No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Crypto analytics platform Santiment has revealed that Bitcoin (BTC) whale profits after the end of last year’s bull market have not been cashed out into fiat currency.

Santimento To tell Once the bull market ends in 2021, Bitcoin whales have converted their profits into stablecoins.

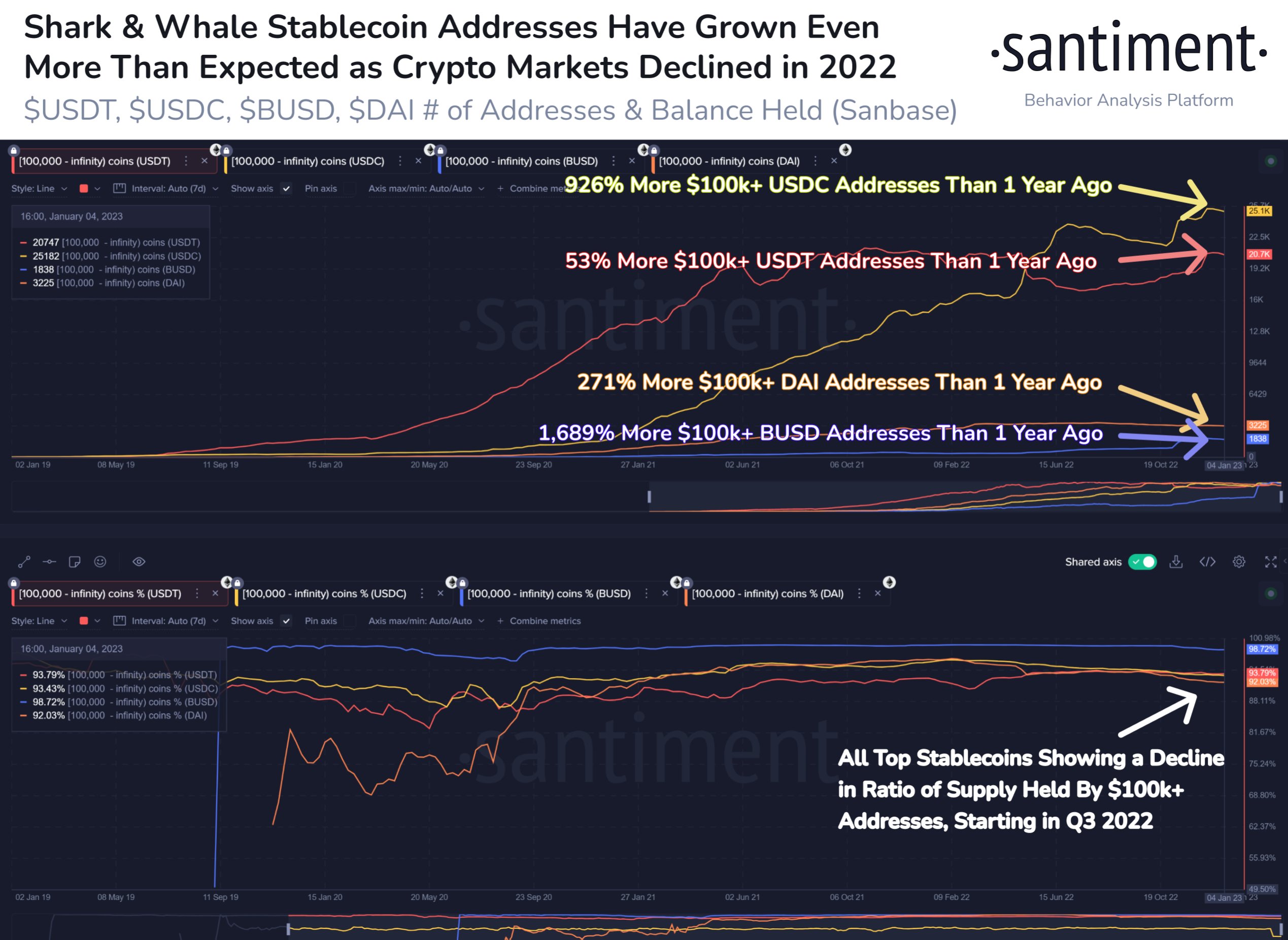

The number of stablecoin addresses holding $100,000 worth of dollar-pegged crypto assets has grown from 53% to 1,689% in one year, according to analytics platforms.

Its no secret that the Bitcoin whale crashed in 2022 as the cryptocurrency market retreated. However, 2021 profits are being held in stablecoin wallets instead of being cashed into fiat currency. As you can see, USDT, USDC, DAI, and BUSD are exploding with new large addresses.

Santiment reveals that the number of Large Tether (USDT) addresses has increased by 53% in one year. Meanwhile, the number of wealthy Dai (DAI), USD Coin (USDC) and Binance USD (BUSD) addresses increased by 271%. , 926% and 1,689%, respectively, over the same period.

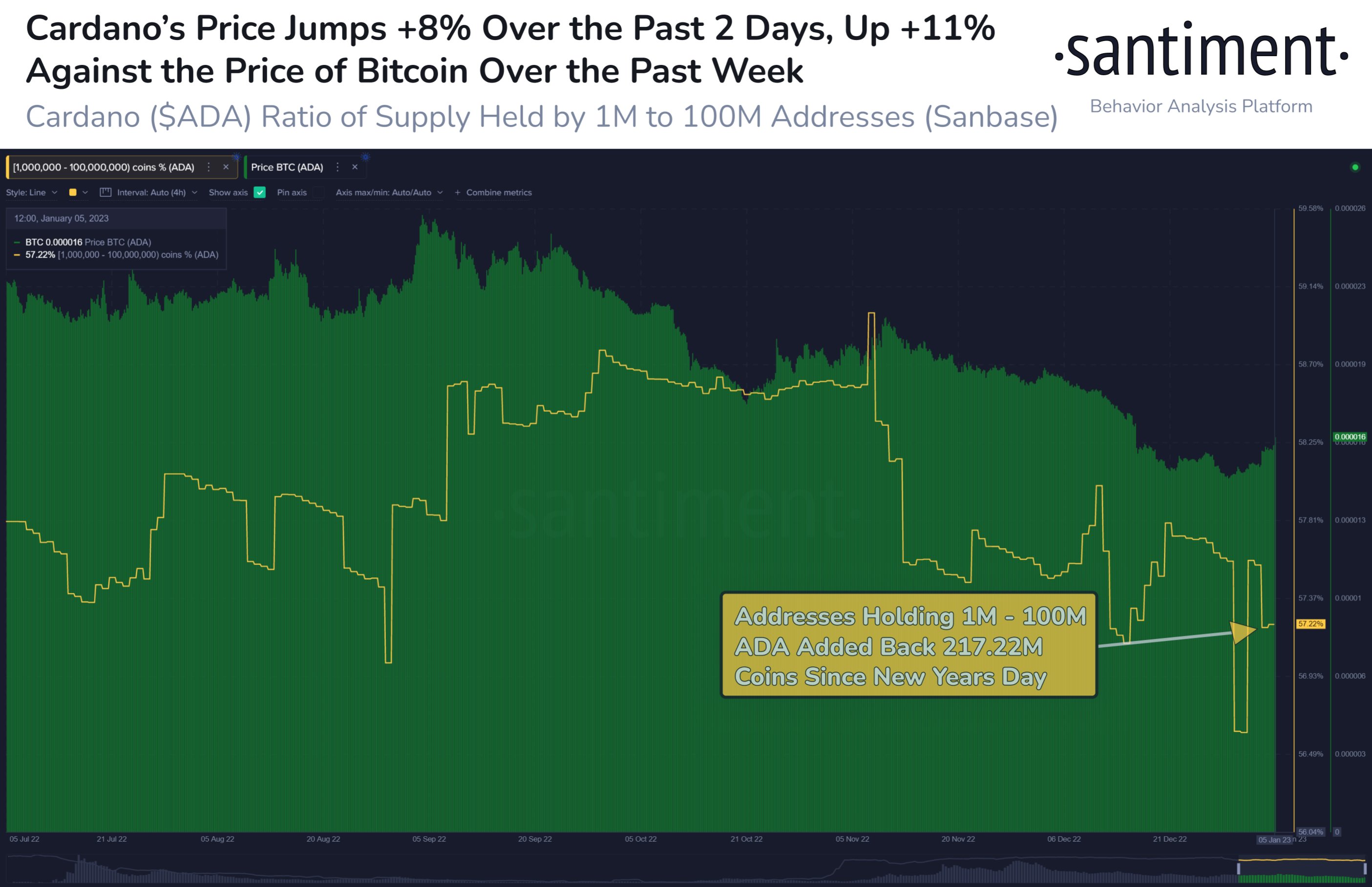

Cardano (ADA) Eyes Santimento To tell The smart contract protocol whale added over $60 million worth of ADA after unloading digital assets late last year.

Cardano is enjoying a small surge during this time, and addresses holding between 1-100 million ada could become prime validators to monitor price breakouts at the end of 2022. After dumping 568.4 million coins in two months, we added 217.2 million ADA to the start of 2023.

Cardano is trading at $0.277 at the time of writing.

Don’t miss a beat subscribe to get encrypted email alerts delivered straight to your inbox

Price action confirmation

Please follow us twitter, Facebook When telegram

Surf The Daily Hodl Mix

Generated image: In the middle of the journey

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024