No products in the cart.

- Latest

- Trending

ADVERTISEMENT

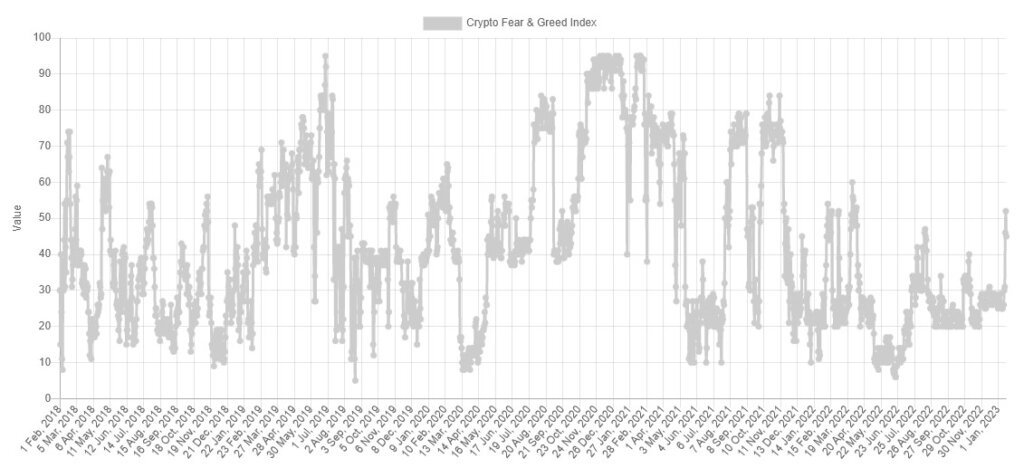

For the first time since April 2022, the Bitcoin Fear & Greed Index (FGI) has moved from the ‘fear’ zone to ‘neutral’.

Over the weekend, Bitcoin reached a score of 52 on the index as it climbed above $21,000.

At the time of writing, the score had slipped slightly to the bottom of the “fear” scale, with a rating of 45. The index started the year in the “extreme fear” zone, indicating bearish sentiment was dominating the market. Beginning of January.

But as Bitcoin climbed from $15,600 to $17,200 in November-December, FGI moved away from extreme fear.

Bitcoin plummeted following the collapse of FTX. However, within the past week he seems to have recovered to pre-FTX collapse levels. The top cryptocurrency by market capitalization was rangebound for about 63 days before breaking resistance above $20,000.

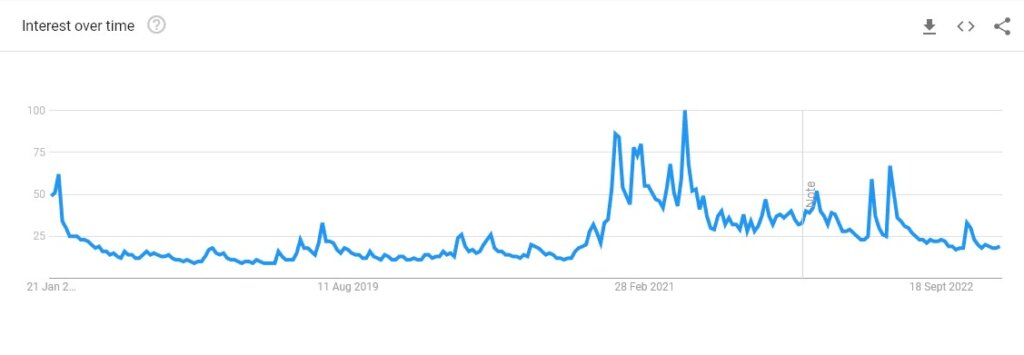

Additionally, FGI may have moved away from ‘fear’ while other global indicators have not shown a similar bullish trend. For example, Google search traffic for the term “bitcoin” remains at its lowest level since December 2020.

Interest by region shows that El Salvador is by some margin the most interested in Bitcoin, followed by Nigeria, with a larger gap than European countries such as the Netherlands, Switzerland and Austria.

Bitcoin is the legal tender in El Salvador and BTC is used for peer-to-peer payments in Nigeria.

Nigeria recently recognized cryptocurrencies as an asset class, along with its own CBDC, e-Naira. However, Paxful CEO Ray Youssef attributed Bitcoin’s rising popularity to Nigeria’s youth culture, stating:

Nigeria is different. Young people were all about it.

Outside of these anomalous countries, interest in bitcoin has arguably waned during bear markets, and the recent rise has not led to a significant increase in bitcoin searches globally.

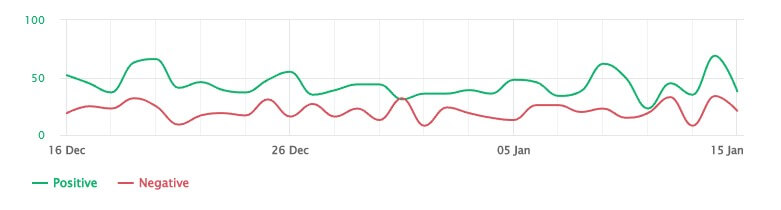

Additionally, a review of sentiment analysis of popular videos, news and blogs related to Bitcoin showed a peak of positive sentiment on January 15th. However, there was no apparent increase in positive or negative views over the past 30 days.

Looking at historical FGI data, it’s clear that Bitcoin has broken out of the downtrend line that started in November 2021. However, other breakouts were supported by growing interest in Bitcoin, which is not clear at the time of writing.

The potential downside catalyst remains at the forefront of investors’ minds as Digital Currency Group fails to publicly vouch for its business. Many have pointed out that the recent price action points to a bullish trap.

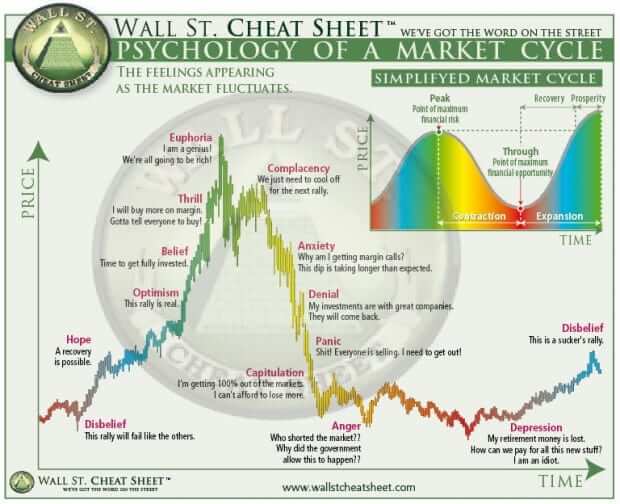

However, Altana Digital Currency Chief Investment Officer Alistair Milne said: popular charts This shows a typical investor mindset at each stage of the price cycle. In the image below, we describe the final stage of a bear market as Disbelief.

After the distrust phase, the market returns to bullish territory.

Such images are not 100% accurate as there is no crystal ball to predict Bitcoin price. But with inflation dropping and Bitcoin’s next halving only a little over a year away, there is finally some reason to hold on to hopes of returning to the bull cycle sooner than expected.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024