No products in the cart.

- Latest

- Trending

ADVERTISEMENT

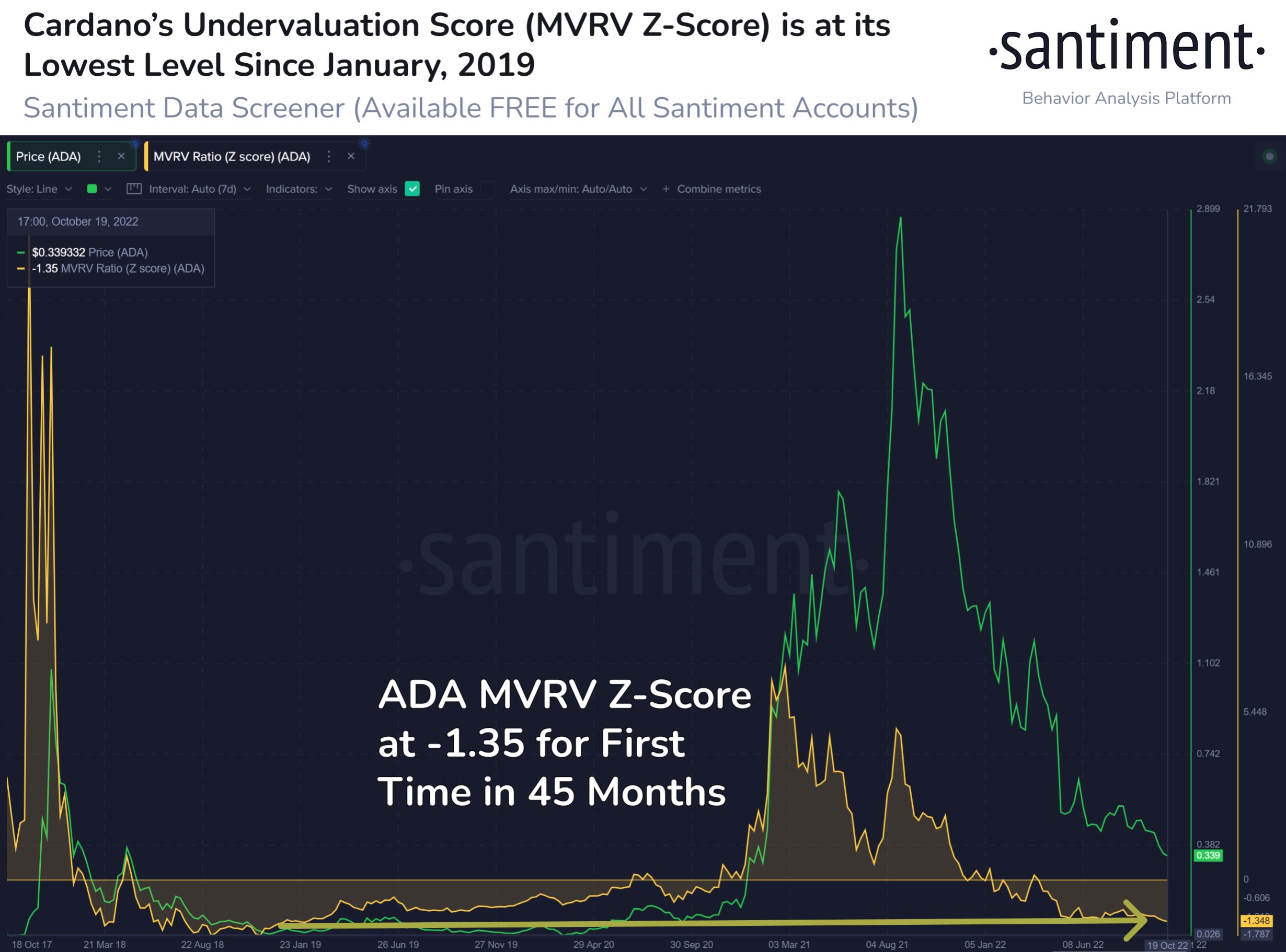

Crypto analytics firm Santiment says Cardano’s on-chain signals show that ADA is currently trading at a significant discount.

Santiment looks at Cardano’s MVRV Z-Score. It compares an asset’s total market capitalization to its total realized market capitalization.

Traditionally, a low Z-score indicates an asset is undervalued. Santiment said his MVRV Z score on the ADA is at his lowest level since January 2019.

Cardano is currently at its lowest relative value compared to realized value since January 2019. This is a sign of undervaluation based on average trader losses. The MVRV Z-score doubled over the next three months when it reached this level.”

At the time of writing, ADA is trading at $0.34, down more than 88% from its all-time high.

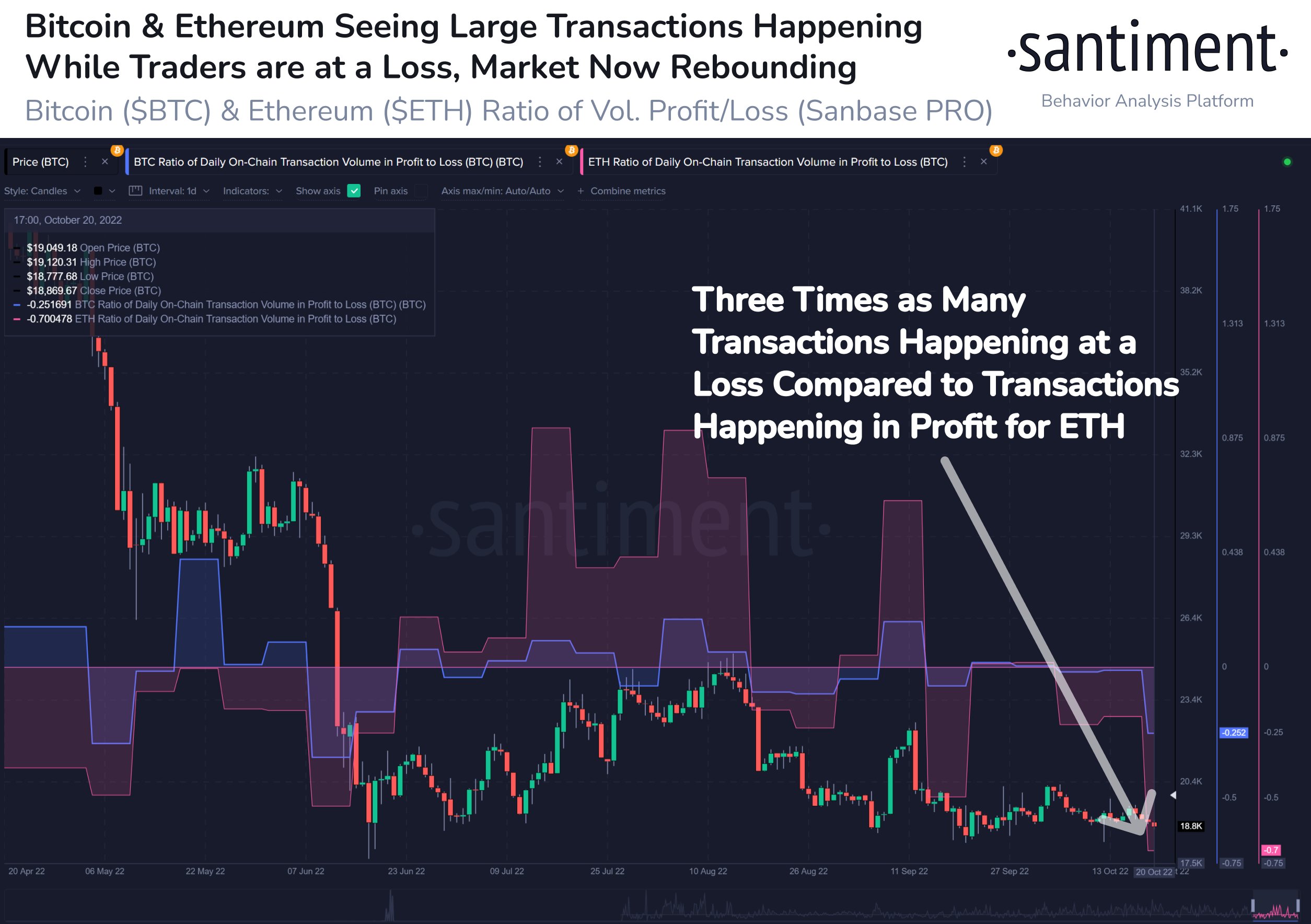

The analytics firm also says the entire cryptocurrency market is showing signs of capitulation, with many traders closing their positions at losses. A surrender could potentially start a market rebound, according to Santiment.

Signs of capitulation have appeared on Friday, including from addresses that trade assets while suffering losses. We have reached a very low level.

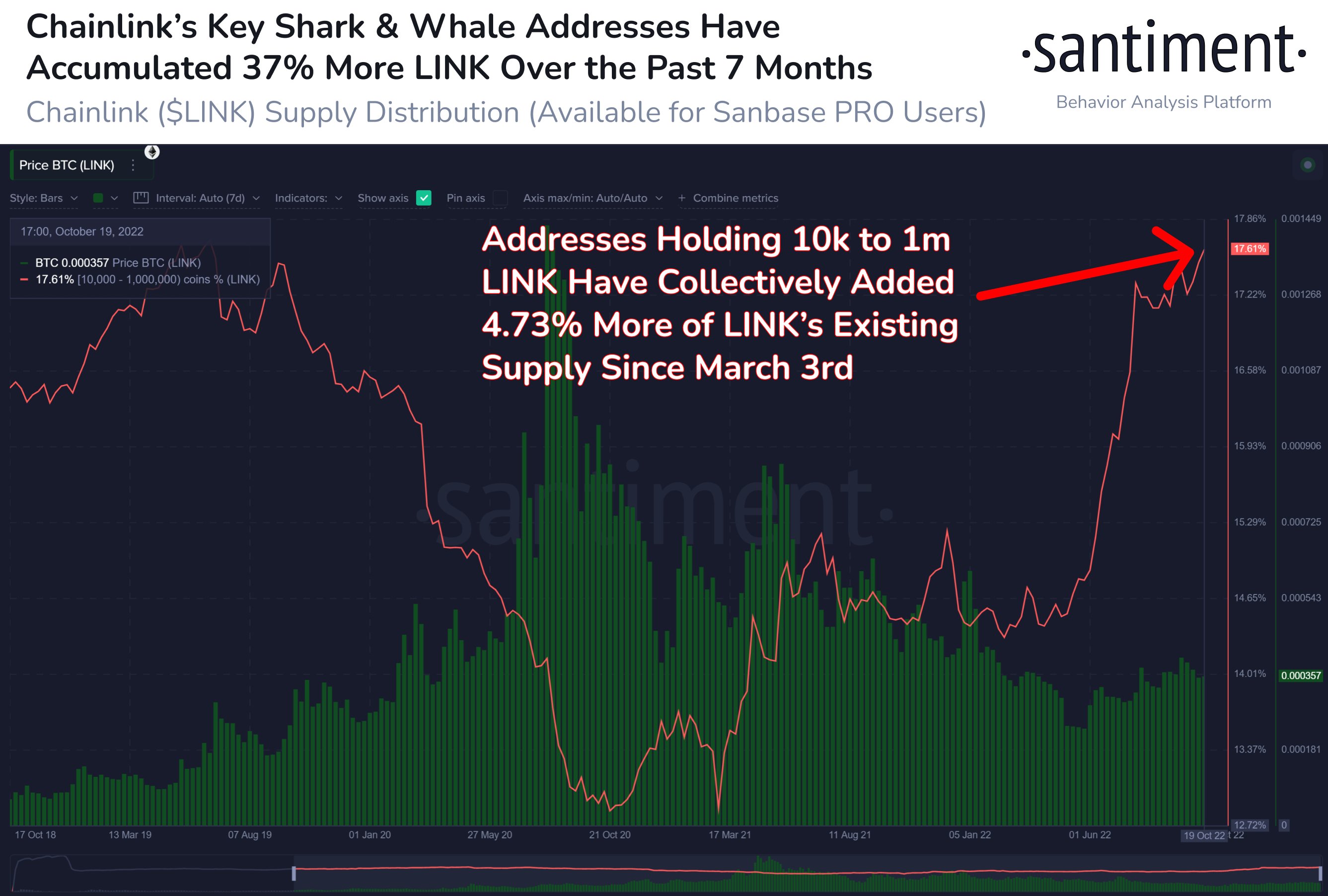

While many crypto assets are showing signs of surrendering, Santiment has also documented the accumulation of large amounts of altcoins by well-heeled investors.

Last week, the company said large investors in its decentralized oracle network Chainlink had amassed more than $312 million worth of LINK since the start of the 2022 bear market.

Chainlink shark and whale addresses (holding between 10,000 and 1 million LINKs) have been busy accumulating during the 2022 bear market. added, which represents an additional investment of $312.7 million.

Don’t miss a beat subscribe to get encrypted email alerts delivered straight to your inbox

Price action confirmation

Please follow us twitter, Facebook When telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Bruce Rolff

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024