No products in the cart.

- Latest

- Trending

ADVERTISEMENT

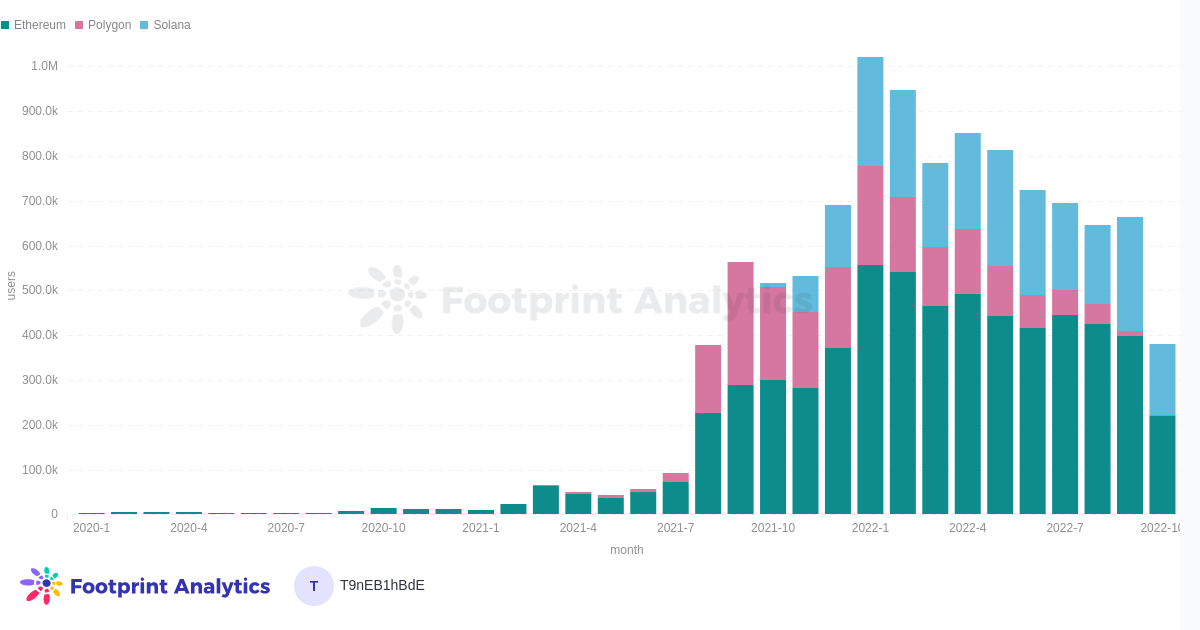

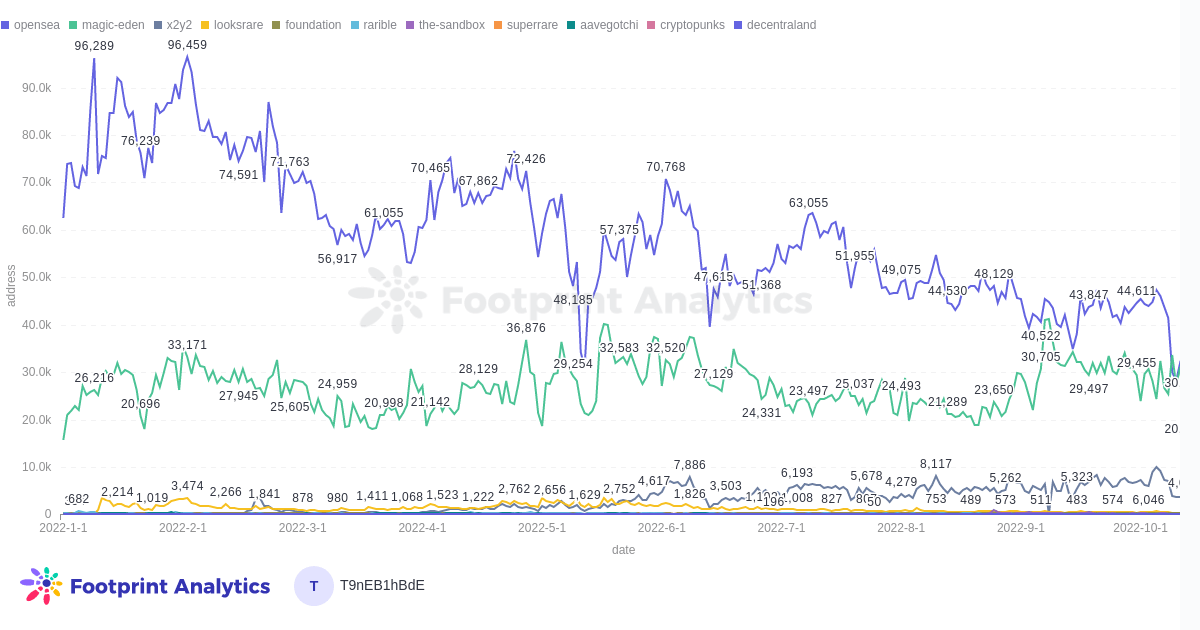

A year ago this time, Polygon was the second largest chain by number of NFT users. This counts as a wallet address that Footprint Analytics has bought or sold NFT assets at least once in the previous month.

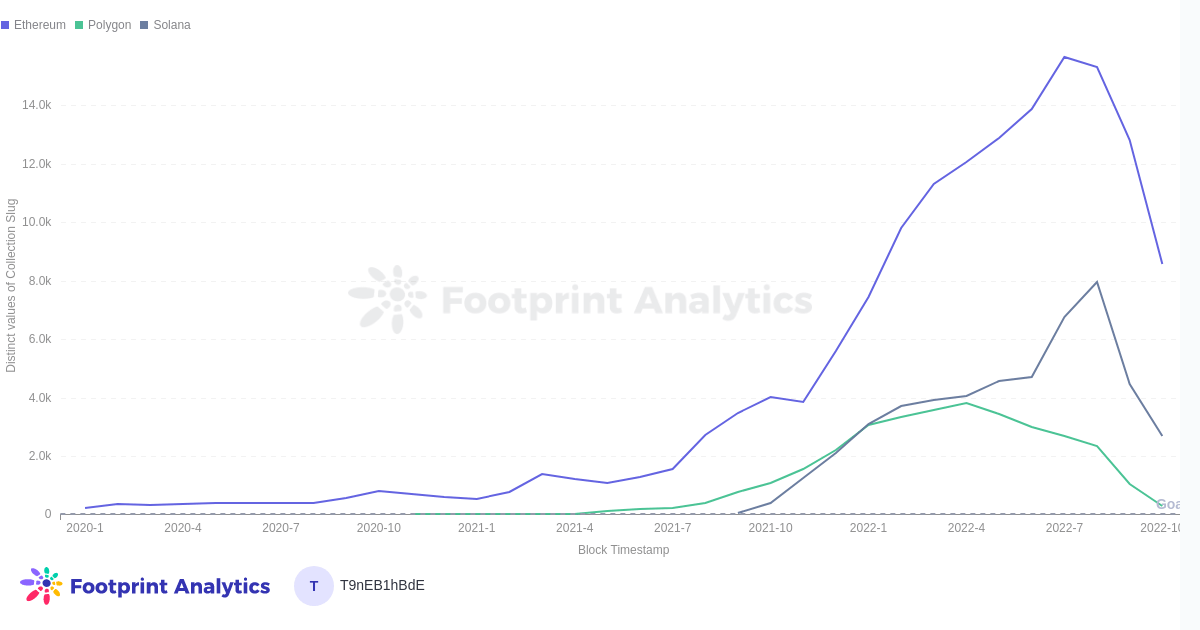

With its market share of NFT users growing from almost zero to 48% in just six months, Polygon looked poised to become the dominant chain for NFTs.

But since the start of the bear market, things have changed and Solana has become the second most important ecosystem for digital assets.

Note: The chart above does not include trading in Element, a market that has become Polygon’s primary force. In other words, it does not accurately represent the current number of Polygon NFT users.. Solana’s growth is likely to continue.

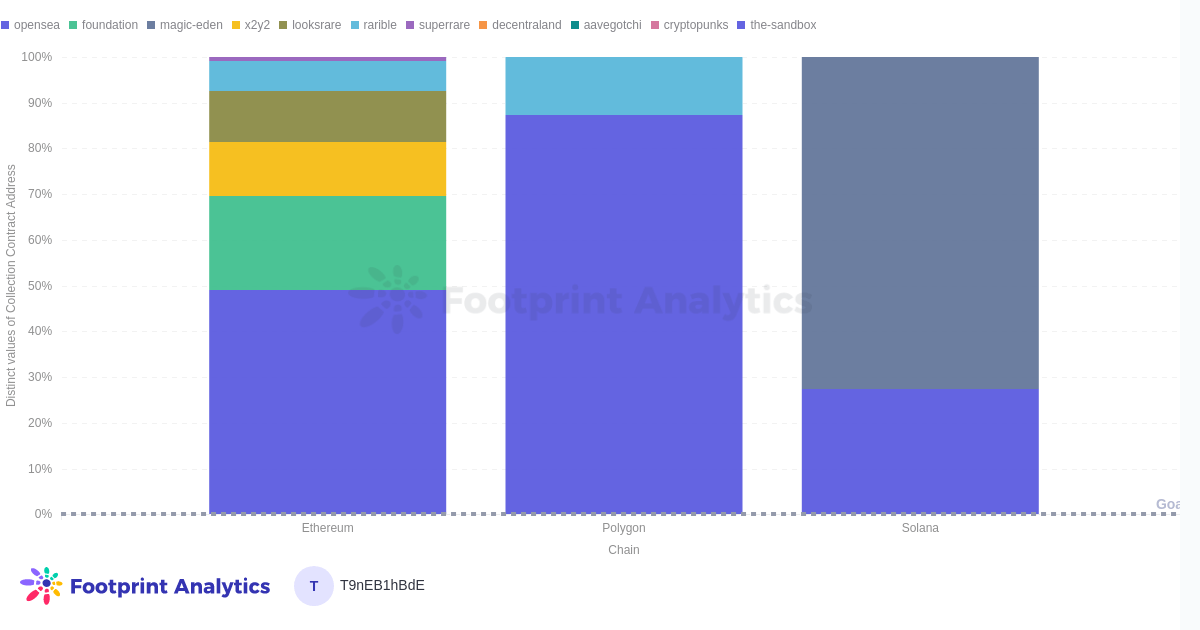

Polygon’s NFT collection, which is mostly listed on OpenSea, Aavengotchi and Element Markets, now trades less and represents a smaller share of the market than before. There has been a significant increase in users trading on Ethereum and Solana.

Polygon was launched in 2017 as a blockchain scaling solution for Ethereum. Using a modified proof-of-stake consensus, the protocol can process transactions quickly and affordably compared to crowded and expensive Ethereum.

At the start of the last bull market, Layer 2 was the leading candidate for solving blockchain scalability problems. Polygon was the leading innovative solution in this category of products. For most people at the time, it was a safe guess that Ethereum would continue to be the underlying infrastructure for the blockchain, upon which improvements would be built.

But during the last year, the narrative has shifted. Developers and analysts began to foresee the possibility of a new chain with its own language, consensus his mechanics and technology, the “Ethereum Killer”. Rather than attaching his HOV lanes to highways to improve traffic flow, these new projects promised to design roads from the ground up for new use cases such as NFT and GameFi.

Solana launched in 2019 and quickly became the dominant Ethereum killer Layer 1. Crypto revolves around the hype cycle. Some of these were needed by the time people came to Solana.

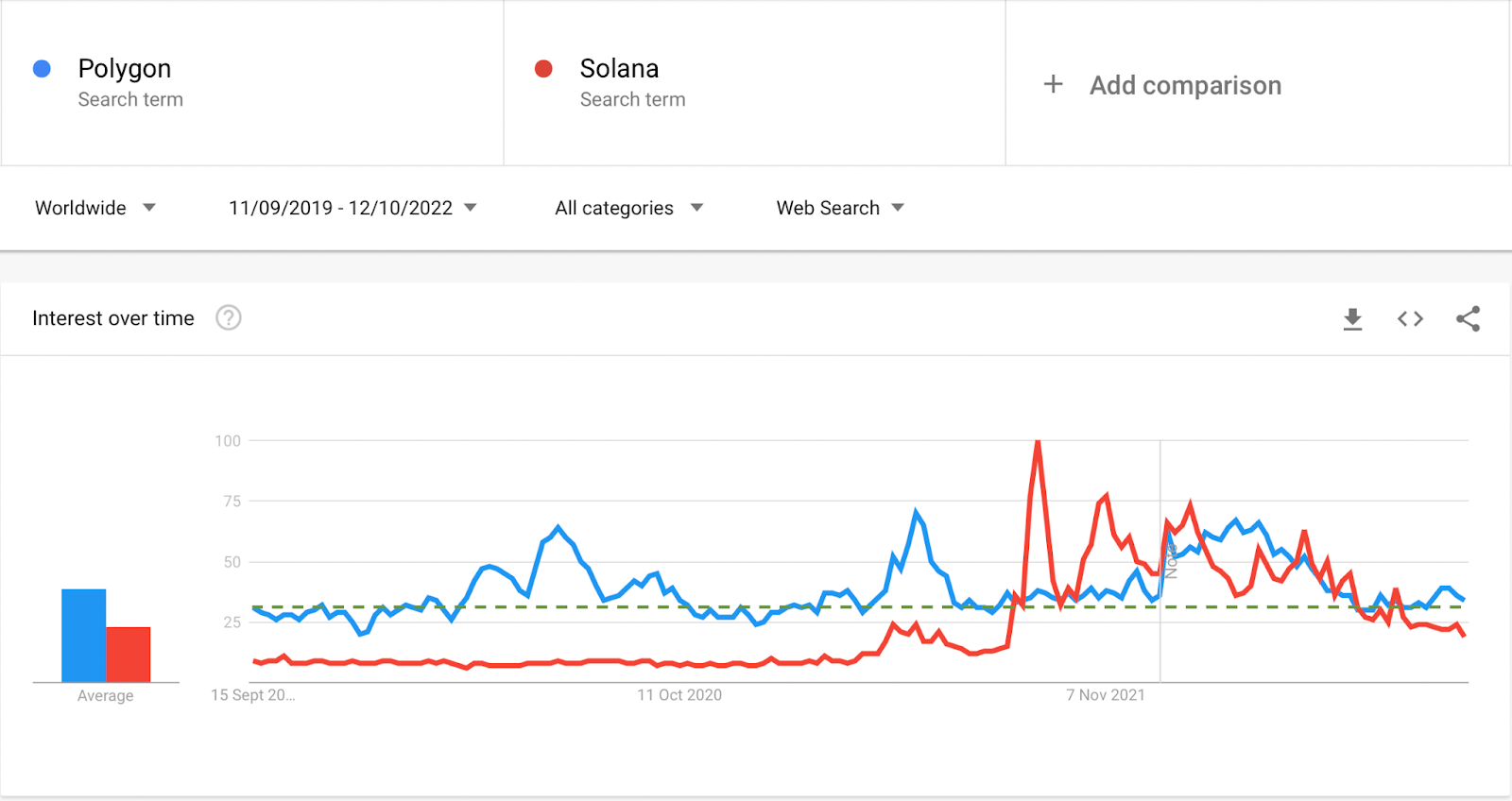

The green dotted line is the baseline for searching for “polygons” shaperemains constant.

This chart shows how Polygon has used its first-mover advantage to gain traction in several previous hype cycles. Polygon remains a solid and innovative protocol with a very active project base and strong token performance, but Solana still attracts more interest.

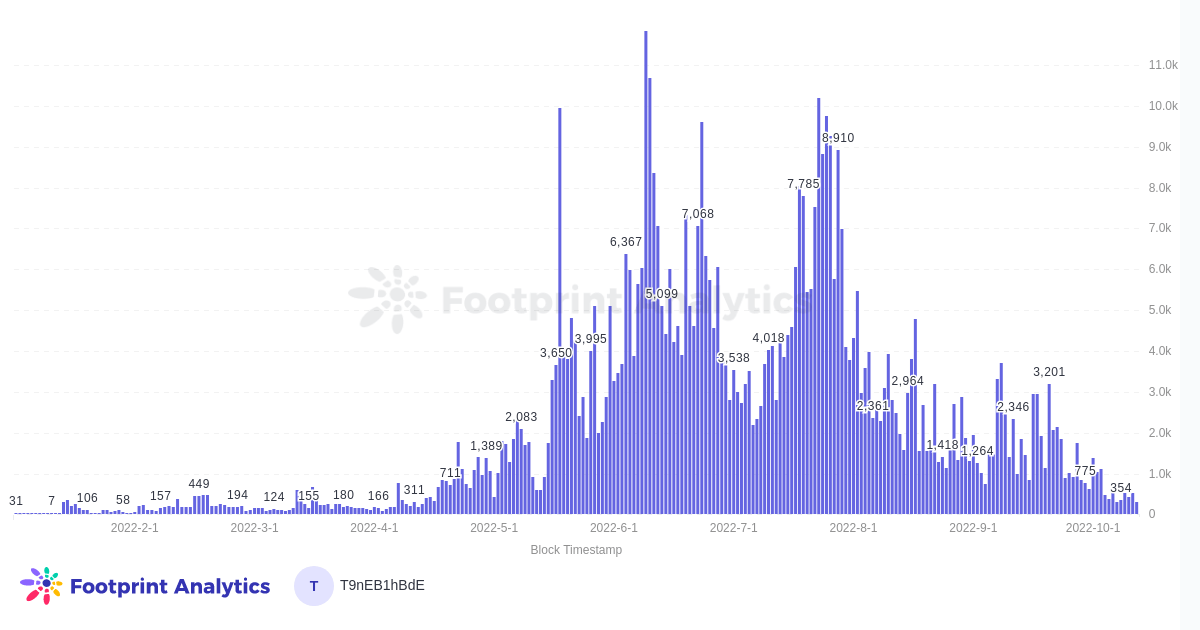

NFT enthusiasts, especially smaller creators, flocked to the emerging Solana ecosystem and its community-driven marketplace, Magic Eden.

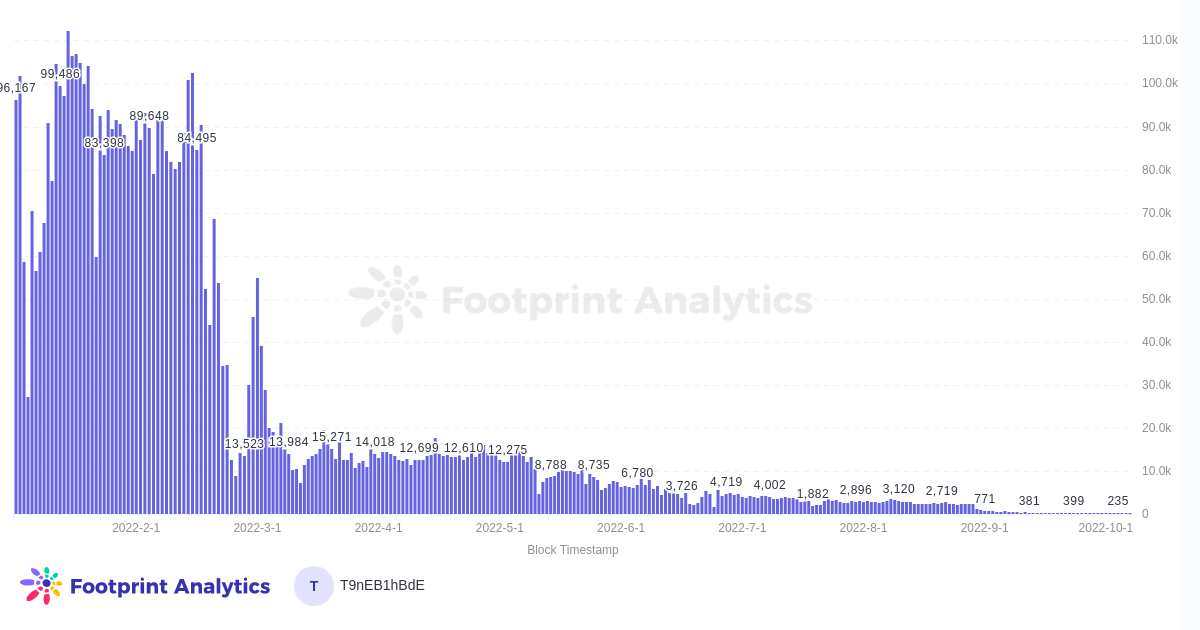

The exodus from Polygon to Solana becomes evident in a side-by-side comparison of OpenSea transaction data for the two chains over the same period.

Polygon is still doing amazing things with Web3, but it’s clearly not the frontrunner next to Ethereum for NFT projects. While some of the charts above don’t give you the full picture (including Element Marketplace and Playdapp Marketplace, Polygon looks somewhat better), Solana has drawn most of his NFT industry hype. It is clear that

This work, footprint analysis Community in October 2022: [emailprotected]

The Footprint Community is a place to help data and crypto enthusiasts around the world understand and gain insights about Web3, the Metaverse, DeFi, GameFi, or any other area of the emerging blockchain world. Here you’ll find vibrant and diverse voices who support each other and move the community forward.

sauce: OpenSea Ethereum-Polygon-Solana

Become a member of CryptoSlate Edge to access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

price snapshot

more context

Register now for $19 per month Explore all benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024