No products in the cart.

- Latest

- Trending

ADVERTISEMENT

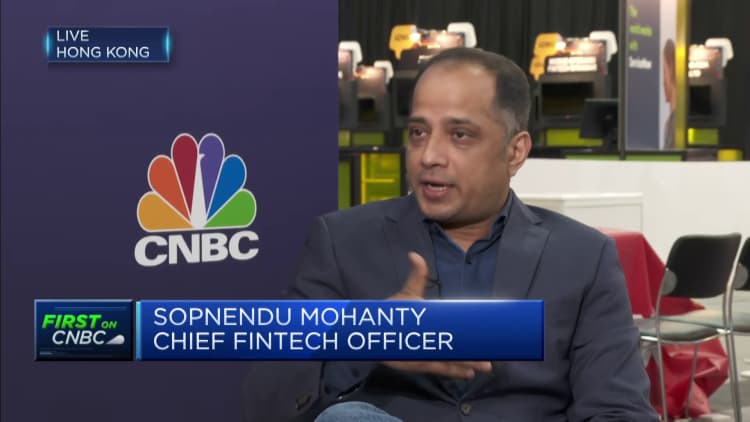

Coinbase Co-Founder and CEO Brian Armstrong chatted with Sopnendu Mohanty, Chief Fintech Officer of the Monetary Authority of Singapore (MAS) at the Singapore Fintech Festival in Singapore on Friday 4 November 2022. I’m here.

Bloomberg | Bloomberg | Bloomberg | Bloomberg | Getty Images

Singapore Co-founder and CEO of US-based crypto exchange platform coin baseBrian Armstrong said Singapore wants to be a positive regulator but is not welcoming to crypto trading.

City-states have repeatedly warned that cryptocurrencies are highly speculative and volatile after many retail investors lost most of their savings. No advertising.

Singapore wants to be a Web3 hub, but at the same time it says, ‘We’re not going to make retail transactions or self-hosted wallets available,’ said Armstrong of Singapore Fintech. Mentioned at Festival 2022. Sopnendu Mohanty, Chief Fintech Officer of the Monetary Authority of Singapore said:

In my view, these two things are at odds and I would like Singapore to embrace retail transactions and self-hosted wallets, Armstrong added.

It Comes After Coinbase received Principle approval from MAS to provide digital payment token services in city-states.

So far, Singapore has distributed only 17 principal approvals and licenses after a rigorous selection process following 180 applications. Binance reportedly withdrew its application to operate in the city-state earlier this year after being in a regulatory stalemate for months.

In response, Mohanty of Singapore’s Monetary Authority said retail investors today “are exposed to risks they don’t understand what they are taking”.

We believe Web 3.0 is the future and what we want to do is ensure that money that can be traded in this ecosystem is seen as a safe asset, a safe currency. That is the direction. As long as we’re okay,’ he added. Mohanty.

Mohanty kept asking Armstrong to name the regulations he felt needed review.

For centralized exchanges and custodians [like Coinbase], I think should be treated like any other financial services business. Anti-money laundering measures are required. There are audits that need to be completed, commingling of funds and proper disclosure to customers,” he said Armstrong.

Cryptocurrencies should not be treated unfavorably. They should be treated on a par with other financial services regulations.

To this, Mohanty compared it to a customer using a banking app.

“As regulators, we don’t worry about Internet protocols. We only care about the customers who went to banks. Banks have a responsibility to ensure they are protected,” he added.

CNBC has reached out to MAS and Coinbase for further comment.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024