No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Crypto analytics firm Santiment says a dwindling stablecoin supply could indicate a major Bitcoin (BTC) breakout is imminent. .

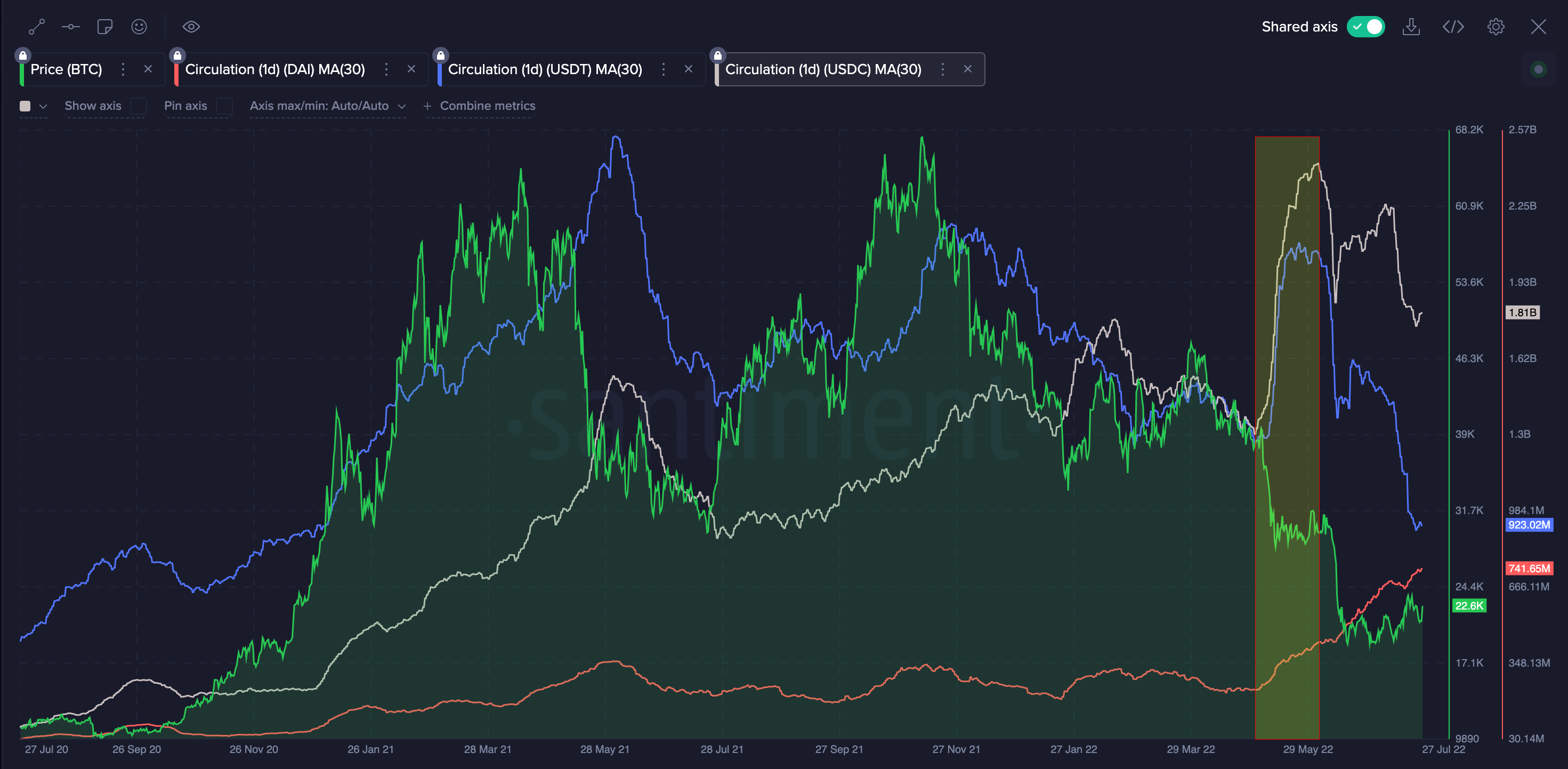

The circulating supply of Tether (USDT) and USD Coin (USDC), the two largest stablecoins by market cap, has dropped dramatically since May 2022, according to a market research firm.

According to Santiment, the amount of these two assets is Continue Even as the Bitcoin price rises, it tends to fall, which has foreseen a parabolic BTC rise in the past. Specifically he was just before King Crypt reached $69,000 from his $29,000 level in July 2021.

Stablecoin circulation continued to decline even in growing markets. [the] The first significant growth came with a decline in circulation. Stablecoins tried to heat up strongly, but no, the market did not.

the best pattern is [stablecoins] still declining [during a] a recovering market. like today. If the stablecoin still does not believe in recovery and prefers to wait. We are probably seeing the same situation as in July 2021 with at least two stablecoins.

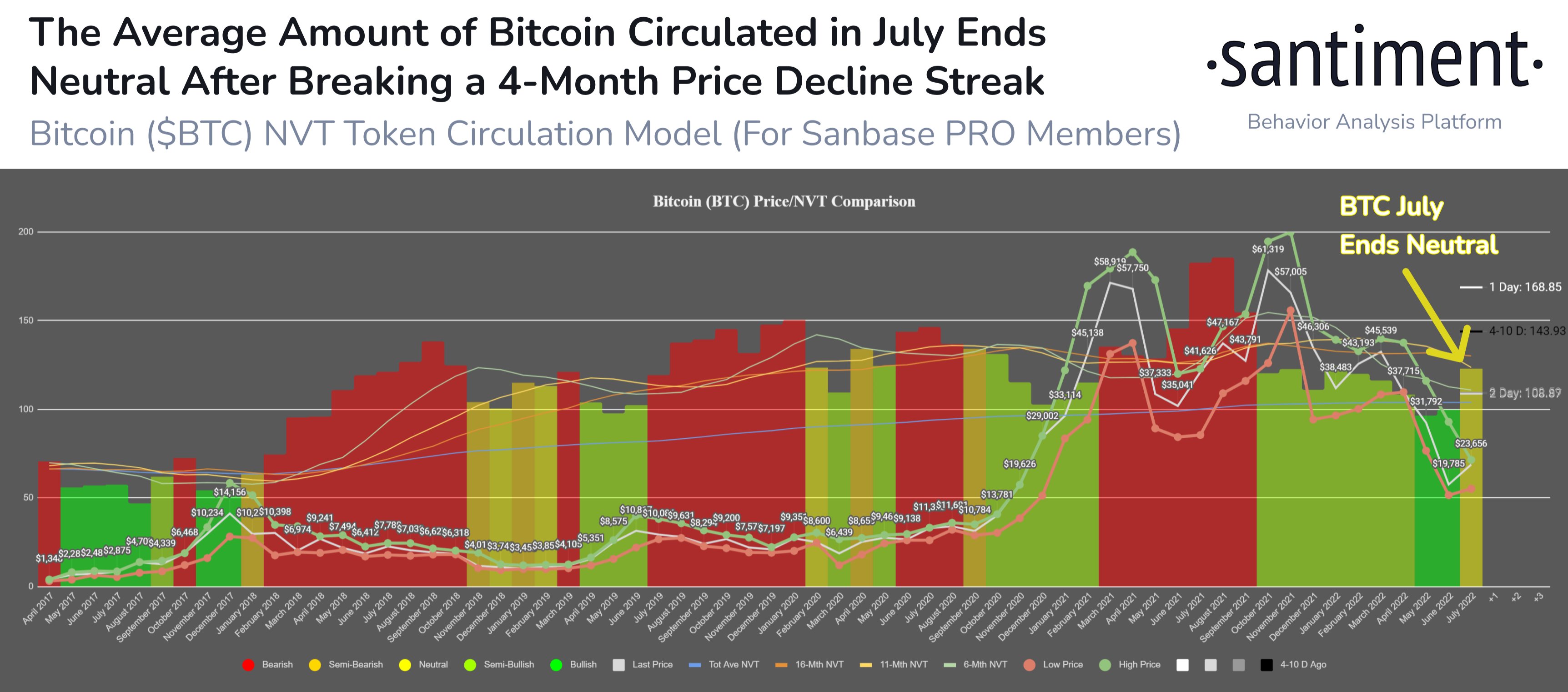

Santiment also notes that Bitcoin’s price is currently in line with valuations based on the Network Value-to-Transaction (NVT) model. This is an indicator that aims to measure the price of an asset based on the ratio of daily market capitalization to daily circulation.

Bitcoin surged +18% in July. [the] The bullish divergence of the NVT model in May and June has finally resulted in a price rebound. With prices rising and token circulation slightly declining, a neutral signal could see August head in either direction. may also move.

Bitcoin is trading at $23,297 at the time of writing, down 1.25% on the day.

Don’t Miss a Beat Subscribe to get encrypted email alerts delivered straight to your inbox

Price action confirmation

Please follow us twitter, Facebook When telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Garan Julia/Aleksandr Kovalev

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024