No products in the cart.

- Latest

- Trending

ADVERTISEMENT

A leading analytics firm has revealed that blockchain scaling solution Polygon has seen a dramatic decline in the supply of MATIC on cryptocurrency exchanges, even after the token’s explosive rally over the past few days. .

In a new report, Santiment says the supply of cryptocurrency exchanges is piling up on Polygon as it plummets from over 1 billion MATIC tokens in mid-October to 833.03 million coins on November 4. ‘ said.

MATIC exchange supply continues to decline even as the price surges, indicating that people are fairly confident of further price increases.

MATIC is in the midst of a blazing rally to kick off November, starting the month at $0.90 and surging 44% to $1.30 in less than a week.

MATIC has since retraced and is trading at $1.17 at the time of writing.

Looking at other on-chain metrics from MATIC, Santiment said it sees the coin rally as Polygon sees its highest network growth in months. According to the analytics firm, network growth shows user adoption by tracking the amount of new addresses transferring MATIC tokens for the first time.

MATIC is having its best network growth in months. Sustained network growth is good, but as soon as it goes down and the price continues to fluctuate and a divergence forms, new It tends to show local tops because people don’t come in.”

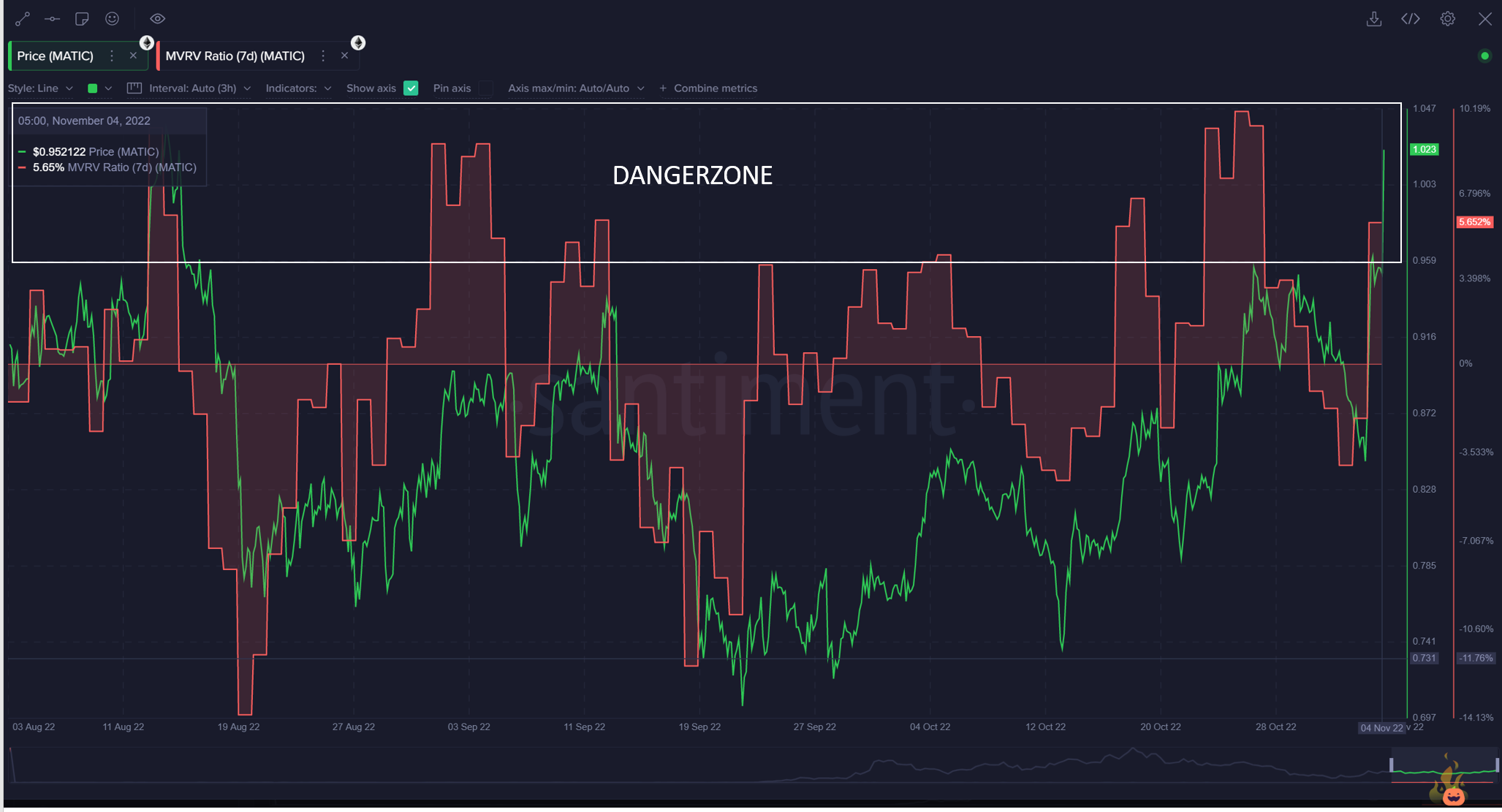

As more traders jump in and participate in the rally, Santiment warns that the 1-chain metric indicates that MATIC may be in danger of corrective action. According to the analytics firm, his 7-day market value to realization value (MVRV) metric of the coin shows that MATIC holders are well positioned to secure profits.

“MATIC’s MVRV 7D, which measures short-term profit/loss for holders, shows us that we are currently in the danger zone. Historically, MATIC’s price has been in It shows that it has fallen.”

Read the full report here.

Don’t miss a beat subscribe to get encrypted email alerts delivered straight to your inbox

Price action confirmation

Please follow us twitter, Facebook When telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Mia Stendal

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024