No products in the cart.

- Latest

- Trending

ADVERTISEMENT

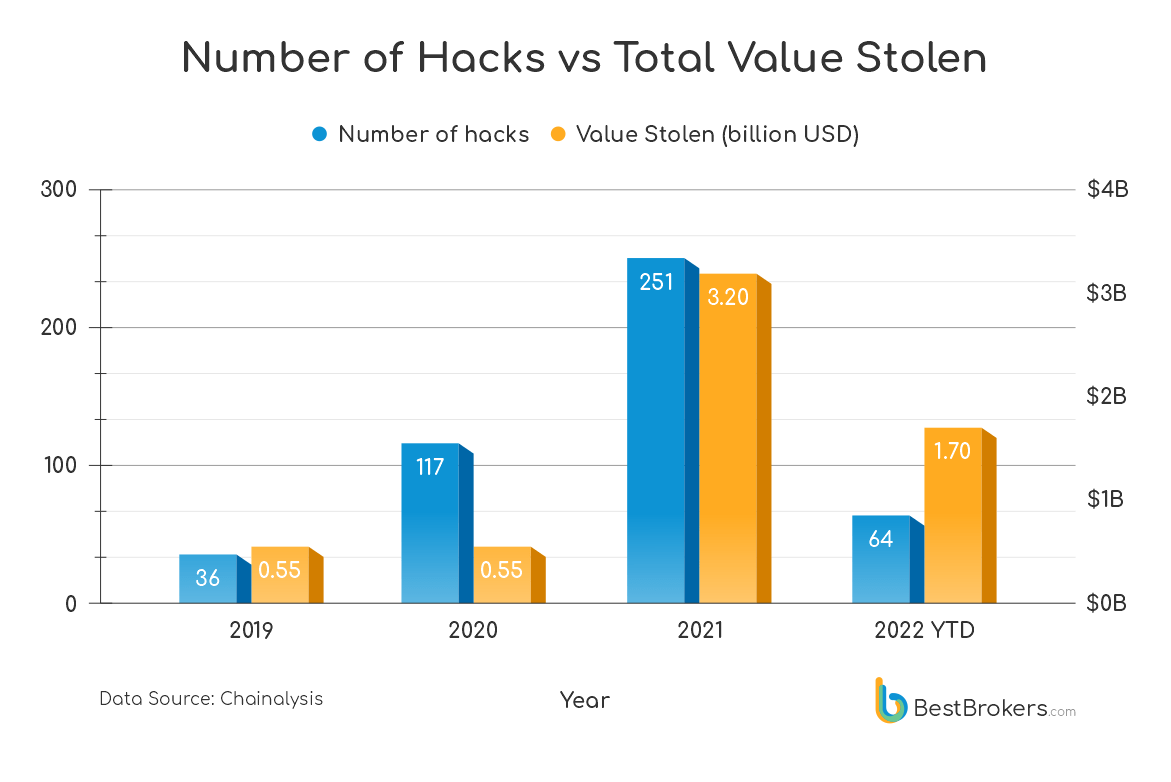

Cryptocurrency hacking has declined significantly since the beginning of the year. By mid-June, the industry had 64 security breaches, according to the latest BestBrokers survey. This is a significant reduction from 251 hacks last year.

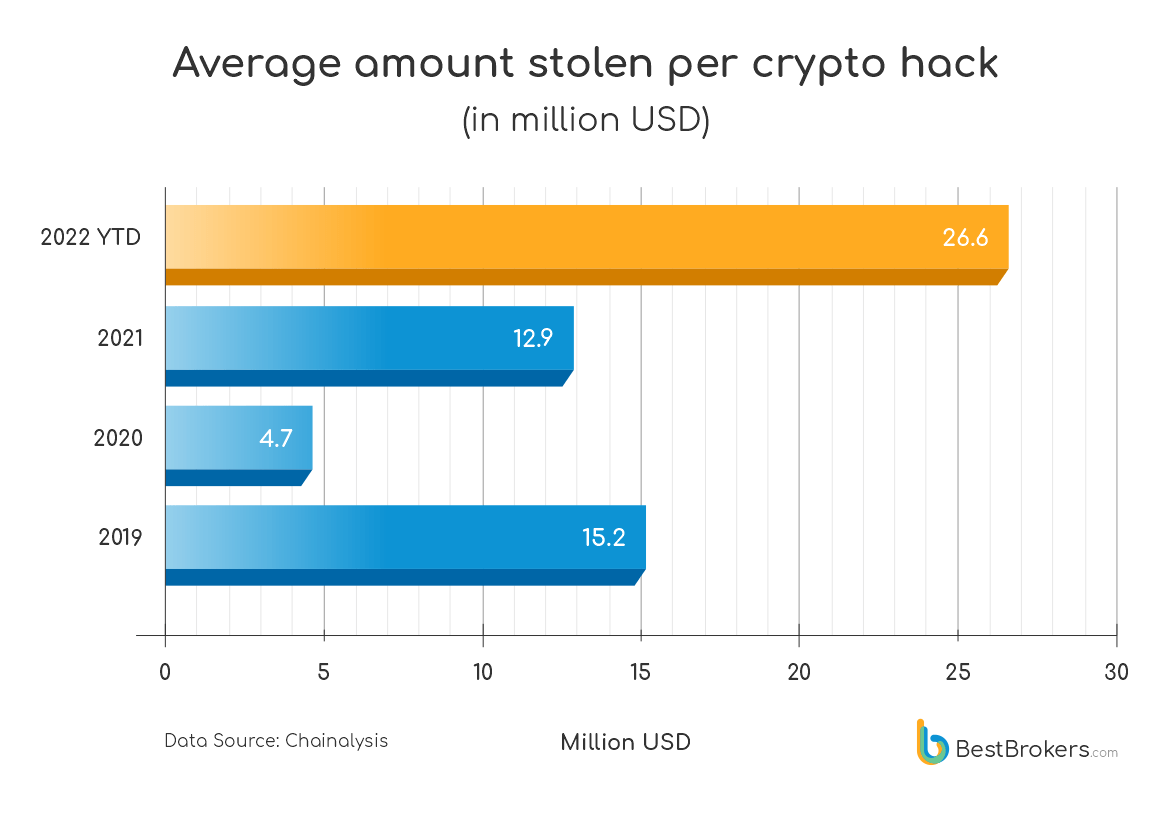

However, while the number of successful hacks has diminished, the damage done to the industry has certainly not diminished. According to the data, the average amount of theft per crypto hack is 206% higher than the 2021 average.

According to a study shared with CryptoSlate, a total of 251 hacks occurred in 2021, which is equivalent to about $ 3.2 billion in cryptocurrency theft. As of mid-June this year, only 65 security breaches in the industry stole about $ 1.7 billion.

“Despite the sharp decline in the number of crypto-related hacks in 2022, this year’s decline in crypto prices has not affected the total amount stolen,” the report said. Says.

According to the latest data from Chainalysis, the average amount of theft per crypto hack this year was $ 26.6 million, an increase of 206% over the 2021 average of $ 12.9 million. This number is even higher than the 2020 average of $ 4.7 million stolen per hack, an increase of 465.9%.

Researchers believe that hackers have successfully achieved their big goals in 2022. The DeFi market seems to be a favorite target for hackers because it can make the most profits with decentralized protocols.

Approximately 72% of all ciphers stolen in 2021 were due to DeFi protocols and services. This year, this percentage has increased to an astonishing 97%.

Robert Hoffman, a cryptocurrency analyst at Best Brokers, said DeFi has become a major target for hackers due to the large amount of venture capital funding in the market. Market competitiveness means that the first protocol to launch is most likely to succeed.

“The competition to build a digital financial system for the Fourth Industrial Revolution is very rapid, with many stakeholders competing for the first place. In many cases, the time to market is too short. , Security and other aspects of the product will be compromised, “Hoffman explains.

The technical nature of smart contracts and the expertise needed to program them leaves a lot of room for operation. However, Hoffman believes that when DeFi becomes mainstream, most security issues will be resolved “as well as new, mass-adopted technologies.”

Become a member of CryptoSlate Edge and access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

Price snapshot

Other contexts

Join now for $ 19 per month Explore all the benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024