No products in the cart.

Sam Bankman-Fried confirmed he’s still around I believe Replying to tweets to Twitter users has the future of FTX wassy lawyer.

SBF said:

“I think so [customers] Being practically perfected is a realistic possibility. “

SBF agreed with Twitter users who said that “a sale of the FTX exchange as a going concern is viable” and they were “bull on the recovery” in relation to FTX.

SBF said that selling FTX as a functioning business “is and has always been the best recovery scenario for our customers.” He also noted the ongoing debate that FTX.US should be able to return the funds to its customers, as it was allegedly solvent at the time of the Chapter 11 filing.

FTX.US was absorbed into the FTX Group bankruptcy proceedings, but SBF has always argued that the platform is solvent and should not be included in the bankruptcy proceedings.

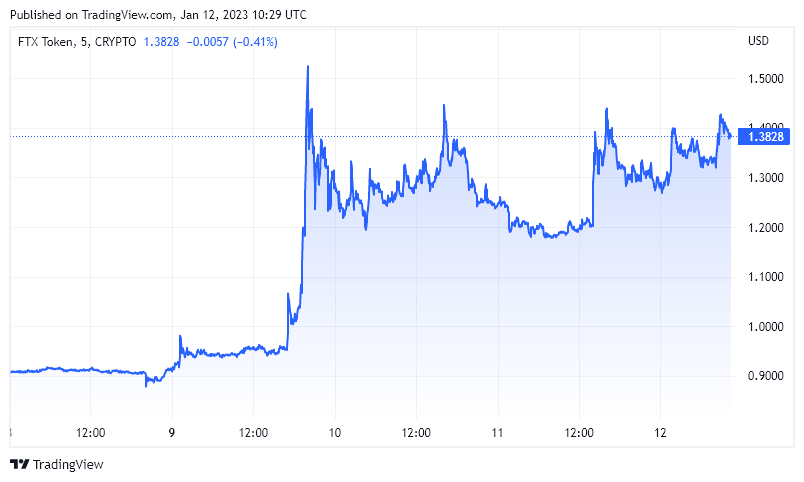

The bullish sentiment on FTX’s recovery appears to be reflected in the price of the FTX token FTT, which has risen 45% over the past 48 hours. Like Bitcoin, FTT has reached his mid-December highs. However, unlike Bitcoin, FTT has almost doubled and Bitcoin is up about 11% in his 2023.

Lawyers working on FTX bankruptcy recently confirmed $5 billion had been recovered. A major supplier.

In a statement that SBF intended to read to Congress in December before he was arrested, he said FTX’s bankruptcy proceedings would cost lawyers hundreds of millions of dollars in fees instead of making clients outright. claimed to be part of a conspiracy.

Bahamas Attorney General Ryan Pinder backed up the SBF’s allegations in December, stating:

“The prospect of multi-million dollar legal and consultant fees could be driving both. [the Chapter 11 teams] Legal strategy and its immoderate remarks. “

However, the path to recovery is currently unclear. Bankruptcy proceedings are focused on managing myriad silos of funds and addressing poor accounting practices that were primarily managed using the consumer accounting software Quickbooks.

Current FTX CEO John Ray III called FTX’s finance team “a very small group of very inexperienced and unsophisticated individuals.” Still, some users, including SBF, are hopeful that FTX will continue to be a viable business even after their accounts have been sorted out.

The debate over whether SBF and his team can assess the true potential of FTX’s recovery is now at stake. It seems to be devoted to the story that it was a financial disaster that was not.