No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Cryptocurrency exchange Coinbase analyzes the impact of scaling solutions on Ethereum (ethereum) blockchain.

In the research report, Coinbase To tell Its Layer 2 scaling solution (L2s) could eat into Ethereum’s revenue.

The future of L2 is very likely to be a zero-sum game, and whichever L2 houses the majority of decentralized applications could one day power the entire Ethereum ecosystem. suggests that L2s may eventually divert revenue away from Ethereum itself.

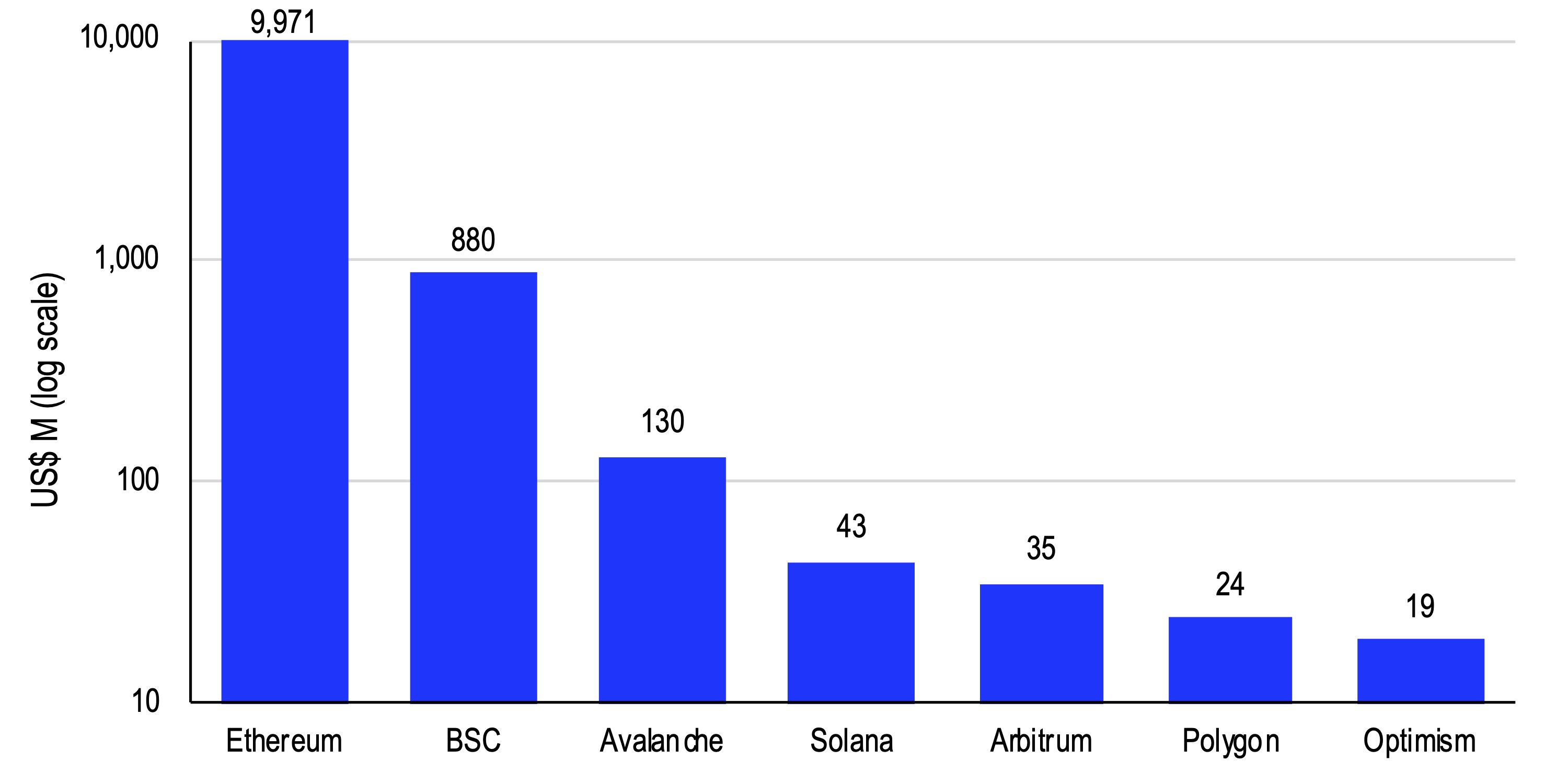

According to Coinbase, in the last 12 months, Polygon (matic),Optimism (OP) and Arbitrum generate less than 1% of the revenue Ethereum draws.

Over the past 12 months, TokenTerminal reports that Ethereum has earned $9.971 billion in total revenue, compared to only about $78 million in total revenue for Arbitrum, Polygon and Optimism.

According to the cryptocurrency exchange, when Ethereum moves to a Proof of Stake (PoS) consensus mechanism, scaling solutions may reduce staking yields, which could adversely affect the price of ETH.

If more user activity shifts to L2 and those L2s require their own tokens to facilitate transactions, the staking yield to validators who earn less on their net transaction fees will increase. If that discourages staking on the platform, it could increase the size of the liquid supply of ETH in circulation, impacting the price of ETH.

However, Coinbase said scaling solutions could benefit Ethereum in the long run as it increases network activity.

Also, the impact of L2 eating into Ethereums revenue could be a short-term phenomenon. or general use) depending on whether it becomes a blockchain.

As L2 facilitates more transactions by making them cheaper, faster, and easier, ultimately the increased activity that takes place on the network will mitigate the impact on initial revenue. There is a possibility.

Don’t miss the beat apply To get encrypted email alerts delivered directly to your inbox

check price action

Please follow us twitter, Facebook When telegram

surf The Daily Hodl Mix

Generated Image: StableDiffusion

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024