No products in the cart.

- Latest

- Trending

ADVERTISEMENT

The recent recession, along with a myriad of other factors, is putting pressure on Bitcoin mining companies to continue operating.

according to PoliticoMiners also had to deal with rising interest rates and soaring energy costs, in addition to price plunges. This means lower demand and lower profit margins.

“Rising interest rates, soaring cryptocurrency prices, and soaring energy costs have put the once-hot industry on the ice.”

An additional threat lies in the EU’s stance on proof-of-work mining bans, which will have disastrous consequences for BTC mining and its prices. In addition, most altcoin prices follow Bitcoin, so if a ban is enacted, the impact could be across the crypto industry, regardless of the specific consensus mechanism of the token.

Despite the fate and darkness of Bitcoin’s design, the homeostasis mechanism has begun to move to offset the recent upheaval.

Miners sending Bitcoin to exchanges for sale in response to the shift have risen since June 7. Reuters.. In addition, it was noted that some publicly traded mining companies liquidated more than the May token output to deal with the deteriorating market conditions.

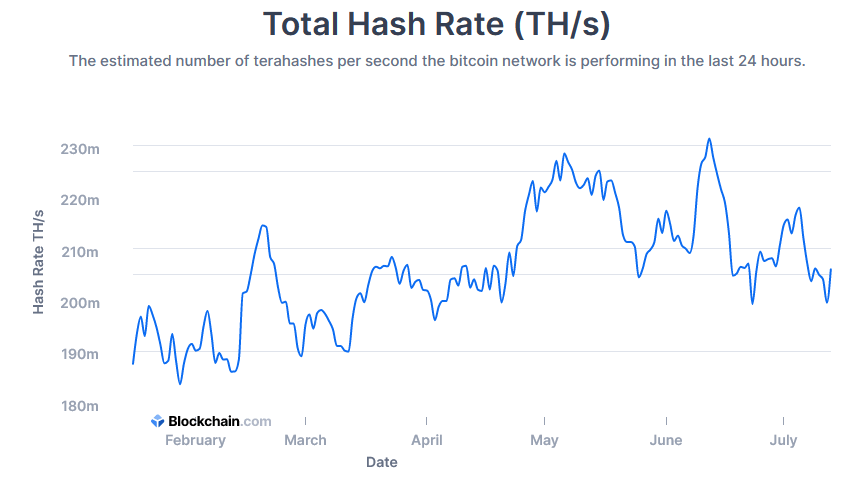

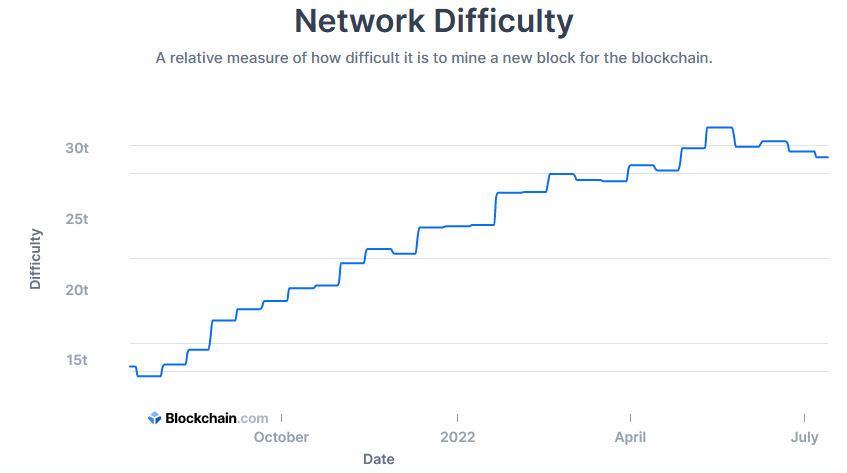

Joe Burnett, an analyst at mining company Blockware Solutions, said the problem was exacerbated by the surge in hash rates and the difficulty of the mining industry over the past six months, further motivating miners to offload tokens.

Over the last six months, Bitcoin prices have fallen, while hash rates and mining difficulty have increased. Both are negative for existing miners, as they both work to reduce margins. “

chime, Charlie SchumacherFor Bitcoin miners, everything that could go wrong seems to go wrong, said Marathon Digital, vice president of communications for mining company Marathon Digital.

An analysis of the 7-day average Bitcoin hash rate over the last 180 days showed a peak of 231 m TH / s on June 12. This was followed by a sharp drop at 199 m TH / s within 2 weeks.

The hash rate recovered to its highest level at 218 mTH / s on July 5, but has formed a series of low highs since its high on June 12. This suggests that miners tend to leave the game.

An analysis of the one-year mining difficulty chart showed that the difficulty reached its highest level of 31.25 tonnes in the two weeks leading up to May 24th.

The above works well in that the production cost of Bitcoin is lower.according to BloombergAccording to a study conducted by JP Morgan, the production cost of one BTC has increased from $ 24,000 last month to $ 13,000.

With the current price of BTC at $ 20,100, this should help reduce pressure on miners.

Become a member of CryptoSlate Edge and access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

Price snapshot

Other contexts

Join now for $ 19 per month Explore all the benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024