No products in the cart.

- Latest

- Trending

ADVERTISEMENT

According to Arcane Research analysts, USDC, the second largest stablecoin by market capitalization, is expected to overtake USDT.

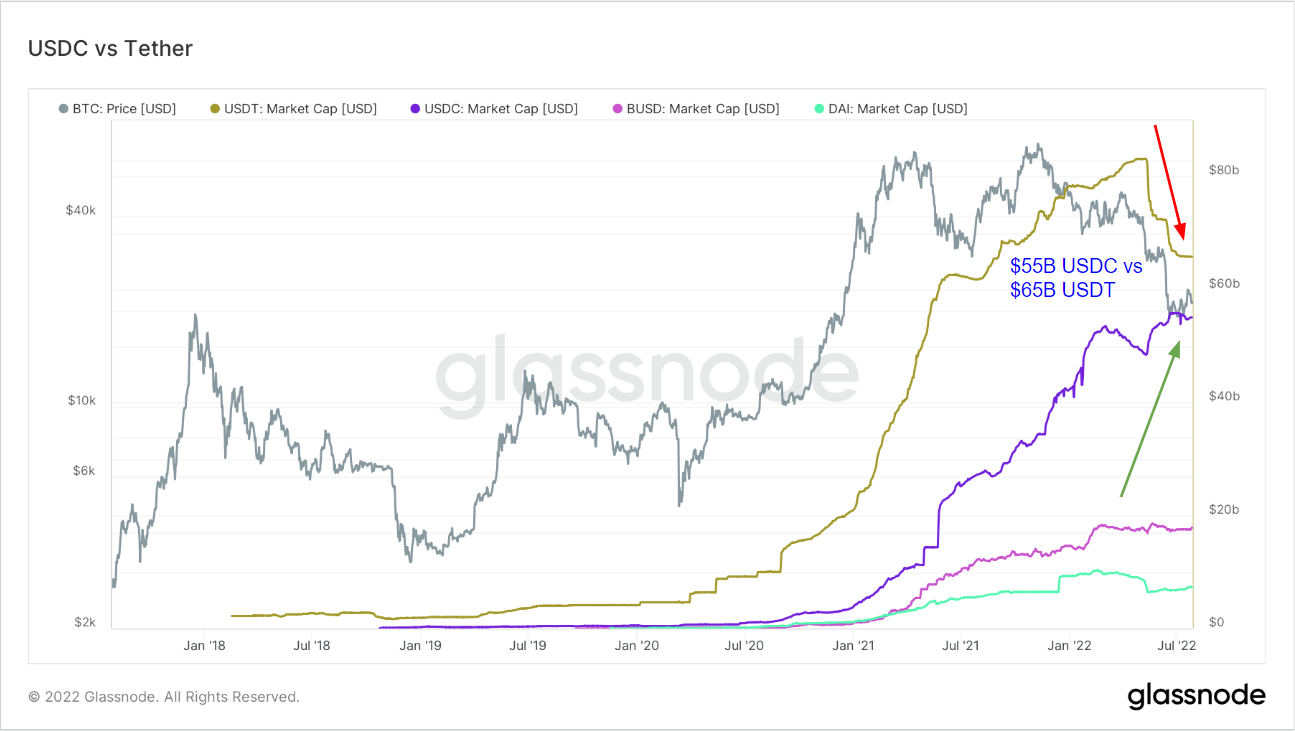

The Glassnode chart below shows the relatively parallel growth of both tokens since September 2020. This period was a preparatory period before the start of the final bull market, as Bitcoin re-reached the peak of the previous cycle of $ 20,000 in December 2020.

Market capitalization growth of USDT exceeded USDC at regular intervals, but USDT fell sharply after May 2022, especially between March 2021 and June 2021. In contrast, the macro upward trend in USDC remains the same.

Given the current 70% growth rate of USDC and the trajectory of USDT’s decline, Arcane Research analysts expect “flip” to occur in October.

The current market capitalization of USDT and USDC is $ 65.9 billion and $ 54.8 billion, respectively, placing both tokens third and fourth in the CryptoSlate ranking.

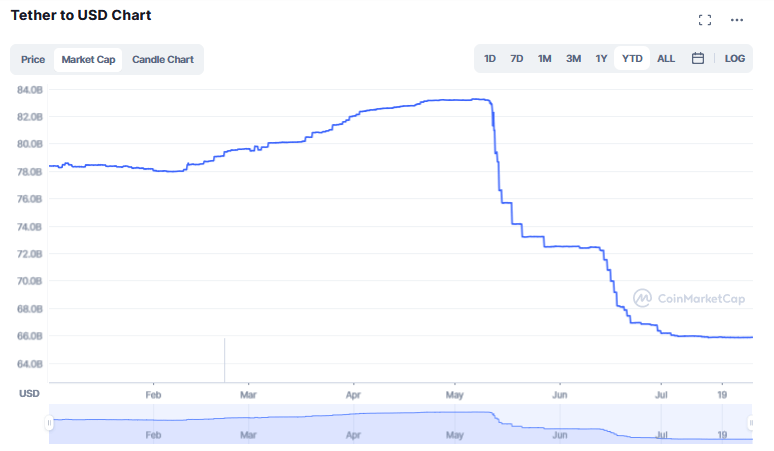

Since the tether implosion in early May, USDT has suffered a serious capital outflow as investors cashed out for security in the midst of market turmoil.

The Tether market cap peaked at $ 83.2 billion on May 8th, leading to two distinct declines between May 11th and May 28th and June 12th and June 22nd. I did. Cryptographic lending platform Celsius is the second drop-off.

Despite the convergence of market capitalization, USDT trading volume is still well above USDC trading volume. In the last 24 hours, USDT has traded $ 67.6 billion, making it the most traded token. At peak times, trading volumes are more than double that of Bitcoin, which ranks second.

Meanwhile, USDC trading volume over the last 24 hours was $ 8.8 billion, 13% of USDT.

Nonetheless, USDC is considered a “safer” stablecoin offer due to more important efforts to comply with audits, regulations, and higher transparency standards, especially its reserve details. Often.

Recent criticisms of the USDC have made Jeremy Allaire, CEO of issuer Circle, more transparent by issuing regular monthly reserve reports starting July 14.

The latest report shows a total of $ reserve assets55,703,500,691 consists of 24% cash and 76% US Treasury securities held by “regulated financial institutions”. On June 30, total reserve assets exceeded cyclical supply as follows: A little less than $ 134 million..

In response to claims that the USDC is struggling in a difficult market environment, Allaire said the company is in the strongest financial position.

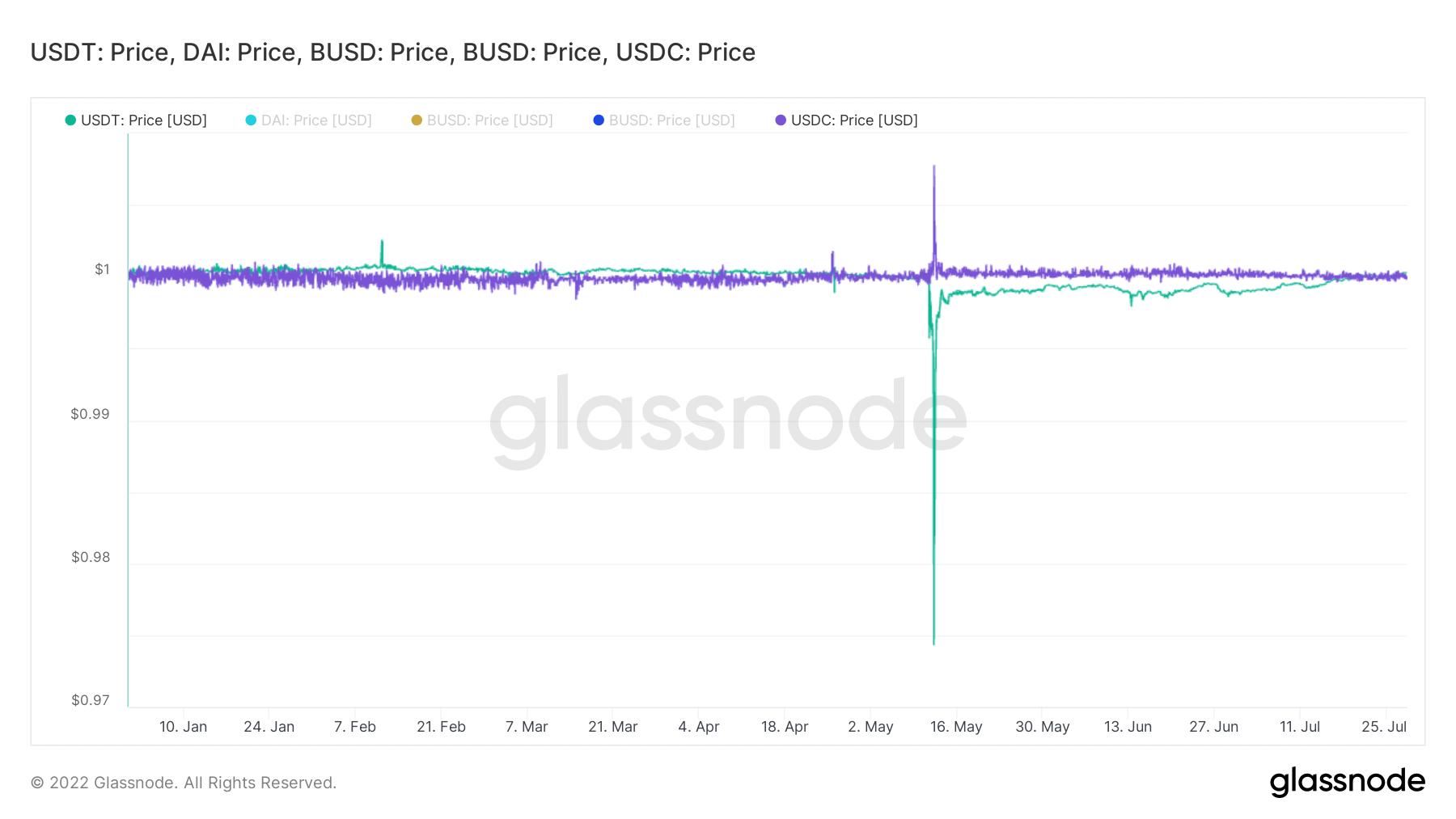

During the Luna / UST implosion in May, USDC and USDT removed the peg from the dollar. The USDT fell to $ 0.97 and it took almost two months to recover the pegs to $ 1, but the USDC recovered the pegs almost immediately, making it a “more stable” stablecoin for the industry. Hardened.

Become a member of CryptoSlate Edge and access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

Price snapshot

Other contexts

Join now for $ 19 per month Explore all the benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024