No products in the cart.

- Latest

- Trending

ADVERTISEMENT

According to recent reports, many private investors in the United States often take out loans at exorbitant interest rates to buy cryptocurrencies, and more than half of such investors lose money. Was Investigation By Debt Hammer.

DebtHammer surveyed more than 1,500 people in the United States to find out about their crypto investment habits and how they affect countries that already have debt.

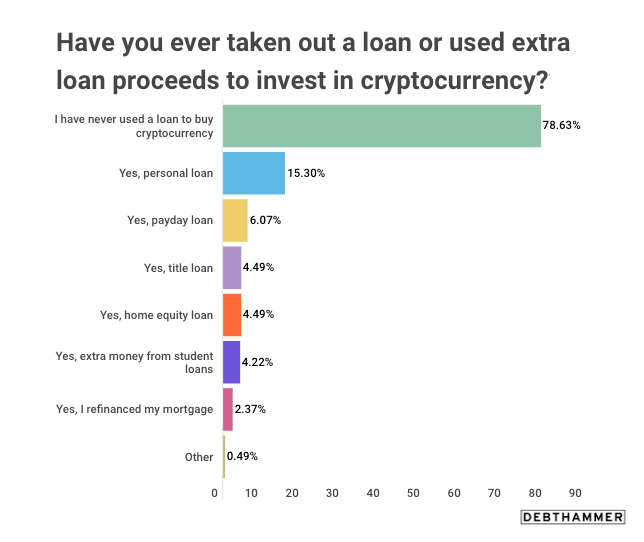

According to a survey, more than 21% of crypto investors used loans to pay for crypto investments.

Personal loans seem to be the most popular option among investors. Over 15% of them say they used personal loans to fund the purchase of cryptocurrencies. Many also used payday loans, title loans, mortgage refinancing, mortgage loans, and even the rest of the student loans to get the code.

About one in ten investors who used payday loans used it to buy cryptocurrencies. Studies show that most borrowed between $ 500 and $ 1,000 to invest in cryptocurrencies. However, DebtHammer researchers pointed out that these are high-risk purchases, despite low borrowings, as the average payday loan is about 400% in April.

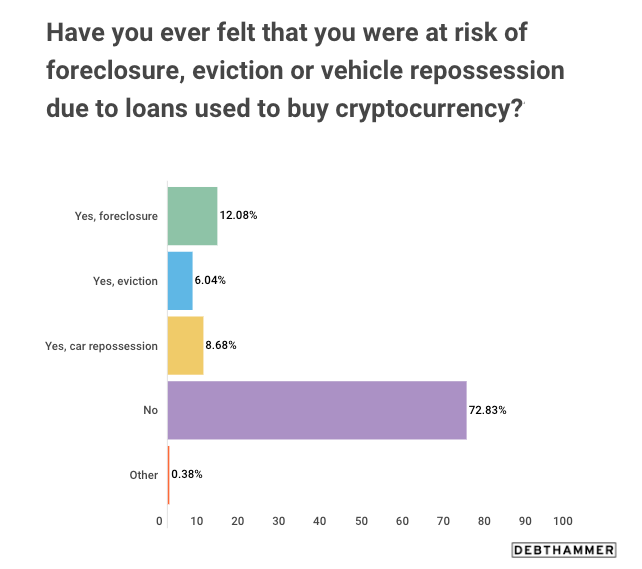

Individual investors who used loans to buy cryptocurrencies said their purchases were not always fruitful. About 19% of respondents said they were having a hard time paying at least one invoice for their crypto investment, and about 15% said they were worried about peasants, foreclosures, or car foreclosures. rice field. Payday loan users seemed to suffer slightly less damage, with only 12% reporting struggling to pay invoices and worrying about evictions, foreclosures and foreclosures of peasants.

Loans aren’t the only way investors were buying cryptocurrencies when they were running out of cash.

According to a survey, more than 35% of respondents said they used credit cards to buy cryptocurrencies. About 20% of them paid it off when the bill was due, but 14% said they were paying off in stages with either a 0% APR referral offer or the full interest rate.

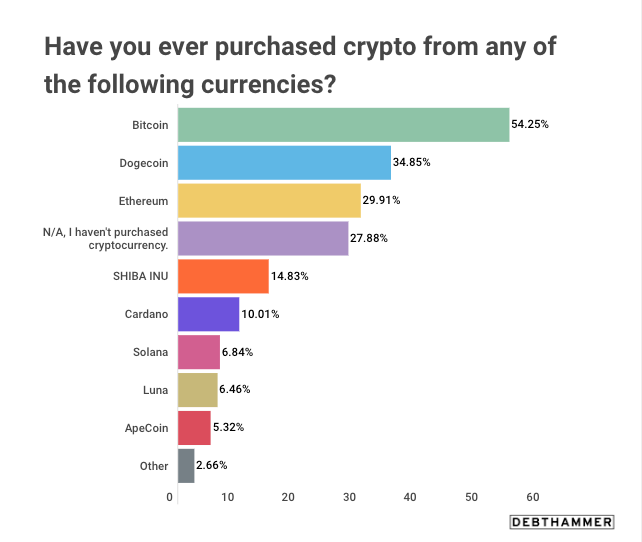

All the money borrowed was sent to just a handful of cryptocurrencies. According to the survey, more than half (54%) of the respondents used the borrowed money to buy Bitcoin (BTC). Dogecoin (DOGE) came in second, with almost 35% of respondents saying they bought tokens on a loan and just under 30% saying they bought Ethereum (ETH).

Just under 23% of those who borrowed money to buy cryptocurrencies said they did it because of the sharp drop in cryptocurrencies. About 15% considered cryptocurrencies to be a good long-term investment, and 17% said crypto prices were “historically low.”

A notable percentage of respondents (18.5%) said they borrowed money to buy cryptocurrencies because a credit card company or bank offered a 0% promotional interest rate.

However, not everyone who gambles wins.

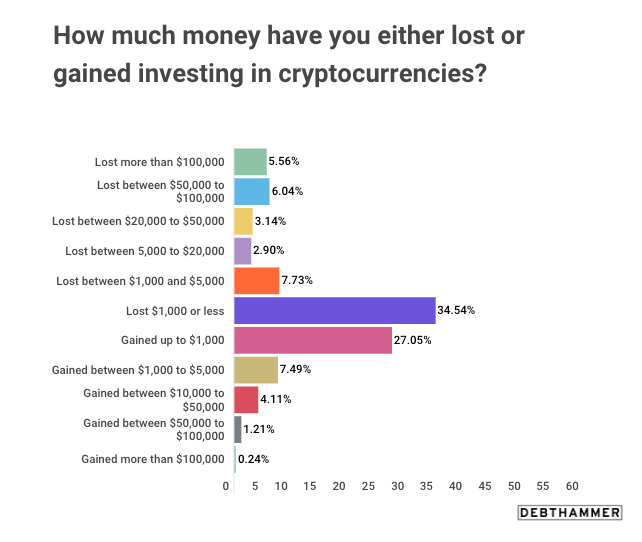

About 60% of those who borrowed money to invest in cryptocurrencies lost money. And while more than one-third lost less than $ 1,000, 6% said they lost between $ 50,000 and $ 100,000, and 5.5% said they lost more than $ 100,000.

Investing in cryptocurrencies with borrowed money is not a big profit either. The majority (27%) made up to $ 1,000, but only 7.5% made between $ 1,000 and $ 5,000.

Become a member of CryptoSlate Edge and access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

Price snapshot

Other contexts

Join now for $ 19 per month Explore all the benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024