No products in the cart.

- Latest

- Trending

ADVERTISEMENT

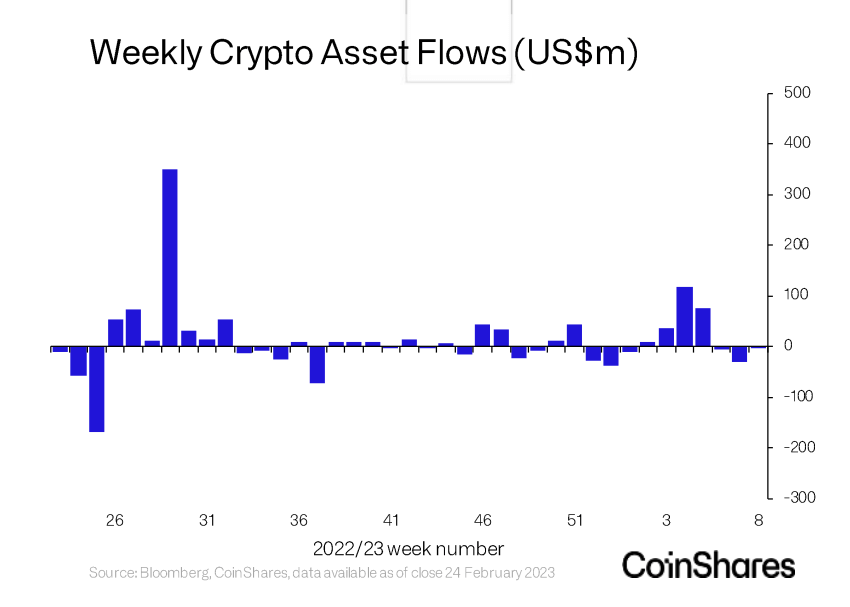

The crypto industry is still stuck in a period of heightened volatility as asset outflows continue to be the dominant trend in the market.

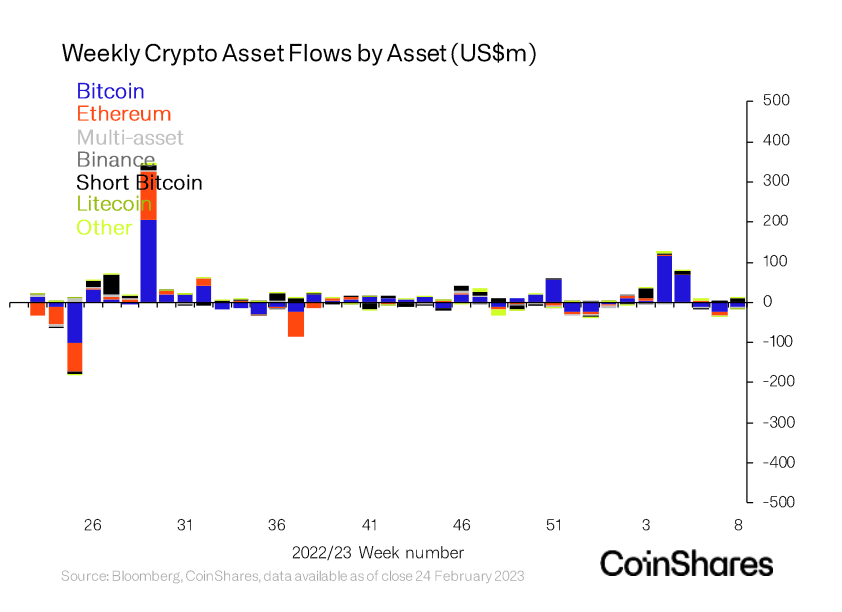

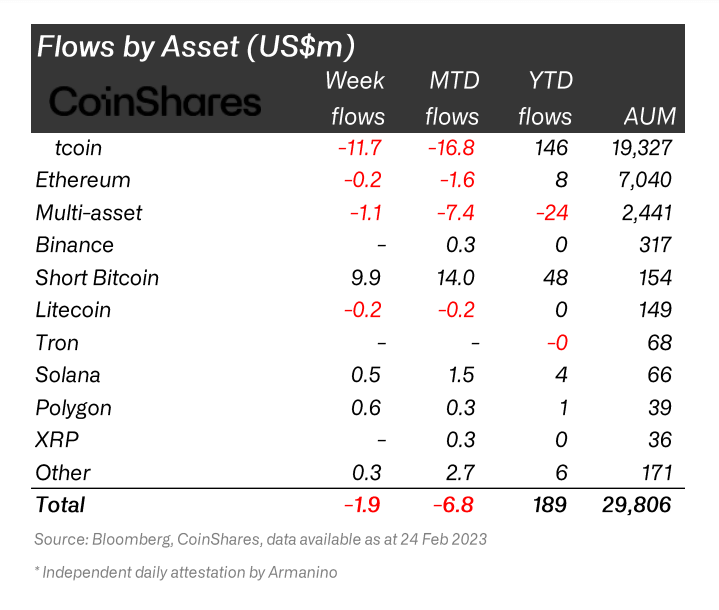

Bitcoin has seen its third consecutive week of outflows despite a slow price increase.data from coinshares Last week’s outflows totaled $12 million, showing inflows reaching $10 million.

The $2 million outflow is not noteworthy, but the inflow amount is notable. All of the $10 million inflows were into digital asset investment products shorting bitcoin.

Ethereum remained unscathed, seeing only a $200,000 outflow over the past week, while Polygon (MATIC), Solana (SOL) and Cardano (ADA) saw smaller inflows.

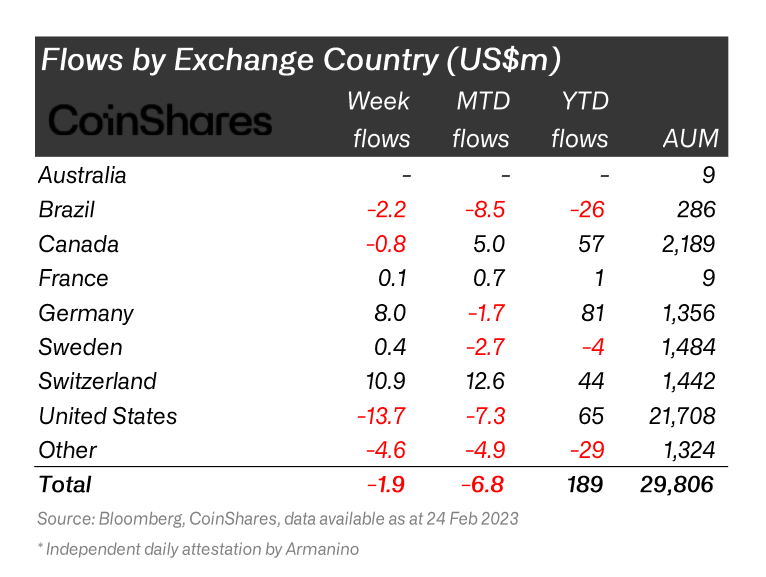

US investors are becoming increasingly nervous after last week’s FOMC meeting as the Federal Reserve released stronger-than-expected macro data.

The significant difference in outflows seen in the US and other countries may be due to the US market’s sensitivity to regulatory crackdowns. Less regulated markets are less likely to see significant outflows or increases in short positions following announcements or enforcement by government agencies.

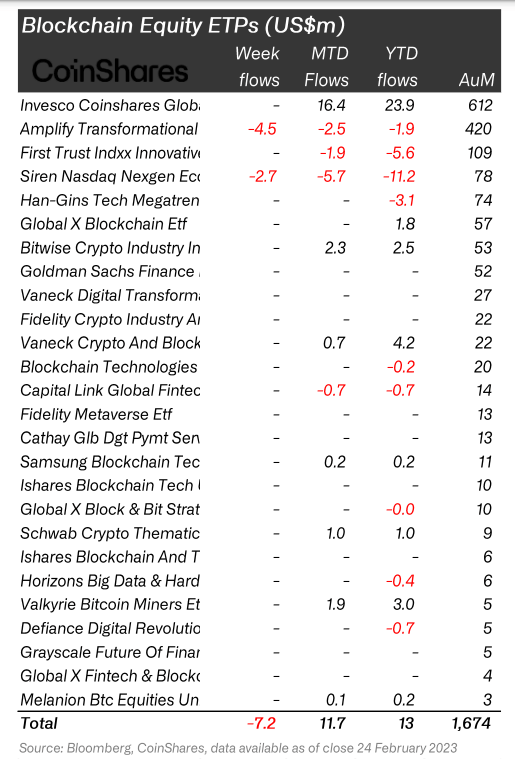

This is evident in blockchain stocks, a regulated product available to US and Canadian investors. Negative sentiment also hit them, leading to a $7.2 million outflow.

Since peaking in November 2021, public blockchain companies have become increasingly sensitive to broader market dynamics. Most publicly traded blockchain companies are focused on growth. This means that even small changes in interest rates can make them vulnerable and prone to volatility.

Journalist at CryptoSlate

Armed with a classical education and a connoisseur of news, Andjela jumped into the cryptocurrency industry in 2018 after spending years covering politics.

Disclaimer: The opinions of our writers are solely their own and do not reflect those of CryptoSlate. Information read on CryptoSlate should not be construed as investment advice. Nor does CryptoSlate endorse any project that may be mentioned or linked in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Exercise extreme caution before taking any action related to the content of this article. Finally, CryptoSlate is not responsible if you lose money trading cryptocurrencies.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024