According to on-chain data, the net value of Ethereum removed from staking has exceeded $1 billion in the last 24 hours, again demonstrating the network’s ability to successfully perform live updates across the network.

Actual ETH withdrawal

A total of $1.7 billion has been withdrawn since the Shanghai and Capella upgrades began. however, round 2 began withdrawing, and the value of the withdrawn Ethereum increased. Round 1 took him 4.14 days to complete as validators in the queue were processed.

There are currently 18,442,455 ETH at stake, worth $38.5 billion at the time of writing. as a result,

ETH staked accounts for 15.32% of the total supply, with 33% staked on Lido.

Withdrawals started, investors are withdrawing their initial capital and earned rewards.Staking Ethereum earns interest over time, and if a validator earns more than 32 ETH through rewards, the excess amount is their majorInstead, it will be automatically deducted as a reward every few days.

The graph below shows the significant difference in deposits and withdrawals (rewards and principal) after the upgrade.

reward

Staking rewards started at around 15% and were placed on a predefined downward curve against the number of validator participants until the merge that the network took over.the current validator reward 4.33% including consensus rewards and transaction fees. These rewards spiked to around 5.2% in the days leading up to the upgrade, but have since returned to a downward trajectory. Total staking rewards went from 4.3% to 5.8% in the merger last September It has fallen 1.4% since the jump.

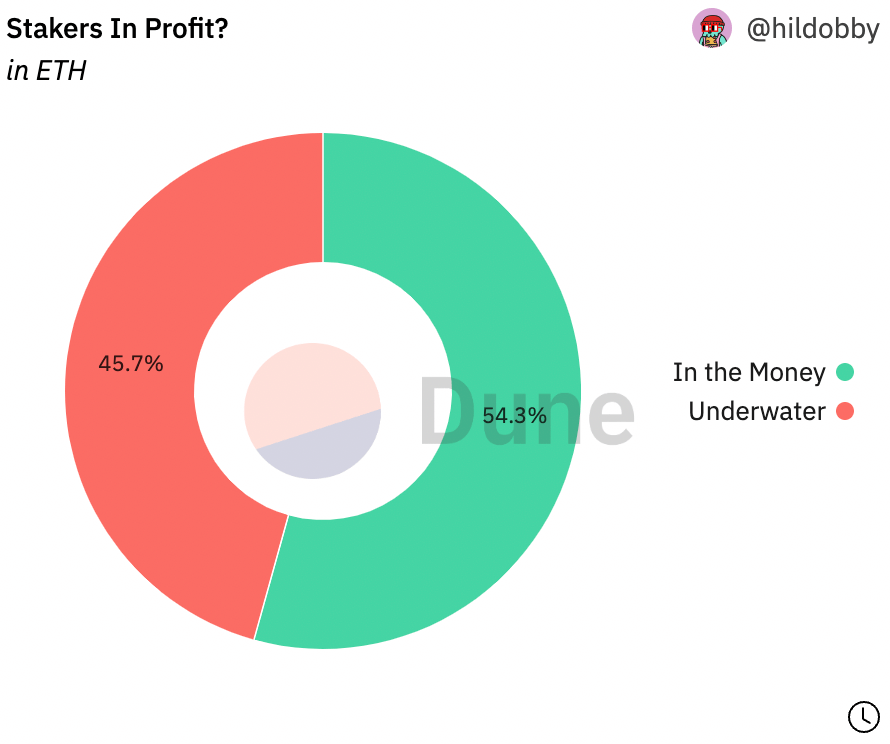

In addition to changes in deposits, withdrawals, and rewards, the average value of Ethereum staked by validators has decreased since withdrawals began. As a result, 54.3% of stakers are currently profiting on his ETH of around $2,000.

bullish momentum

Ultimately, both the Shanghai and Capella upgrades appear to have been successful. Because the network handles new deposits, principal withdrawals and reward payments without major problems. Moreover, these actions are being carried out against billions of dollars worth of Ethereum every day.

Blockchain networks can certainly be considered still in beta in many ways, but Ethereum’s ability to successfully undertake the enormous task of upgrading a live network is a huge boon to the burgeoning industry. Promising.

A post first appeared on CryptoSlate about $1 billion in staked ETH being withdrawn 24 hours after Round 2 started.