No products in the cart.

- Latest

- Trending

ADVERTISEMENT

The US debt ceiling reached $31.4 trillion on January 19, raising calls for radical action. remove the whole ceiling.

Bitcoin offers an alternative to fiat currency systems that are doomed to failure as a result of the inherent need to expand the money supply through money printing.

While the US government is unlikely to adopt BTC by any means, there are some innovative solutions using Bitcoin to deal with runaway debt.

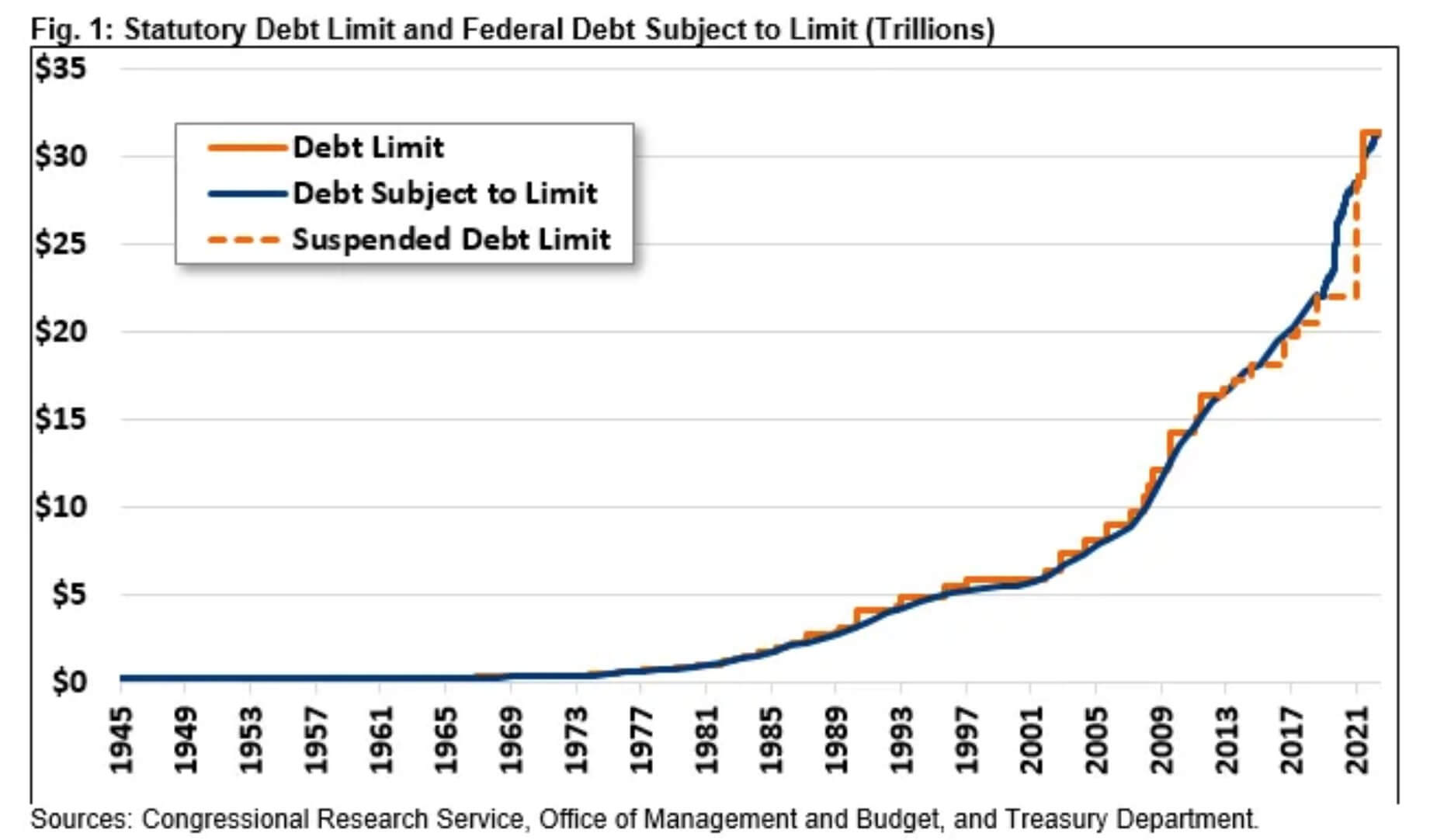

The US debt ceiling refers to the legislative cap on national debt borne by the US Treasury Department. In other words, it limits the money the US can borrow to process its bills.

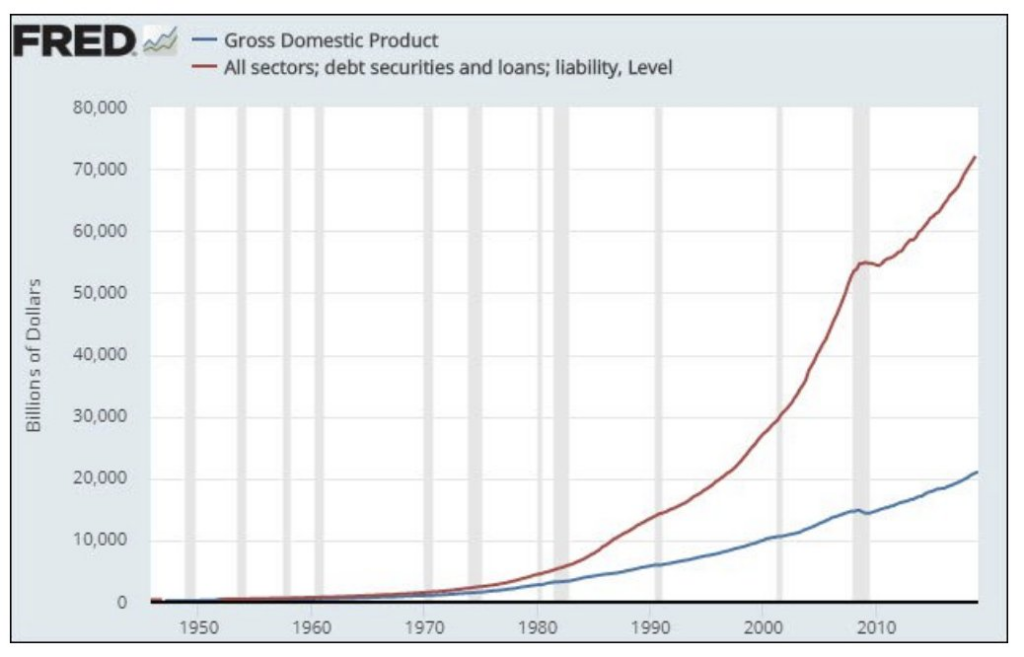

The chart below shows that US government debt far exceeds Gross Domestic Product (GDP), forcing the US to raise additional funds through the sale of government bonds. However, please note the following: Second Liberty Bond Act (1917) Prevents the sale of government bonds after the debt ceiling is reached.

Any increase in the debt ceiling requires bipartisan approval. Recent examples of nearing the debt ceiling in the past face political stance from both sides of the divide.

On January 19th, the $31.4 trillion cap was reached, promoting Treasury Secretary Janet Yellen Enact special measures by asking Congress to raise caps or suspend them to avoid shutting down government agencies.

Meanwhile, to keep the Treasury moving, Yellen said: $335 billion With a short-term bill to keep the government running.

Failure to reach a timely agreement could mean economic catastrophe, with delayed Social Security payments, unpaid military personnel, and severe consequences for families dependent on benefits. Don’t forget the potential impact on financial markets fearing a government default.

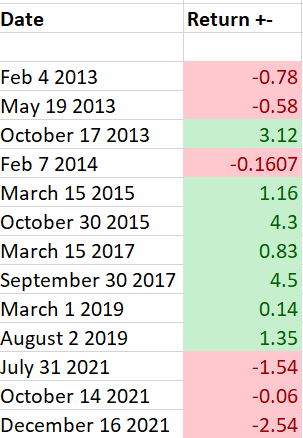

The table below shows the dates in Bitcoin’s history when the US debt ceiling was reached and the intraday performance of the coin on those days.

Mixed results have shown whether the debt ceiling crisis provokes positive or negative price performance. Seven of the 13 days yielded positive intraday returns, with October 17, 2013 being the best performing day with a 3.12% gain.

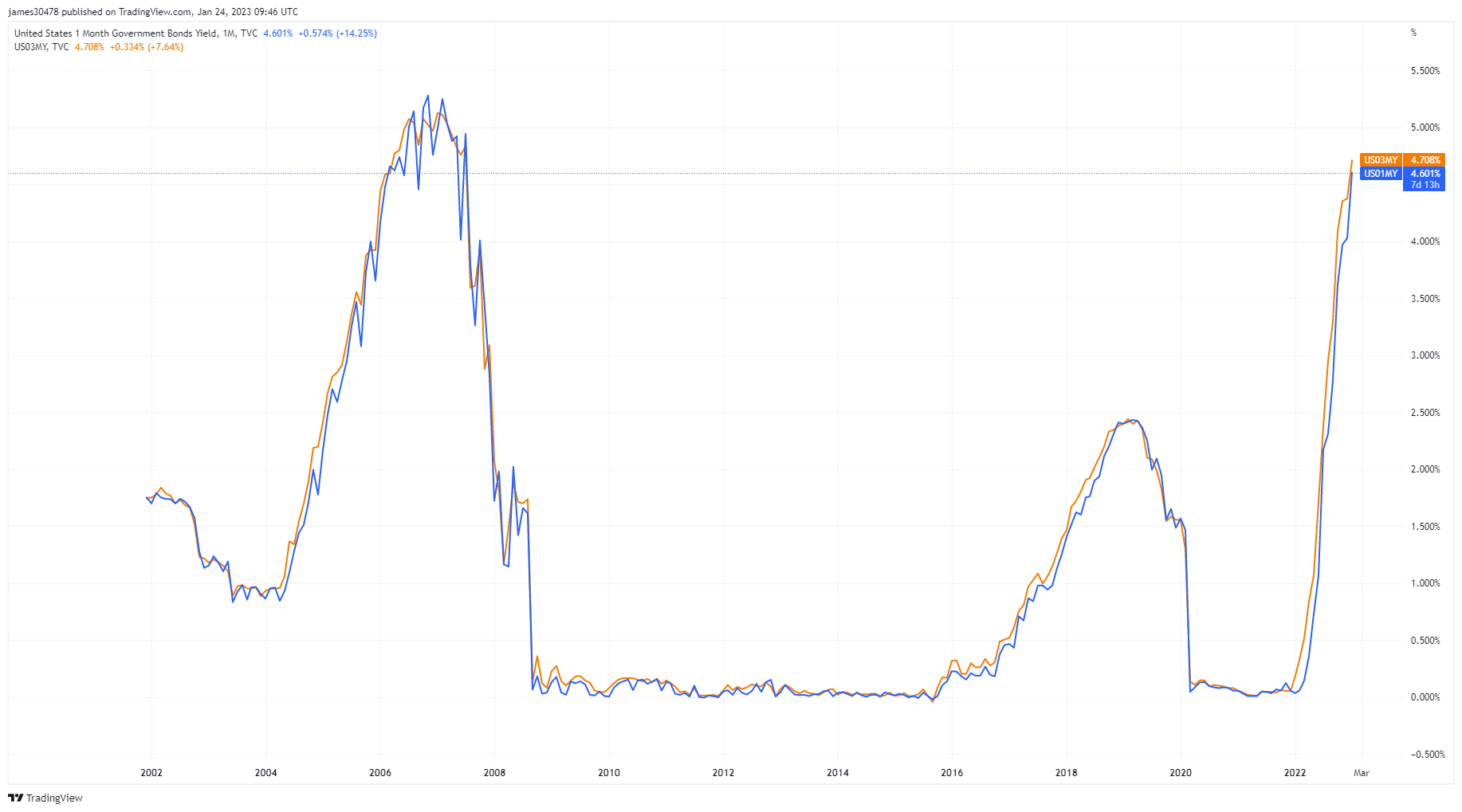

However, none of these events occurred under extreme economic conditions such as high interest rates and an inflationary environment.

The US faces the dilemma that extending the cap, as it has done in the past, is the only viable solution. As we’ll see below, the extension only makes us more dependent on the debt, making the problem of not being able to pay it back worse.

Intraday performance aside, bitcoin proponents argue that it is a possible solution to the debt surge, as it is not subject to currency expansion or political and state control.

For example, on October 7, 2021, the Senate approved a cap increase of $480 billion, Cynthia Lumis He said the danger of irresponsible debt management would have consequences, including devaluation.

In the event of unforeseen circumstances, non-fiat currencies that are not issued by governments and are not subject to political elections will grow and allow people to save and be there if they fail to do what we know. We want to make sure we are in. We have to.

In terms of using bitcoin in innovative ways to tackle the debt problem, there are several such as issuing bitcoin-denominated bonds instead of dollars, allowing governments to raise money without increasing the debt ceiling. Some solution exists.

Similarly, incorporating BTC into a hybrid model of monetary policy can offset the impact of a loss of purchasing power due to expansion.

The fundamental problem with fiat money is that it relies on perpetual growth. That means the system has to keep printing to keep his Ponzi alive. A currency’s depreciation or a decline in its purchasing power occurs when the money supply increases without a corresponding increase in economic output.

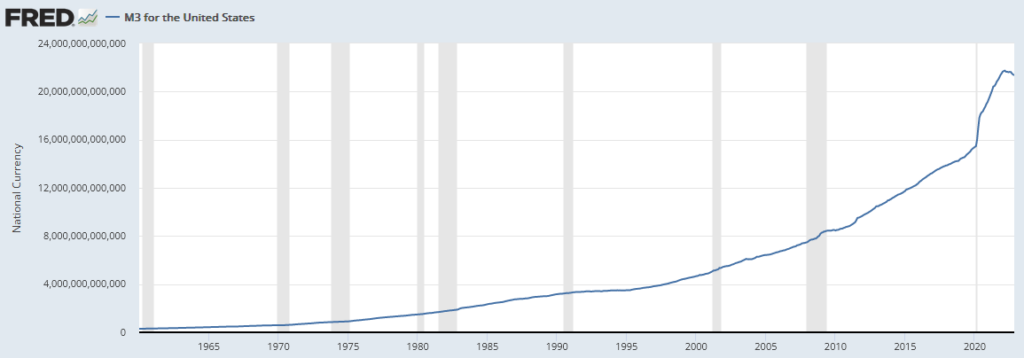

US M3 money. Money in circulation and bank checkable bank deposits, savings deposits (less than $100,000), money market mutual funds, and bank term deposits have increased since records began.

The chart below shows a significant increase in the M3 money supply since 2001. The covid crisis prompted a near-vertical increase, which then declined, peaking at $21.7 trillion in February 2022. 40% Existing dollars created during this period.

The M3 money supply is on a downward trend due to the recent shift to quantitative tightening. But inevitably, the Fed will eventually be forced to restart the press to stimulate economic activity.

Gross Domestic Product (GDP) data from St. Louis Fed showed that economic output increased by 13% between the first quarter of 2020 and the first quarter of 2022. This is well below the expansion of the M3 money supply.

micro strategy chair Michael Thaler Bitcoin is called the scarcest asset on earth. His reasoning boils down to his 21 million fixed supply of tokens. That is, unlike the dollar, it will not fall.

Theoretically, when the M3 money supply increases, the dollar begins to depreciate, thus increasing the price of BTC in dollars. That means you will need more dollars to buy the same BTC of him.

In practice, however, legislators are generally wary of cryptocurrencies.Yellen, for example, has publicly denounced them many times, but most recently statement Calling for “more effective surveillance” in the wake of FTX’s demise.

As such, the US government is unlikely to adopt BTC. But staying this way, adding more debt and losing more purchasing power will only lead to further erosion of dollar hegemony.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024