No products in the cart.

- Latest

- Trending

ADVERTISEMENT

The Federal Reserve Board will hold its final FOMC meeting on July 27, before a two-month break. All eyes are on whether Fed Chair Jerome Powell is chasing the market consensus Note the more aggressive 100bp, as it is 75 basis points (bp) or inflation continues to skyrocket.

The Fed’s interest rate decision is scheduled for Wednesday at 2:00 pm EST and GDP data will be released Thursday at 8:30 am.

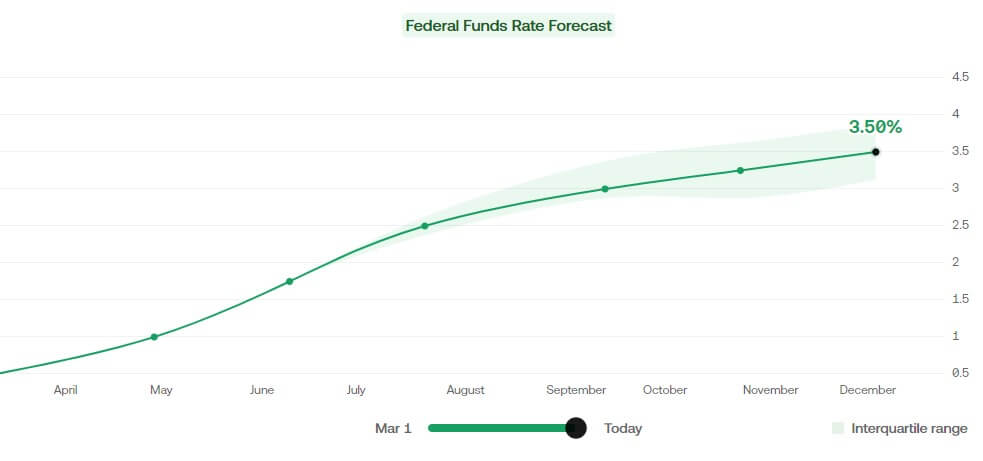

according to Zero Hedge In a preview of the FOMC conference and economists surveyed by Reuters, “100bp movement is only 10% likely.” Economists surveyed see the July 27 meeting as a peak rise in inflation. The rise will slow to 50bp in September and 25bp in November.

The Fed’s meeting will take place a few days after the White House considers publicly redefining the generally accepted methods established when the economy is in recession. Data on US GDP is expected Thursday, and if the information shows a two-quarter decline in GDP, it could disrupt the market.

Two-quarters of negative GDP growth is often cited as the definition of recession. However, the current White House administration has chosen not to use this indicator. Instead, metrics from “labor market, consumer and corporate spending, industrial production, and income” are added to the data to create an “overall” view of economic health.

Market analysts and commentators, such as Coin Bureau Guy, anticipate a “market turmoil” on Wednesday prior to the Fed meeting.

Today’s interest rate decision. The Fed’s last opportunity to curb inflation before a two-month vacation.

Expect market turmoil!

Coin Bureau (guy.eth) (@coinbureau) July 27, 2022

Morgan Stanley’s Michael J. Wilson said Yahoo! Finance,

The “stock market” may be ahead of the final suspension by the Fed, which is always a sign of bullishness. The problem this time is that the pause may be too late. “

Attempts to “go ahead” may be part of the recent rise in crypto prices. Bitcoin broke above $ 24,000 on July 20th, but is declining at the FOMC meeting on Wednesday. As of this writing, Bitcoin is $ 21.3K, an increase of 3% daily.

After the report, oil prices rose prior to the meeting across the wider market clearly Decrease in crude oil inventories in the United States. S & P rose 5% in July. This indicates that sentiment may be switching to a more bullish outlook.

CNBC report Analysts at Standard Chartered Bank say gold prices can see volatility. However, the long-term trend is still on the downside. “

In addition to the FOMC meeting, companies with a total valuation of $ 4 trillion, such as Meta, Boeing, Spotify, Shopify, and Upwork, will also report Q2 earnings on July 27.

More than $ 4 trillion are reporting today’s earnings, tomorrow’s FOMC / Fed meeting and rate hikes, and Q2 GDP numbers (confirming recession) announced yesterday.

The market can be volatile in the short term.

Josh (@CryptoWorldJosh) July 26, 2022

It is no exaggeration to say that there are various emotions in the world market. We still don’t know how the crypto industry will respond.Bitcoin price is Lowest correlation With Nasdaq from the beginning of the year. In the face of expected market volatility, Michael Saylor frankly reminded the world that “Bitcoin never misses revenue.”

#Bitcoin Never miss a profit.

Michael Saylor (@saylor) July 26, 2022

Looking at the data related to the reversal of financial yields, Compound Capital CEO Charlie Bilello said: I believe 75bp is already priced on the bond market. Given that Bitcoin has never experienced a global recession or soaring inflation, it’s not easy to see if the same applies to cryptography.

Bitcoin has fallen the next day after the last FOMC meeting this year. However, as the correlation with the stock market declines, it becomes more likely to break the trend. There was no separate FOMC meeting until September, so we could see inflation expectations for the next two months priced on Wednesday’s decision. The market is then left to summer’s own price discovery without Fed intervention.

Become a member of CryptoSlate Edge and access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

Price snapshot

Other contexts

Join now for $ 19 per month Explore all the benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024