No products in the cart.

The Ethereum (ETH) Shanghai upgrade is scheduled to be released in March, enabling withdrawals from the beacon chain and allowing ETH currently staked by ETH 2.0 validators to be unstaked.

Currently, more than 70% of ETH stakers are unable to access ETH and suffer losses, but with the Shanghai upgrade, stakers will now be able to access ETH and either sell at a loss or wait long-term until profits return. You can decide whether to keep

After ETH Merge

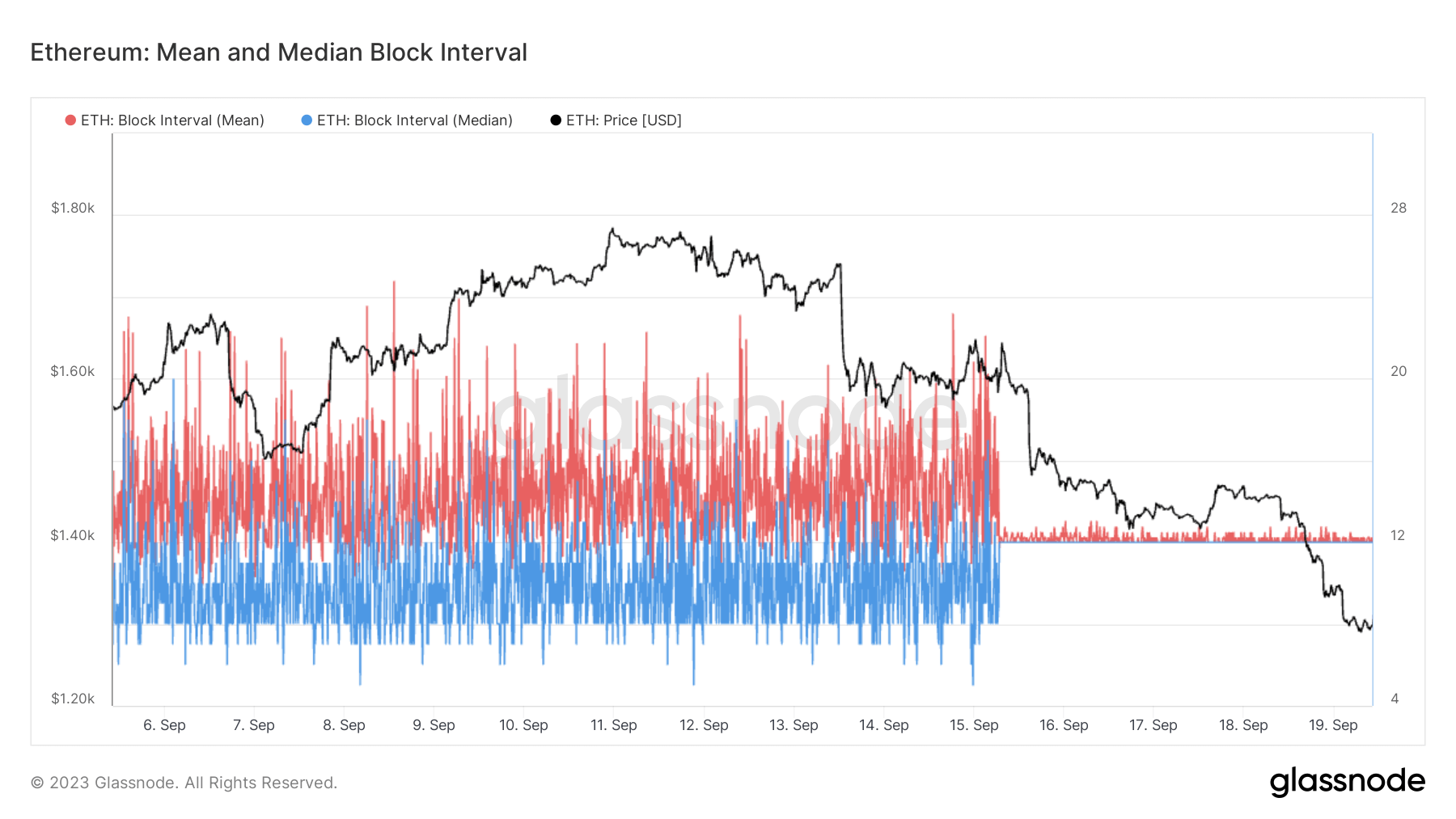

Back in September 2022, an ETH merge occurred with the Bellatrix upgrade. Along the way, block verification was taken over by the Beacon Chain, completing the transition from Proof of Work (POW) to Proof of Stake (POS).

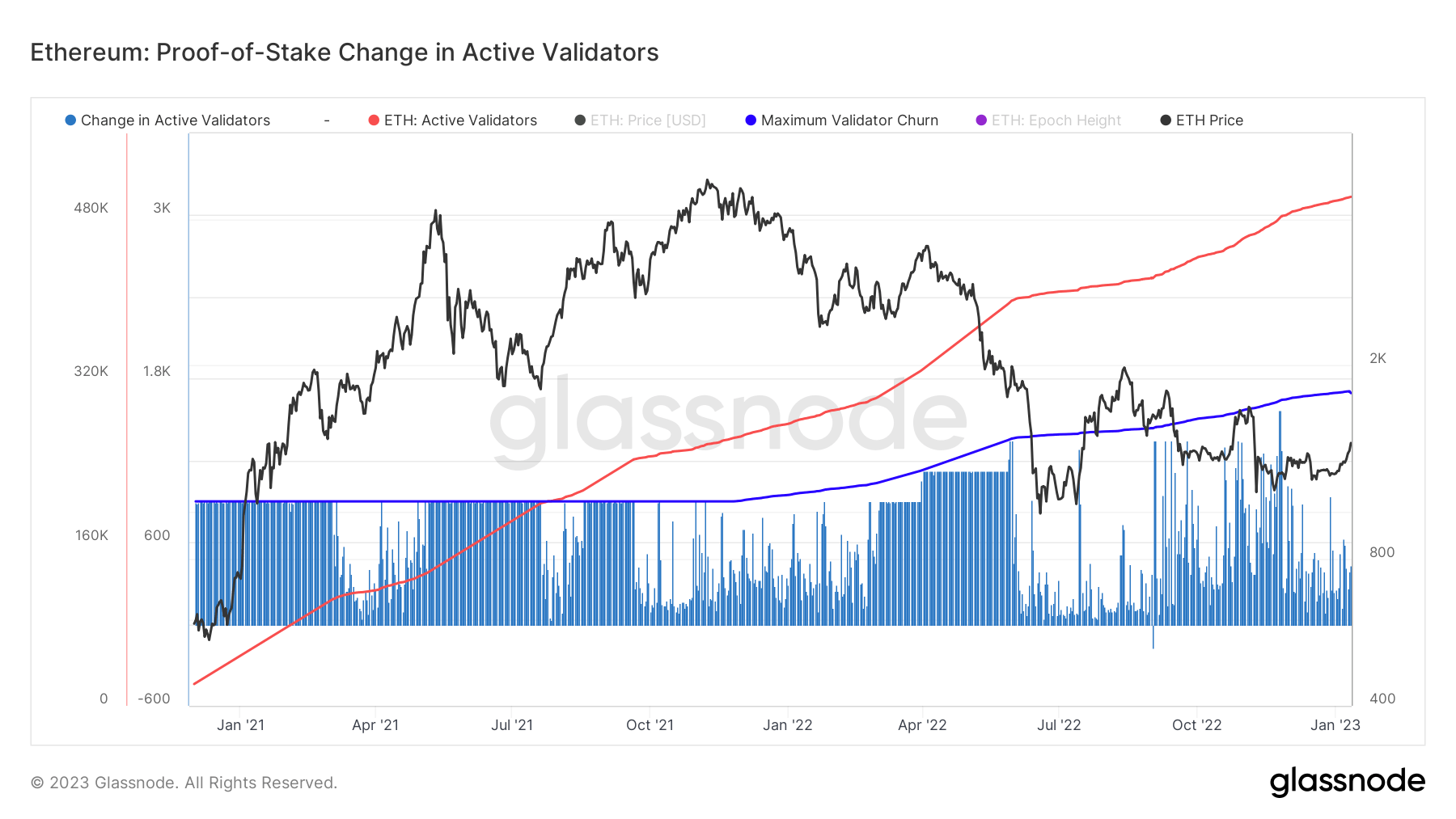

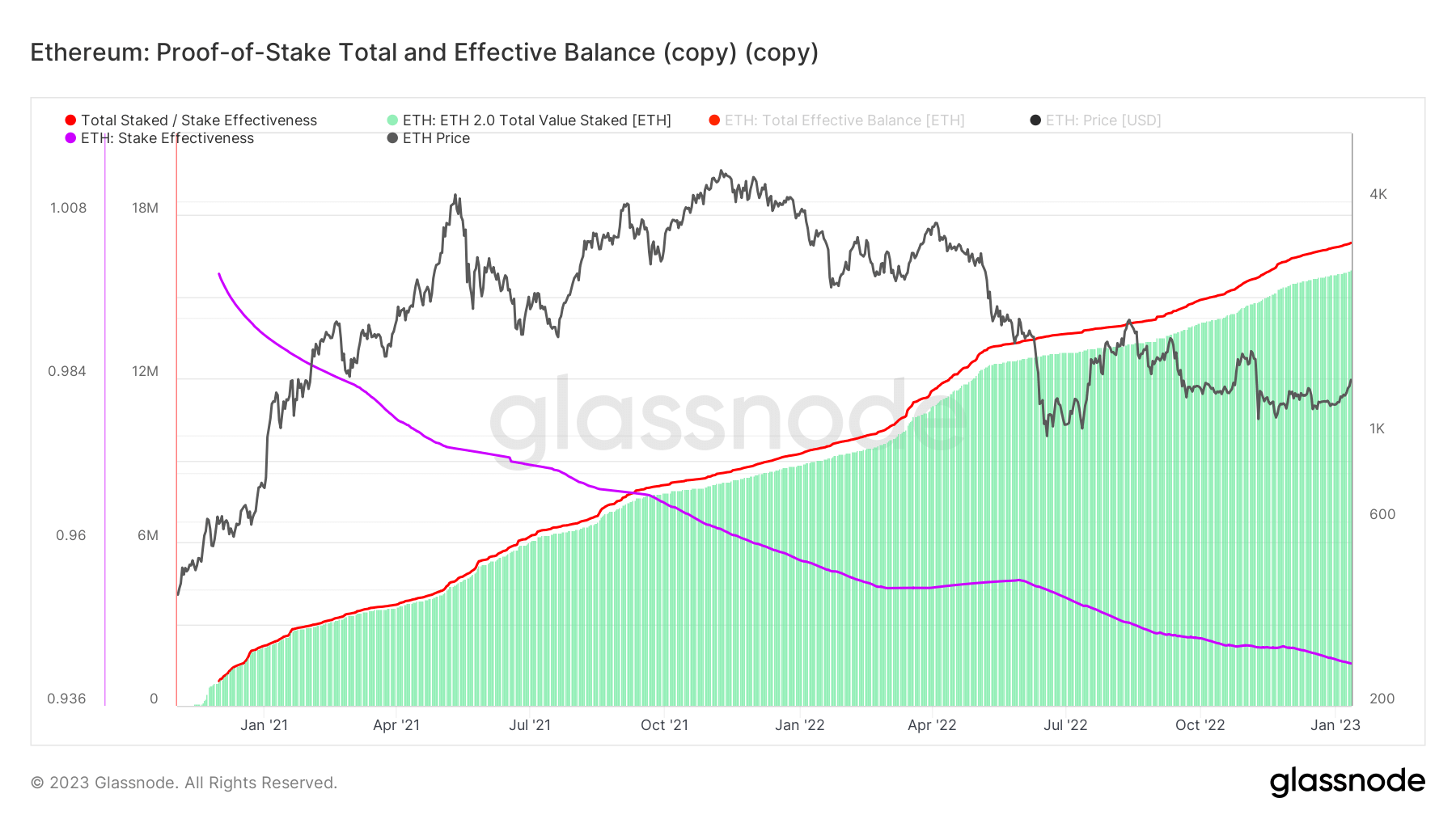

The beacon chain is organized by validators who have deposited 32 ETH before starting operations. Currently, the number of beacon chain validators has reached 500,000, with a surge of new active validators, with a total of over 16 million of his ETH staked on ETH 2.0 deposit contracts.

New ETH credential format

Validators wishing to withdraw staking rewards should ensure that their withdrawal credentials are updated to the new 0x01 standardized format. The same prerequisites apply to validators who wish to stop validating or terminate their balances entirely.

Currently, approximately 300,000 validators have not yet updated their credentials from ‘0x00’, while approximately 200,000 have already been updated on the beacon chain.

Out of a total of 500,000 validators, over 16 million ETH staked by them account for about 13% of the total ETH supply.

- Slashing for malicious behavior.

- Income derived from issuance and fees.

- Inactive leaks when validators block or prove.

- New deposits and eventually withdrawals.

Liquid staking derivatives

Due to the nature of staked ETH, it becomes a non-tradable asset once staked. As such, a number of providers have emerged that allow ETH to be staked in exchange for a tradable asset representing a portion of the staked ETH, known as Liquid Staking Derivatives (LSDs).

To date, Lido is the largest LSD provider with a market holding of around 5 million ETH. However, staking providers such as Lido, Coinbase, and Binance currently dominate the majority of his ETH market, revealing centralization issues.

![Ethereum: Total Stake by ETH 2.0 Providers [ETH] - Source: CryptoSlate](https://cryptoslate.com/wp-content/uploads/2023/01/eth-2-staked.jpg)

As an asset towards decentralization, the ETH holdings amassed by the aforementioned ETH staking providers serve the narrative that ETH is too centralized and ultimately controlled by the companies with the largest holdings. increase.

With the upcoming Shanghai Upgrade integration, ETH investors and validators will withdraw their staked ETH in favor of positions that allow the share and value of staked ETH to be returned in the form of LSD. Get ready.