No products in the cart.

Siemens, Germany’s third largest listed company by market capitalization, has issued its first digital bond worth 60 million ($64 million) on the Polygon blockchain.

The bond was issued pursuant to the German Electronic Securities Act, which entered into force in June 2021, allowing the sale of blockchain-based bonds.

Blockchain-based bonds are expected to reduce paperwork and reach potential buyers directly without the need for intermediaries such as banks.

A blockchain bond is CoinDesk report The one-year maturity “removes the need for paper-based global certificates and central clearing,” the company said in a statement. Additionally, bonds can be sold directly to investors without the need for banks to act as intermediaries.

The firm did not specify the interest rate on the bonds, but said it hopes it will make such transactions faster and more efficient in the future.

Moving away from paper and onto public blockchains for issuing securities makes trading much faster and more efficient than issuing bonds in the past, said Peter Rasgeb, Corporate Treasurer at Siemens. can be executed.

Siemens, the German engineering and manufacturing giant, Since 2021, has been actively exploring the possibilities of blockchain technology in various fields such as settlement and bond issuance.

2021, Siemens partnered In collaboration with JPMorgan Chase, we have developed a blockchain-based payment system that will be used to automatically transfer money between Siemens’ own accounts. The system aims to simplify and streamline payments, reduce the need for intermediaries, and enable faster and more efficient transactions.

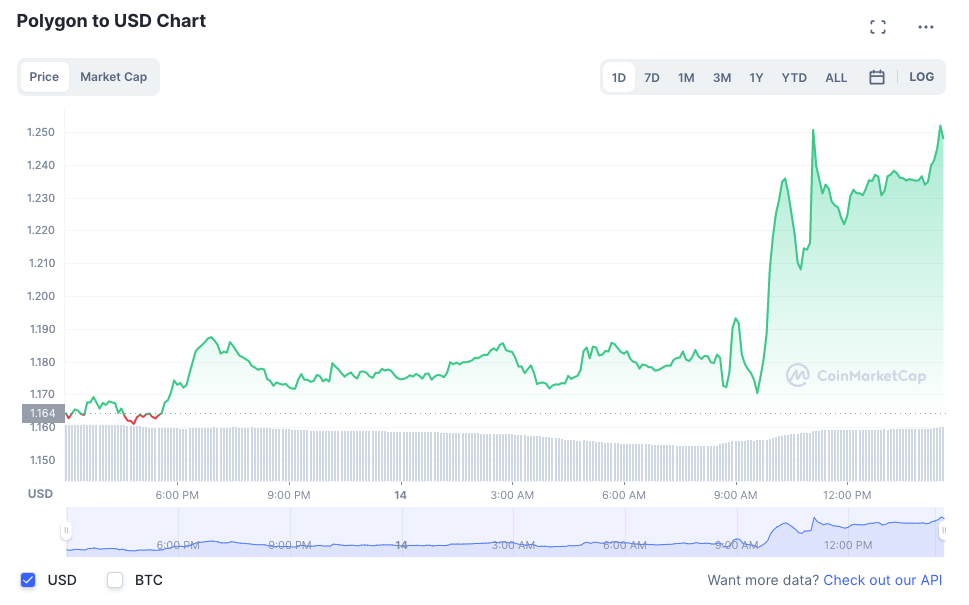

Following the news that Siemens has issued the first digital bond on the Polygon network, MATIC’s token price rose 7.21% during trading on 14 February. MATIC is currently priced at $1.25.

Posted In: Banking, Investment