No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Asset management and risk management are key elements of any investment strategy, and the digital asset sector is no exception. Due to the volatility and complexity of the crypto market, it is imperative that investors monitor their investments and carefully assess their risk exposure.

CryptoCompare, a leading digital asset data provider, release monthly Digital asset management reviewprovides an overview of the global digital asset investment product landscape.

This report tracks the adoption of digital asset products by analyzing assets under management, trading volume, and price performance. For this review, we collected data from various sources including Financial Times, 21Shares, Coinshares, XBT Provider, Grayscale, OTC Markets, HanETF, Yahoo Finance, 3iQ, Purpose, VanEck, ByteTree, Nordic Growth Market, Bloomberg, CryptoCompare .

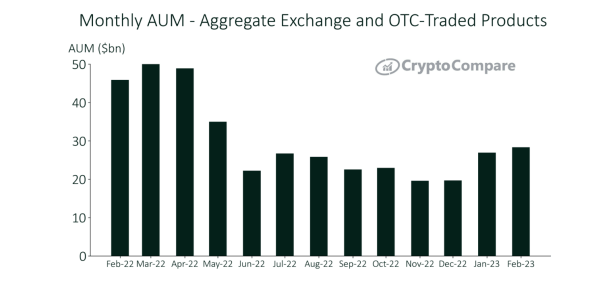

Digital asset investment continued its upward trend in February, with total assets under management (AUM) for digital asset investment products reaching a new all-time high of $28.3 billion.

This represents a 5.25% increase from January, marking the third straight month of AUM growth. The surge in AUM shows investor sentiment and growing appetite for digital assets.

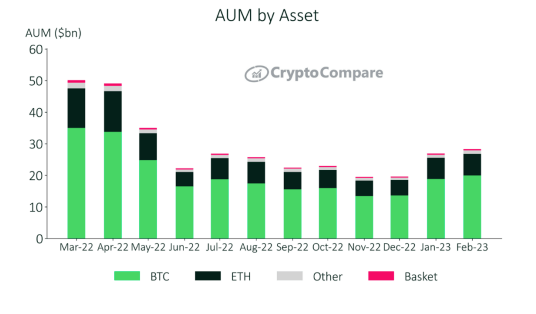

Bitcoin- and Ethereum-based products saw an increase in assets under management (AUM) in February. BTC-based products increased by 6.06%, with a total AUM of $20 billion, while ETH-based products increased by 1.72%, with a total AUM of $6.8 billion. As a result, BTC and ETH commodities currently account for 70.5% and 24.0% of the total AUM market share, respectively.

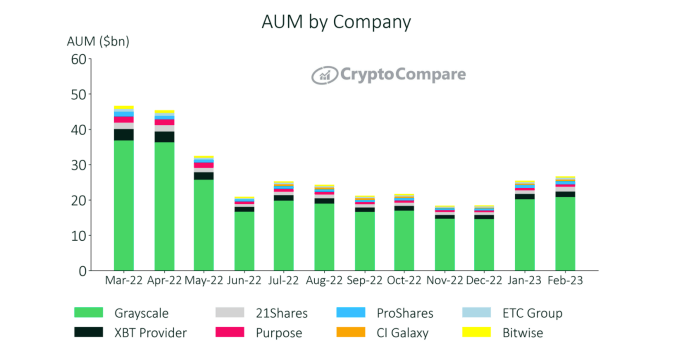

During February, CI Galaxy’s assets under management (AUM) recorded the highest growth of $460 million, up 37.7%. 21Shares followed closely, up 33.4% to take him to $1.38 billion. Despite these gains, Grayscale continued to maintain its dominant position, with total product AUM recording his $20.8 billion, up 3.02% compared to the previous month. XBT Providers ($1.54 billion) and 21Shares ($1.38 billion) followed Grayscale as his second and third largest players in the market.

According to the latest report for February 2023, the average daily total product volume of all digital asset investment products decreased by 9.39% to $73.3 million.

Compared to December 2022, the sales volume has increased by 21.5%. Despite this improvement, trading volumes are down 80.1% for him compared to February 2022, demonstrating the volatile nature of the market.

Both BTC-based and short BTC commodities recorded positive flows of $5.3m and $4.6m respectively, with BTC-based commodities dominating in terms of weekly net flow.

DCG’s decision to sell its position in Grayscale Trust Products was driven by funding needs. According to a Financial Times report cited in the report, one of the most significant sales was the sale of about 25% of Ethereum Trust (ETHE) at a discount of about 50% off the price of the trust.

You can find the complete CryptoCompare Digital Asset Management Review Report here.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024