No products in the cart.

- Latest

- Trending

ADVERTISEMENT

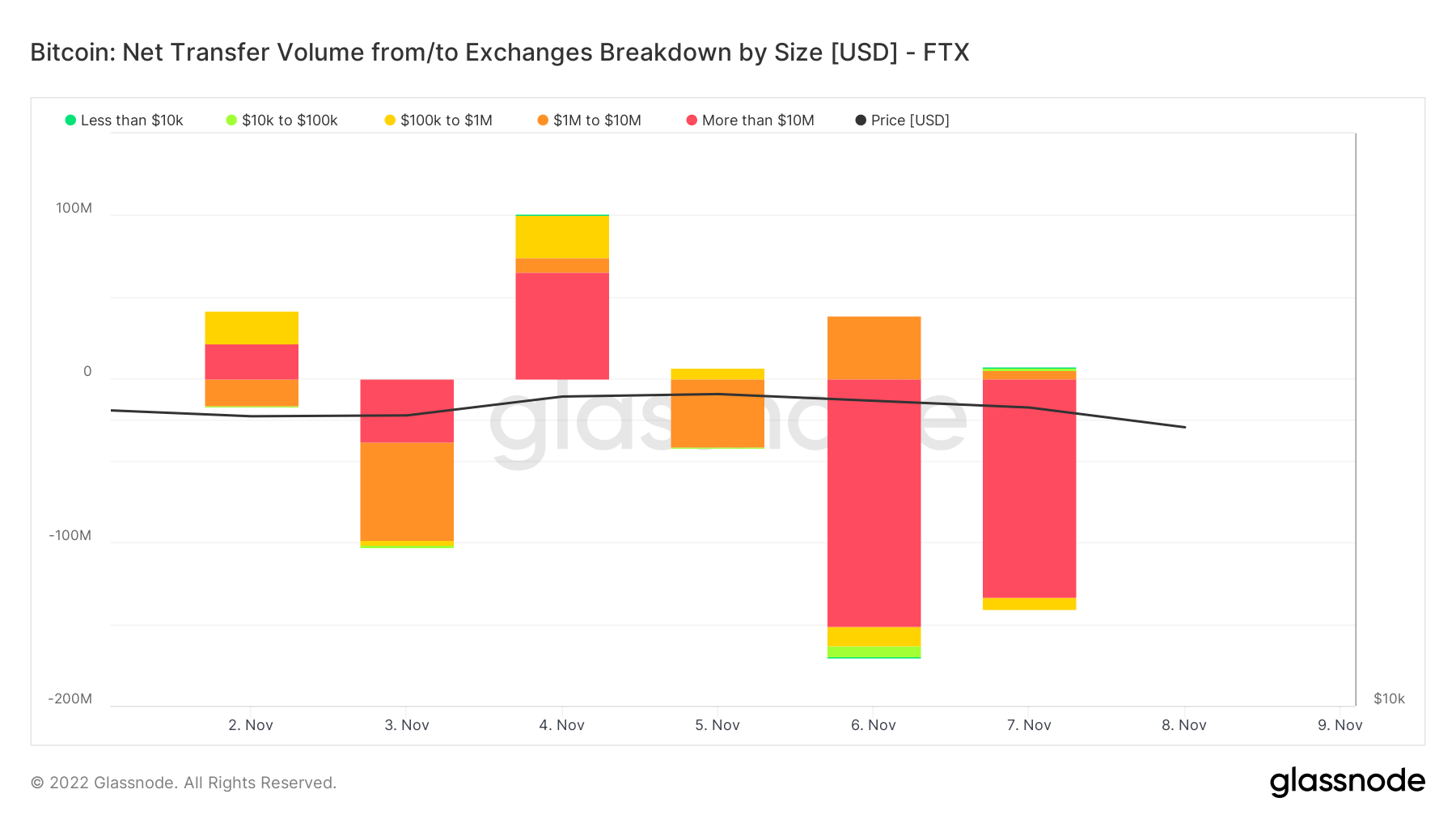

FTX recorded $360 million worth of Bitcoin (BTC) withdrawals in two days, with most of the selling pressure coming from whales.

This is reportedly the 10th largest BTC withdrawal of the year. Additionally, Nansen data shows that the FTX stablecoin outflow was the highest among exchanges in the last seven days. report By Data Geek. Stablecoin withdrawals hit $451 million in weekly outflows.

large-scale sales Occurred After Binance CEO publication Its Binance will liquidate FTX’s native exchange token FTT.

In the meantime, FTX CEO Sam Bankman-Fried said: tried To assuage fears of a potential collapse by reassurance that FTX and its assets are all right and that the company has enough assets to cover all of its customers’ positions.

Yet the CEO’s submission was largely ignored. Negative BTC balance. According to on-chain analytics platform CryptoQuant, FTX had a BTC balance of -19,956 BTC as of November 7th.

moreover, CryptoQuant data It shows that Ethereum withdrawals on FTX have reached a new record. His FTX reserves now stand at 108,246.43 ETH, the lowest level since November 2020.

ether scan data Indicates that FTX has stopped processing Ethereum (ETH), Solana (SOL), and TRON (TRX) withdrawals.

Recently, many users have reported relatively slow Bitcoin withdrawal speeds.Then Reddit user expressed Concerned with the development, I compared the situation to Celsius, which stops withdrawals before crashing and misleading users.

In response to concerns, FTX said Yesterday we said that node has a “throughput limit”, but the withdrawal will be accelerated soon.

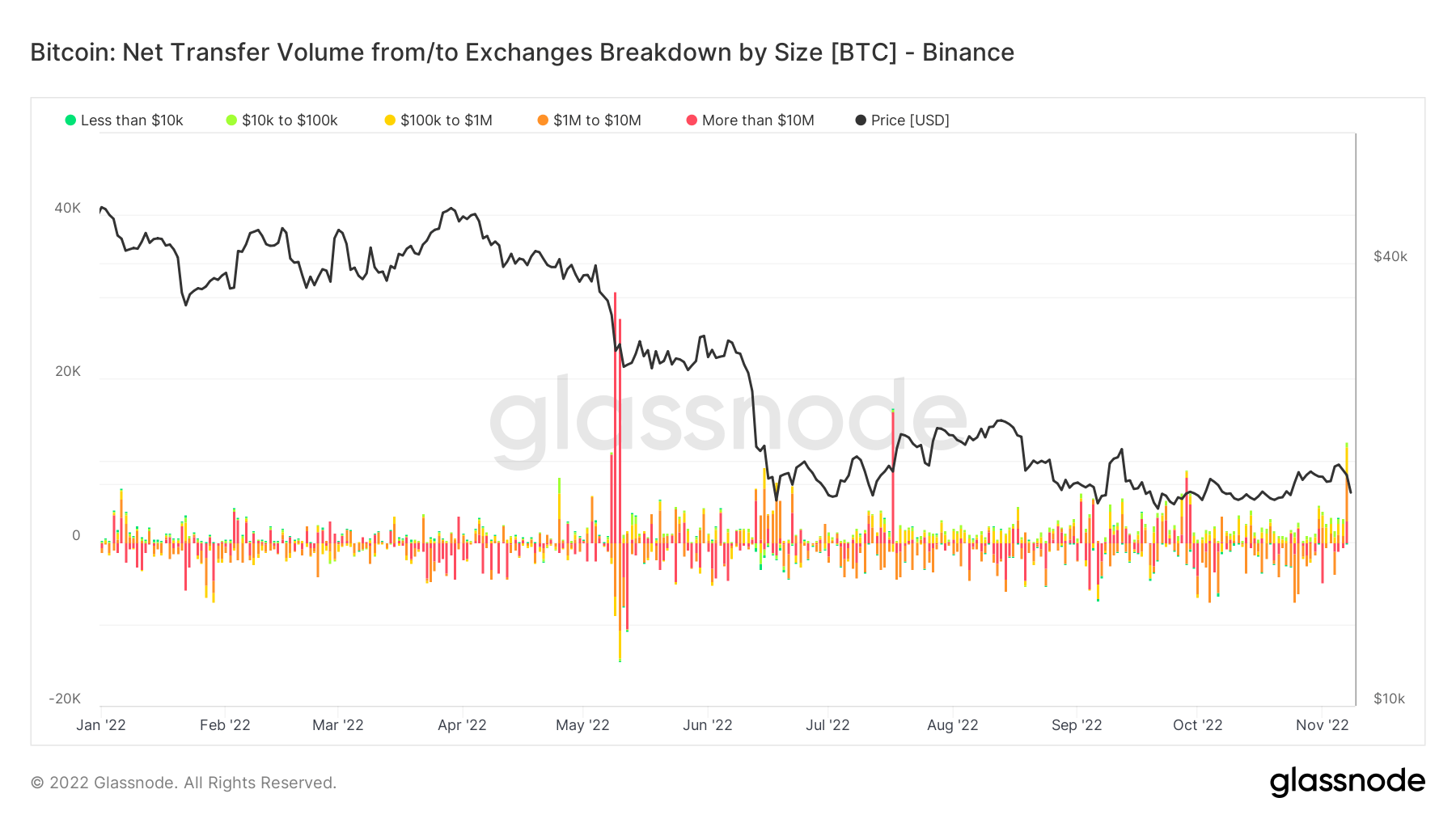

Binance’s Treasury is growing while FTX’s volume is declining. After the event, Binance saw his biggest BTC inflow of the year.

within 48 hours 20,000 Bitcoin Switched from FTX to Binance. As a result, Binance now holds over 640,000 Bitcoins, while FTX’s Bitcoin holdings fell from 80,000 in January to 6,000 in November.

During the current event, BTC fell to a two-week low below $20,000, but is now $20,206.97.

Become a member of CryptoSlate Edge to access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

price snapshot

more context

Register now for $19 per month Explore all benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024