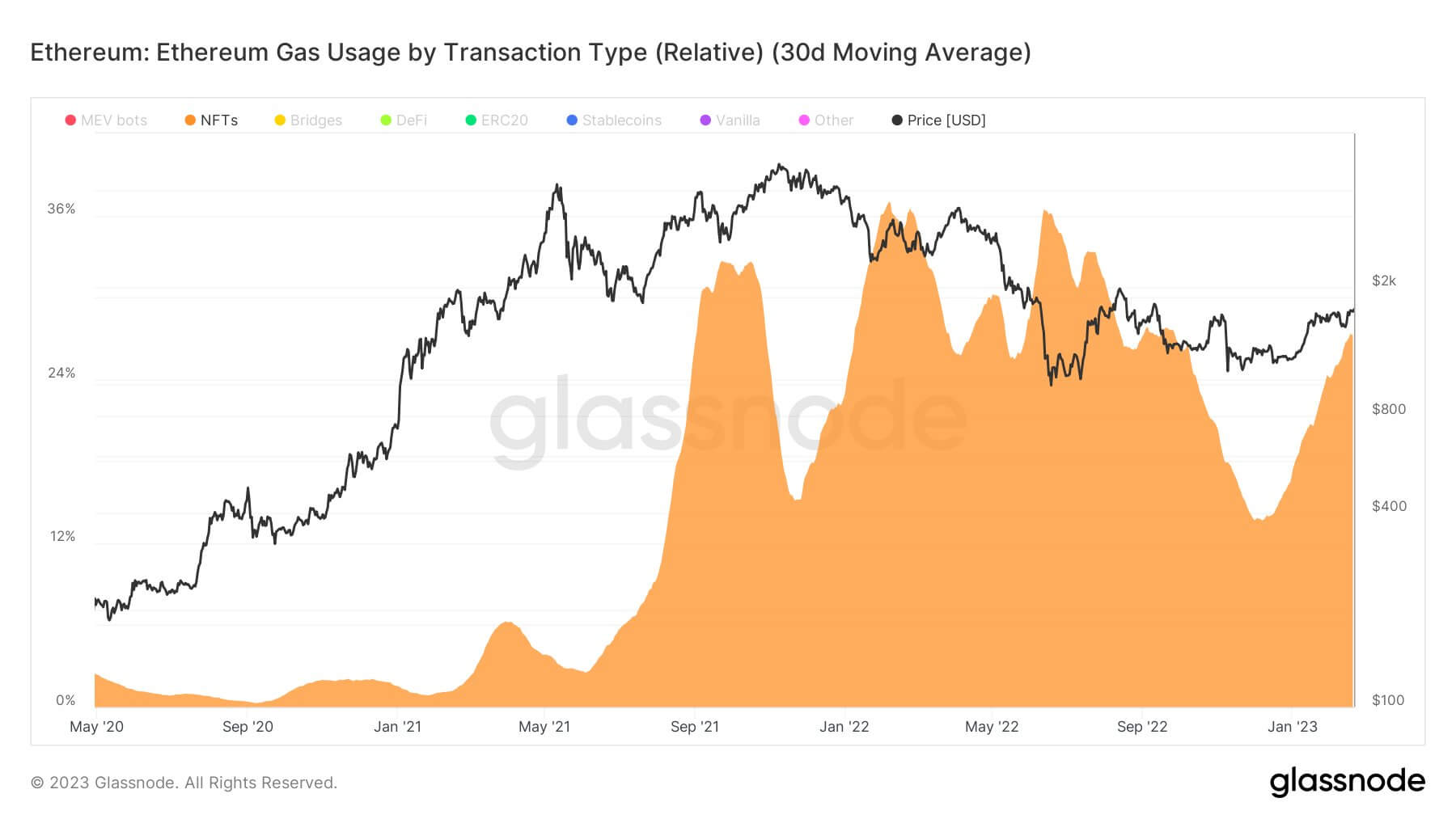

New chart showing Ethereum Gas usage by transaction type compared to 30-day moving average shows NFTs account for 27% of Ethereum Gas usage, up from around 15% towards the end of 2022 .

In Ethereum, gas is a unit of measurement that determines the amount of work required to execute a transaction or smart contract on the Ethereum network. Gas prices are denominated in Gwei, a subunit of Ether.

The amount of gas used in an Ethereum transaction depends on the type of transaction. For example, a simple transaction like sending Ether from one account to another requires less gas than complex smart contract execution or multisig authentication.

An NFT (Non-Fungible Token) is a type of digital asset that represents ownership of unique items or content, such as artwork or game collectibles. NFTs are becoming more and more popular on the Ethereum network, and according to recent data, NFTs currently make up a significant portion (27%) of Ethereum’s total gas usage.

However, a new market competitor has recently upended the NFT market, which analysts point to as the reason behind the recent surge in NFTs as a percentage of ETH gas usage.

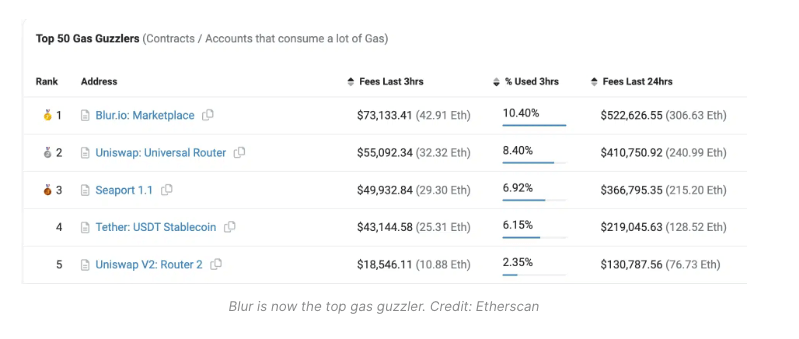

This week, new NFT marketplace Blur surpassed OpenSea in daily NFT trading volume, surpassed UniSwap and Seaport, and became the leading Gas Guzzler on the Ethereum network.

February 15th (Wednesday) Blur Daily trading volume It reached 6,602 ETH, surpassing OpenSea’s 5,649 ETH for the first time. The achievement caused Ethereum gas prices to skyrocket as trading activity surged.

according to crunch baseBlur is valued at $1 billion and has raised $11 million in seed funding from Paradigm, Coinbase Ventures and E-GIRL Capital in its first round in March 2022.

Blur offers users attractive benefits such as zero transaction fees. This is the main factor likely contributing to the increase in gas usage.

The platform released its native token, BLUR, on February 15th, offering token airdrops to its most active users. Although the price fell 84% as a result of the airdrop, Blur’s trading volume increased significantly. The platform airdropped a total of 360 million of his BLUR tokens as of yesterday, hitting a record high of $1.59 billion in unique trading volume.

According to DappRadar, Blur surpassed OpenSea in both 7 days ($435.24 million) and 30 days of trading volume ($711.83 million).

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024