No products in the cart.

- Latest

- Trending

ADVERTISEMENT

The US crypto space is in turmoil. In March, the prestigious law firm Cooper & Kirk released the paper Operation Choke Point 2.0: Federal Bank Regulators Target Cryptocurrencies.

Has the US market become hostile enough to require a crypto outflow? If so, what other jurisdictions are poised to attract innovators, builders and entrepreneurs in the fintech and cryptocurrency space?

First, let’s take a look at the current cryptocurrency landscape.

Even before Operation Chokepoint 2.0 became a focus, the SEC’s refusal to approve even one was rather suggestive. Spot Trading Bitcoin ETF. As market liquidity fundamentals go, that’s all there is to it.

Instead, regulators chose to drain liquidity. Despite the questionable circumstances, crypto-friendly banks Silvergate and Signature were the first to fail, with Cooper & Kirk’s lawyers ruling that it showed “over-regulation of the crypto industry.”

Meanwhile, the Securities Commission (SEC) continues to rumble through 2023. The watchdog has filed complaints against Bittrex, Kraken, Gemini and Paxos, and has also taken the finishing blow against Binance.US and Coinbase.

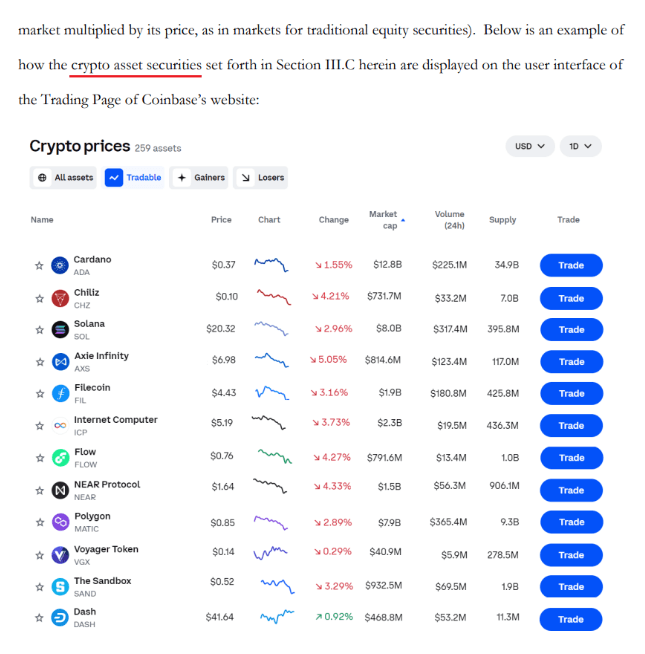

By charging Coinbase as an unregistered stock exchange, the floodgates of legal uncertainty seem to have opened. The SEC has approved the exchange’s underlying business model, a prerequisite for listing under the ticker COIN in April 2021. But as Coinbase expands its cryptocurrency offering, SEC opinion Part of the offering as a crypto asset security: At the same time, the SEC failed to provide a clear explanation when previously asked. This appears to be a ruse by the authorities to take advantage of the current legal void to establish rules from enforcement. Coinbase is suing the SEC in court to unravel the securities, but the damage is already done.

At the same time, the SEC failed to provide a clear explanation when previously asked. This appears to be a ruse by the authorities to take advantage of the current legal void to establish rules from enforcement. Coinbase is suing the SEC in court to unravel the securities, but the damage is already done.

Robinhood plans to delist major cryptocurrencies Cardano (ADA), Solana (SOL), and Polygon (MATIC) on June 27, which is likely to follow according to the SEC’s interpretation. Binance.US We have stopped all USD depositsmeanwhile, Crypto.com is closing its institutional exchange.

Subsequently, legal uncertainty caused a torrent of liquidity to drain, shrinking the overall cryptocurrency market capitalization. $55 billion from friday. Which crypto-friendly regions are most likely to benefit as FUD in US crypto space cement?

The Eurozone has officially entered recession, but is the first major region to introduce a comprehensive legal framework for digital assets.according to Eurostatthis market accounts for about 14% of global trade and is in the top three alongside China and the United States.

The EU Crypto Asset Market (MiCA) Regulation will come into force from June to December 2024. Thanks to this clarity, Ripple CEO Brad Garlinghouse has named Europe as a key beneficiary of the turmoil that exists in the United States.Recent CNBC interview.

Similarly, Coinbase Chief Legal Officer Paul Gruwal said he sees the US crackdown on cryptocurrencies as an incredible opportunity for Ireland and Europe. Irish independence.

Over the years, MiCA has adopted a balanced and proactive approach to cryptocurrency regulation. Innovation is encouraged, while financial stability and consumer protection are taken into account.Here are some of the keys mica Points to consider:

To maintain its license with the European Securities and Markets Authority (ESMA), CASP is required to report user transactions. This includes transfers of more than his 1,000 between CASP and self-custodial wallets. However, regardless of the size of the transaction, CASP must record the sender/receiver of the hosted wallet under the so-called “travel rule”.

All of this tracking isn’t ideal, but it’s a big step towards legitimizing the industry. At least in contrast to the US, where SEC Chairman Gary Gensler recently took office. blanket name They call cryptocurrency investors scammers, scammers, scammers.

It is also worth noting that Switzerland remains a sandbox innovation zone, but is also connected to the Eurozone. This is why Switzerland has many prominent foundations such as Tezos and Ethereum.

In the EU itself, many cryptocurrency companies have already gone global.

Some of the most popular options trading platforms are Dutch Deribit, Finland’s LocalBitcoins, Lithuania’s DappRadar and French hardware wallet provider Ledger.

Hong Kong, China’s semi-autonomous proxy region, is back on the cryptocurrency menu. Mainland China banned cryptocurrencies to avoid interfering with the digital yuan, but Hong Kong gave the go-ahead to retail cryptocurrency trading on June 1.

Of course, this means Hong Kong’s virtual asset service providers (VASPs) have to block retail traders from mainland China. Each token listed must have high liquidity, two major indices, with 1 year of trading experience. In addition to these basic requirements, VASPs must segregate customer assets, set exposure limits, follow cybersecurity standards, and avoid conflicts of interest.

The DeFi space can also thrive under the Securities and Futures Ordinance (Type 7 license), where tokens are designated as futures or securities. Following the new regime, many exchanges, including CoinEx, Huobi, OKX, Gate.io and BitMEX, are rushing to obtain new Hong Kong VASP licenses.

Interestingly, as Hong Kong’s largest digital bank, ZA Bank, a subsidiary of Chinese state-owned Greenland, has also entered Hong Kong. e-HKD Pilot Program Initiative. This shows that China has completely given the go-ahead for long-term acceptance of Hong Kong’s digital assets.

Hong Kong is also very generous in the area of cryptocurrency tax. Capital gains tax is void for taxpayers, but businesses are subject to a progressive tax regime of up to 17%.

Another highly developed city-state, Singapore has been a cryptocurrency hub since its early days, driving cryptocurrency adoption across the Asia-Pacific region. And for good reason. There is no capital gains tax, so it doesn’t matter if you are selling or trading cryptocurrencies.

Additionally, the Monetary Authority of Singapore (MAS) classifies cryptocurrencies as intangible assets, meaning that they can be used to pay for goods and services, which is considered barter. By the way, this is very easy thanks to his Singapore-born Alchemy Pay.

That being said, the zero tax regime does not apply to businesses. They are subject to a flat corporate tax rate of 17%. But for Singapore to outperform Hong Kong, he has a three-year tax exemption for start-ups, which is especially beneficial for start-ups. Companies needing credit building assistanceTherefore, funding opportunities are limited.

Financial and social stability have made Singapore a strong magnet for cryptocurrencies. For example, California-based OKCoin opened its shop in 2020. Of course, Coinbase and Binance, including Crypto.com, also have offices in Singapore.

Crypto.com has rushed to close institutional exchanges in the US due to current market conditions, but the aptly-named exchange had no trouble attracting major clearinghouses. (MPI) License from MAS.

Crypto.com is no longer subject to the Digital Payments Token (DPT) service threshold. Given the SEC’s hostile attitude towards these exchanges, their alternative stance in Singapore is sound.

Finally, Singapore has taken a friendly approach to the integration of machine learning and artificial intelligence technologies for several years.of Ministry of education is already developing AI-powered learning and teaching systems for students. How AI is Predicted to Drive Business Operations communication Singapore has demonstrated a proactive approach to leveraging innovative technology, ranging from training to other areas.

Singapore could become a hotspot for new cryptocurrency projects as AI is projected to integrate with and even assist the cryptocurrency industry.

Shane Neagle is the EIC of The Tokenist. Check out The Tokenist’s free newsletter. 5 minutes financea weekly analysis of the biggest trends in finance and artificial intelligence.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024