No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Determining the market bottom requires a lot of guesswork. Bitcoin’s recent volatility has been attributed to a variety of factors, from geopolitical uncertainty and regional regulation to crypto market implosion.

Miners have historically been one of the most reliable predictors of Bitcoin’s performance.

Bitcoin miners form the foundation of crypto markets and create powerful resistance levels that reduce volatility. One of BTC’s largest holders, miners can move the market by holding and liquidating coins.

To analyze the market situation, we need to analyze the Bitcoin miner situation.

As CryptoSlate previously covered, some of the surest indicators of miner health are hash ribbons.

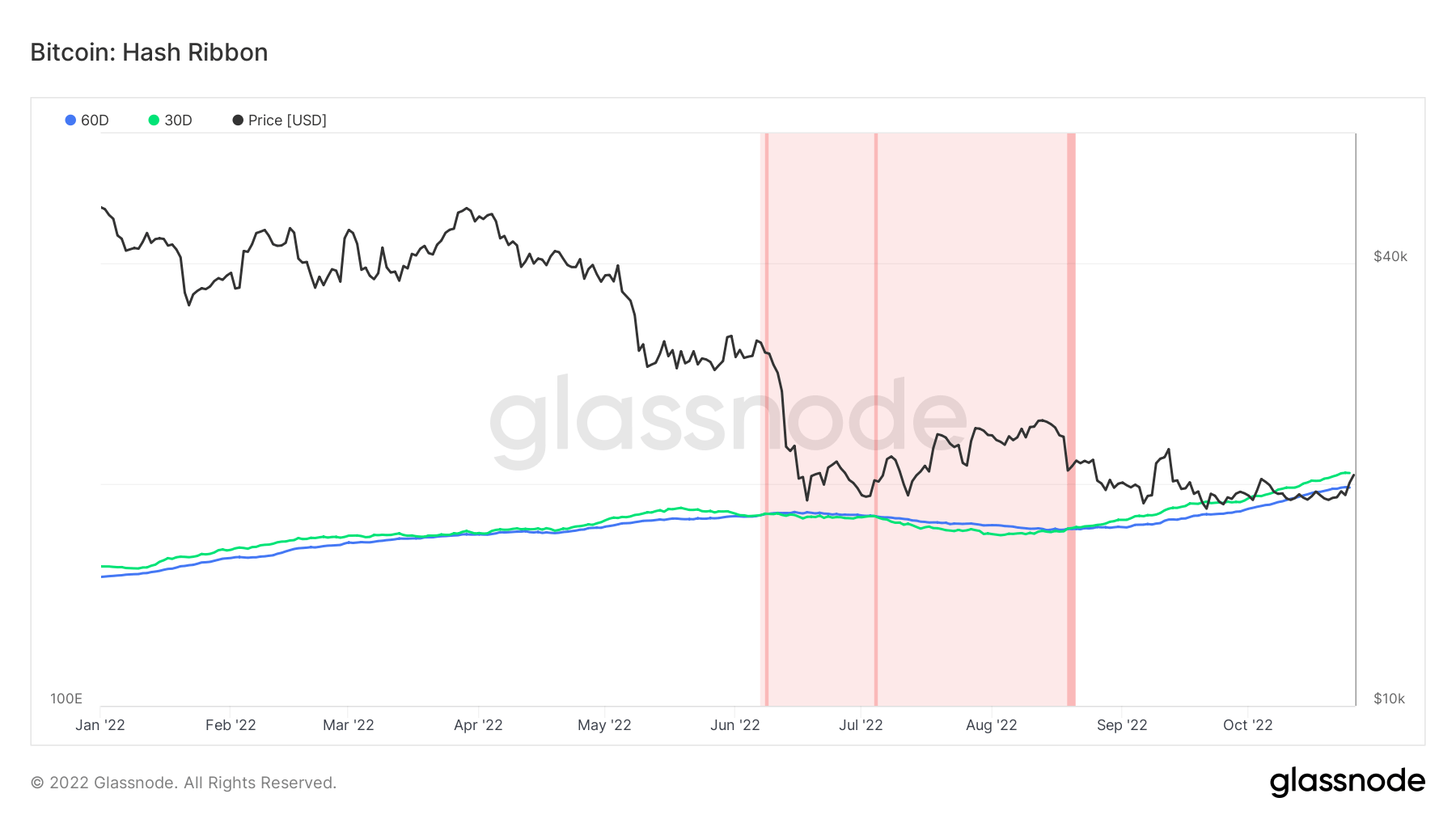

Hash ribbons indicate when miners surrendered and show the divergence between the 30-day and 60-day moving averages of the Bitcoin hash rate. In other words, the market price of Bitcoin is too low to cover the electricity costs required to produce Bitcoin.

According to Hash Ribbon, the worst miner capitulation usually ends when the 30-day moving average of Bitcoin hash rate crosses the 60-day moving average. Since the beginning of the year, we’ve seen three separate instances of this transition, shown in dark red in the chart below.

Data analyzed by crypto slate It shows that a severe minor capitulation began in mid-June of this year and continued until mid-August. The data are supported by crossing hash ribbons shown in the graph above.

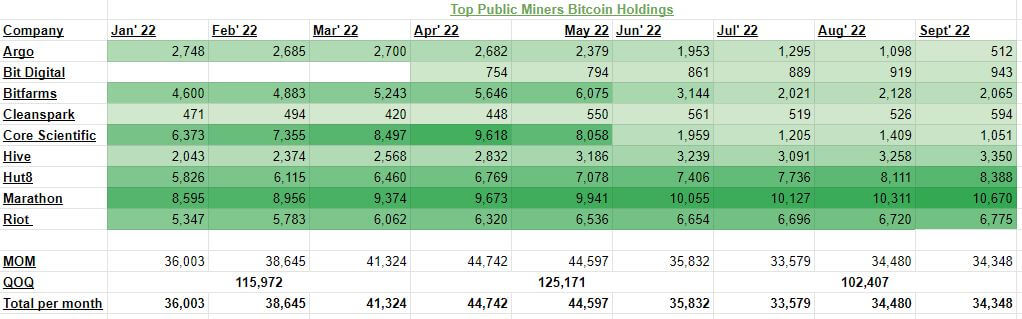

This trend is further supported when looking at the BTC holdings of the top nine listed Bitcoin mining companies. Several large miners generated significant selling pressure in May and June, liquidating around 8,765 BTC.

Month-to-month sales pressure looks to have stabilized since June, but the quarterly data tells a very different picture.

The holdings of the top nine public Bitcoin miners fell from 125,171 BTC in Q2 to 102,407 in Q3.

The numbers shown in the table above were further reduced in October. Earlier this month, Core Scientific liquidated over 1,000 BTC he held in September, report I only have 24 BTC on October 26th.

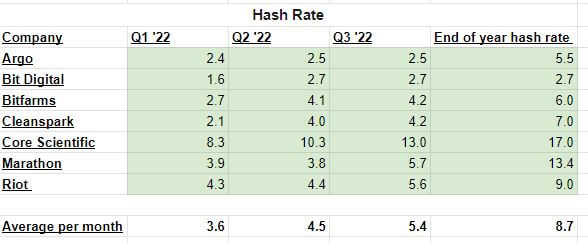

With mining difficulty and hashrate at all-time highs, miners are under pressure in terms of revenue and resources. The average hash rate in 2022 has been increasing quarter by quarter and is expected to grow at an even higher rate after Q4.

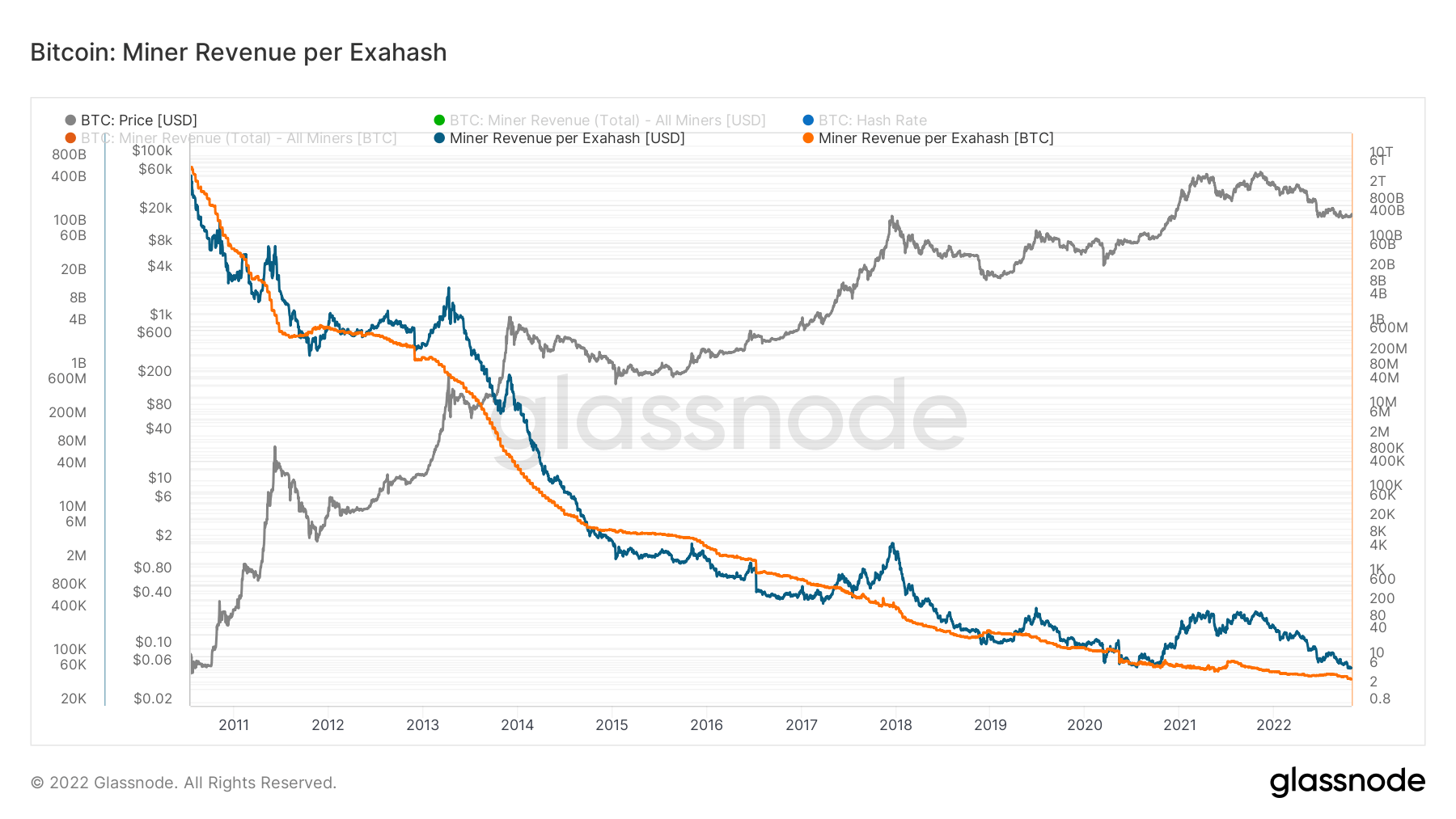

Data analyzed by CryptoSlate showed that Bitcoin’s decline later this year caused a notable drop in miner earnings.

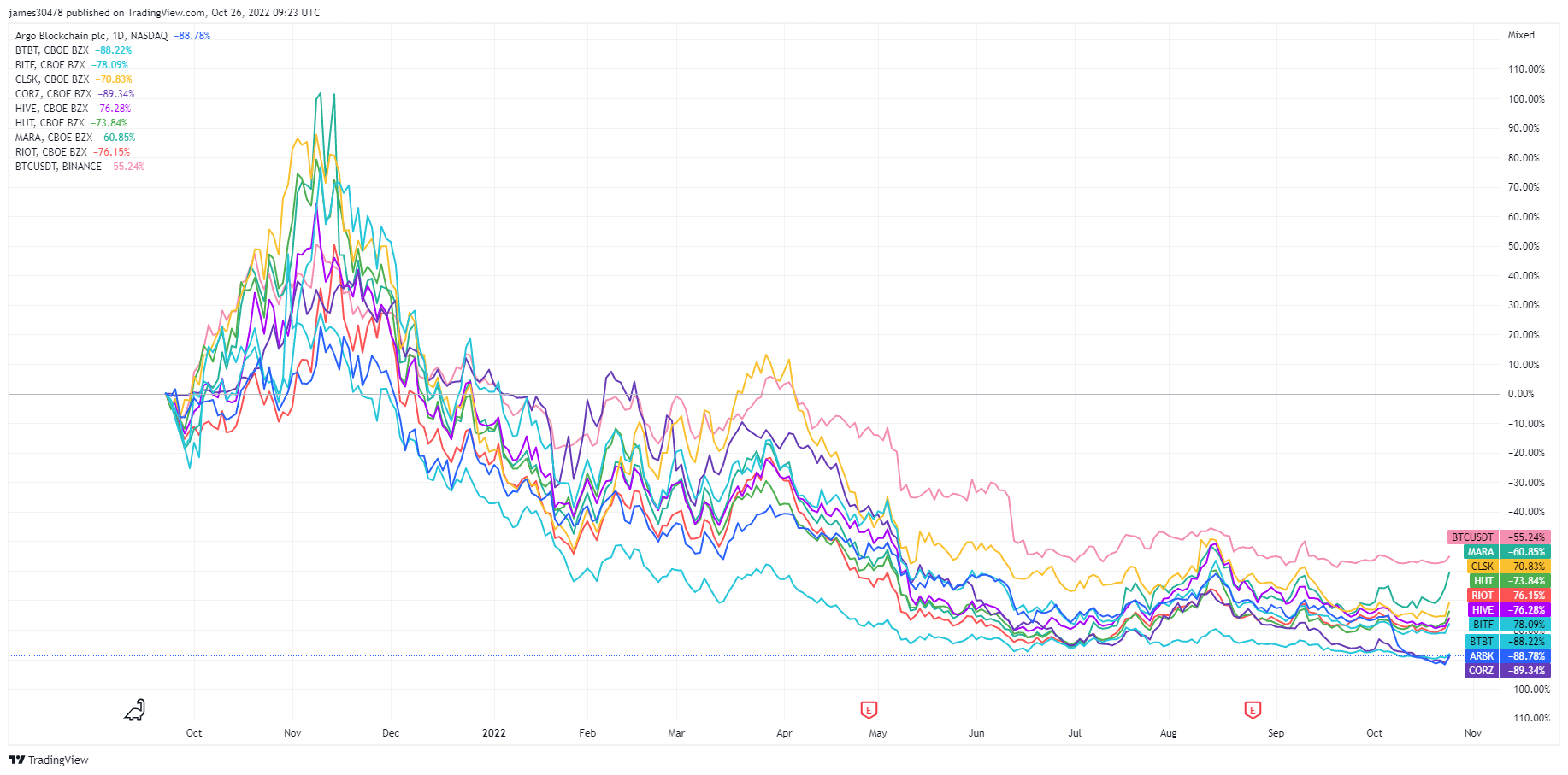

Bitcoin price volatility, declining earnings, and declining BTC holdings are also impacting the stock market. Shares of all publicly traded bitcoin mining companies have fallen sharply since peaking in October 2021. Core Scientific is leading the way, with CORZ down nearly 90% over the past year, with Argo Blockchain and BitDigital trailing him down 88%. .

With hashrate expected to rise further and a bear market with no end in sight, we find the ongoing miner capitulation to continue through the end of the year. The worse is not over yet. If the current situation continues, we could see another miner surrender before the end of the year, creating additional selling pressure that could further shake sensitive markets.

Become a member of CryptoSlate Edge to access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

price snapshot

more context

Register now for $19 per month Explore all benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024