No products in the cart.

Data analyzed by crypto slate We have shown that there is some relationship between Bitcoin’s highs and lows relative to gold, the S&P 500 and the S&P Case-Shiller Home Price Index (CSHPI).

Bitcoin vs Others

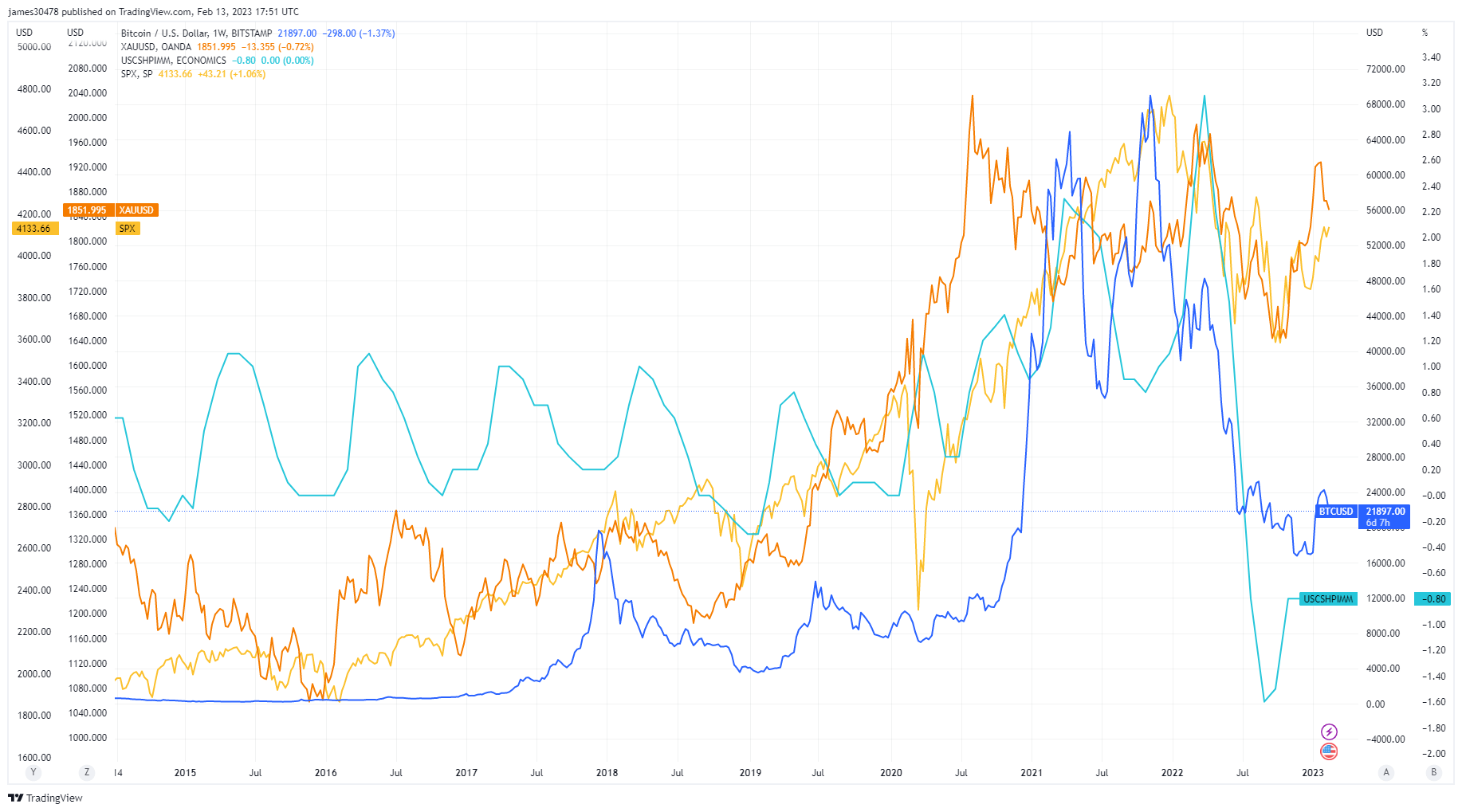

The chart below interweaves BTC, gold, S&P 500, and CSHPI prices. When Bitcoin bottomed out in the March 2020 coronavirus crash, it was noted that, with the exception of CSHPI, the prices of three other assets/indices also bottomed out quickly.

Examining the tops on the extended timeframe, the results for BTC as a leading indicator are also mixed. Bitcoin hit $69,000 in November 2021, followed by the S&P 500 at the end of the year, and his CSHPI peaking in January 2022.

However, gold reached $2,070 around August 2020, about 15 months before BTC topped out.

In summary, the data show high bottoming correlations between Bitcoin, gold and the S&P 500, but not US assets. The COVID-19 period was a black swan event putting selling pressure on a liquid asset class.

In terms of toppings, Bitcoin showed strong correlations with the S&P 500 and CSHPI, but not with gold.

Posted In: Bitcoin, Analysis