No products in the cart.

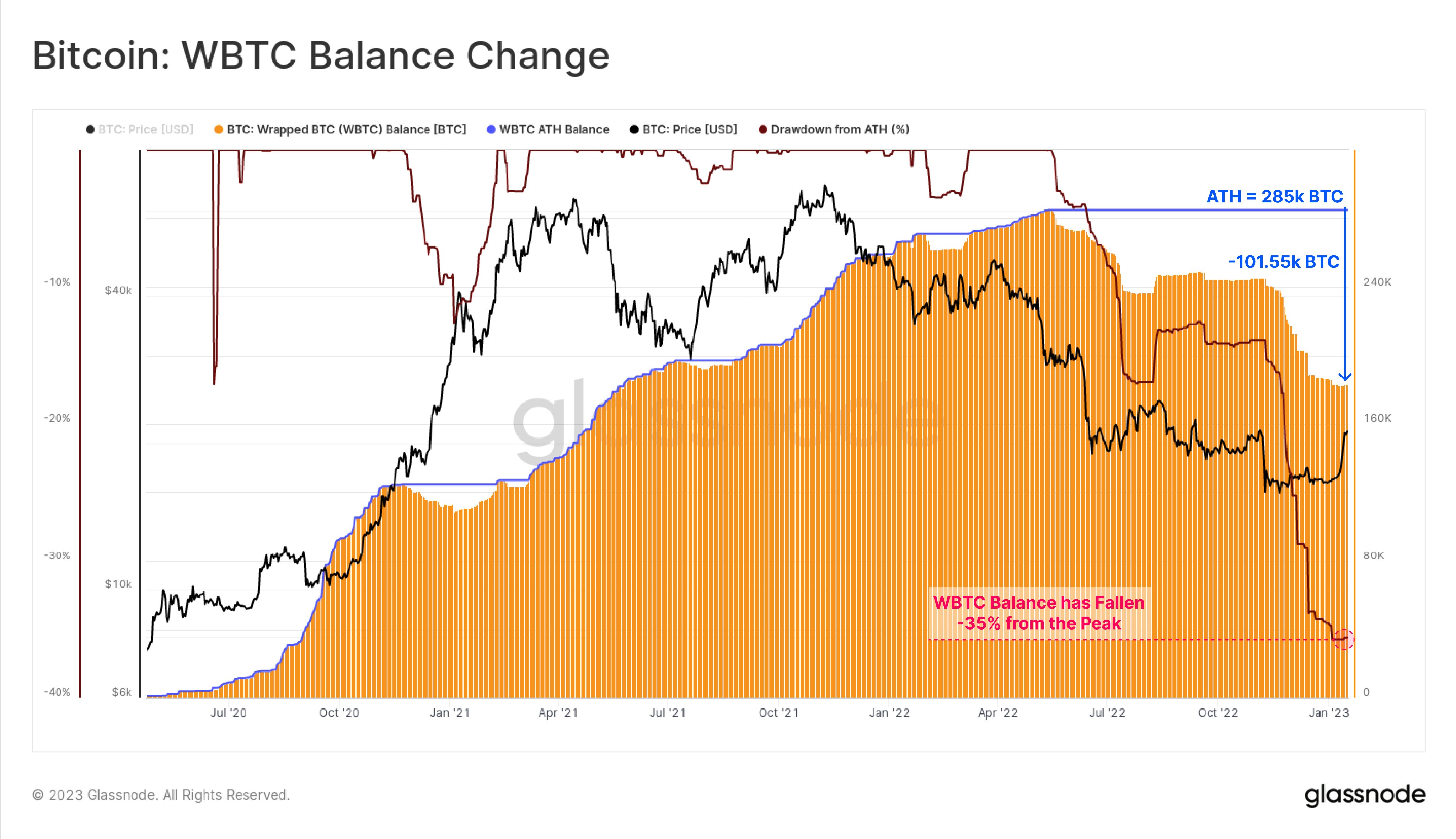

Since Terra (LUNA) collapsed in May 2022, the supply of wrapped Bitcoin (WBTC) on Ethereum (ETH) has fallen by more than 35% to 183,450, according to Glassnode data.

WBTC’s market cap has fallen from a peak of $13.03 billion in April 2022 to $3.1 billion in December 2022. crypto slate data.

The chart above shows that WBTC supply peaked at 285,000 in April 2022. At the time, the flagship digital asset was trading at around $48,000. Demand for the asset was relatively high during this period as investors found its use in decentralized finance (DeFi) trading.

However, LUNA’s bankruptcy spilled over into several cryptocurrency companies, resulting in record liquidations among investors. At the time, whales like the Celsius Network were reportedly redeeming his WBTC holdings, and to meet the growing demand for redemption, put 9,000 WBTC into his FTX as his OTC trading potential. I was sending money.

Things got even worse when WBTC’s top merchants Alameda Research and FTX faced a liquidity crisis in November 2022.

On November 25, 2022, the price differential between BTC and WBTC has decreased to 0.9774.

Meanwhile, Gap has since returned to the market relatively calmly, but demand for BTC on the ETH blockchain remains sluggish.

Asset order book show 180,447.6213 WBTC vs 180,455.0500 BTC are stored at the time of pressing.

Posted In: Bitcoin, Analysis