No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Volumes on decentralized financial platform Curve Finance (CRV) are in a parabolic shape following the news that Paxos will stop issuing Binance USD (BUSD).

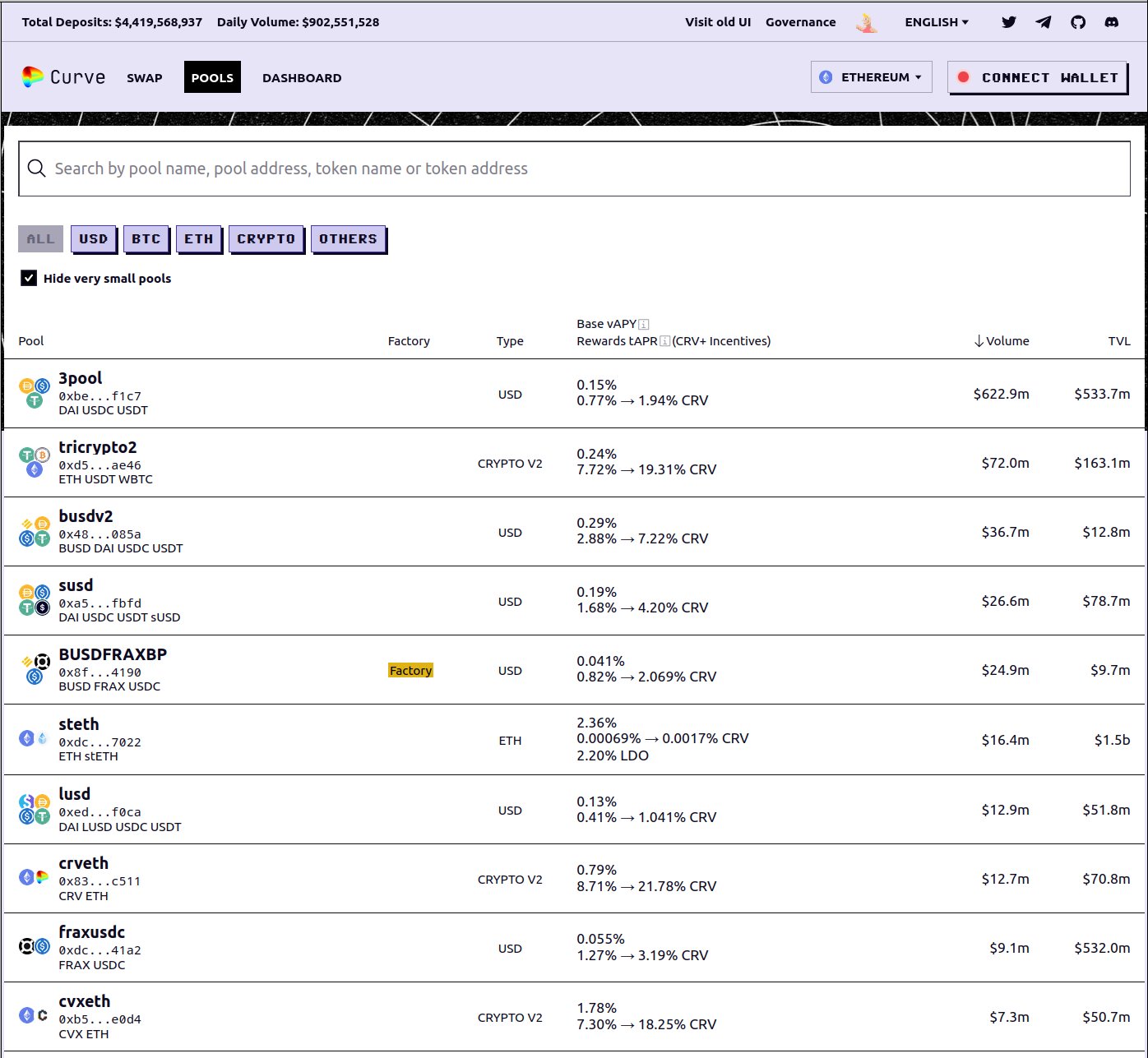

Curve Finance is a stablecoin-focused decentralized exchange (DEX) with some of the largest liquidity pools available in DeFi.

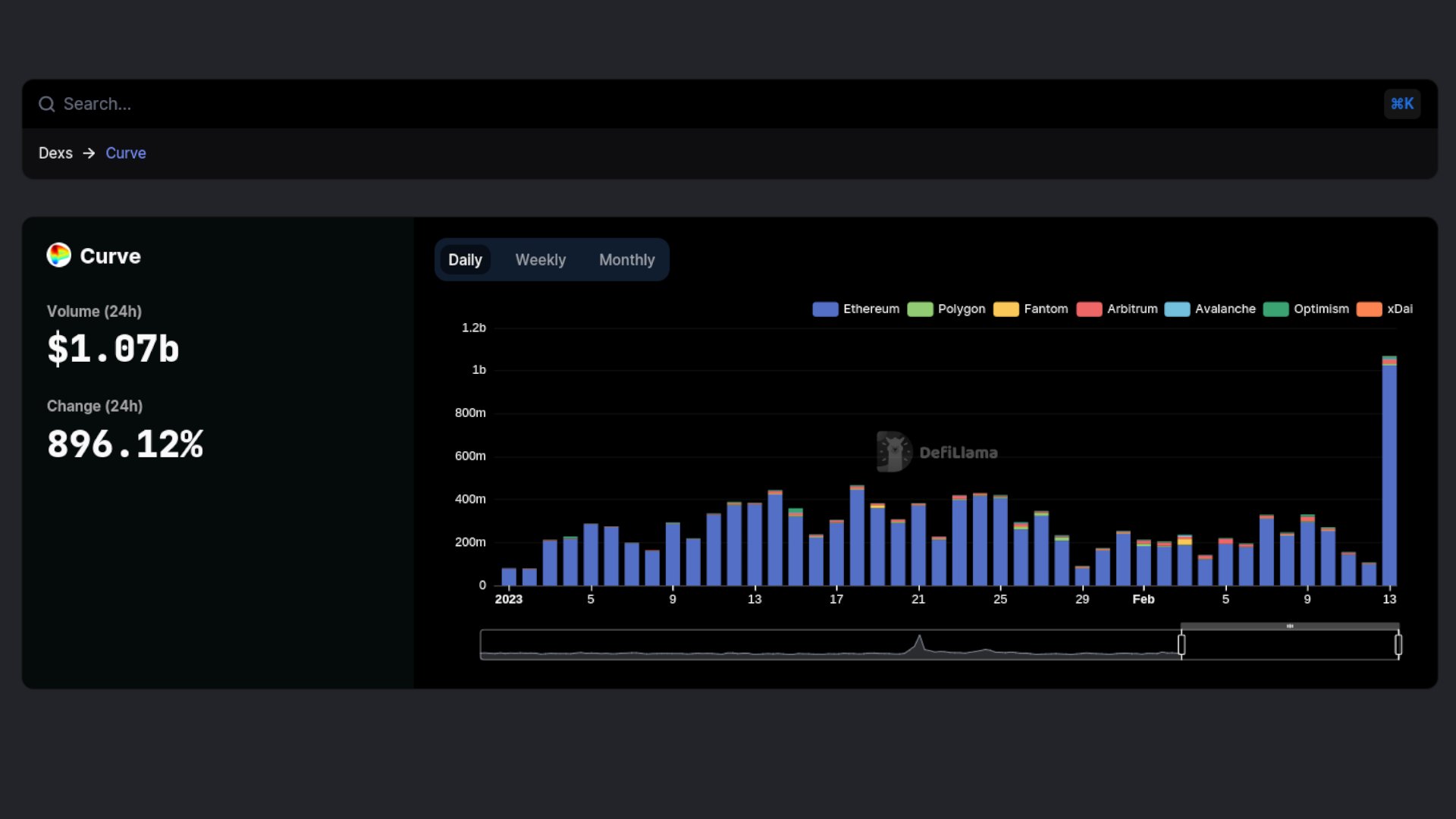

According to Blockchain Tracker DefilamaCurve Finance volumes surged to the third-highest level in its entire history earlier this week.

CurveFinance set a record high for the year with $1.07 billion in trading volume in the last 24 hours. It occurred shortly after the collapse of the

CurveFinance’s Twitter page also acknowledged the surge in activity, stating that “good drama produces good volume.”

Just before the platform’s trading volume surged, the New York Department of Financial Services (NYDFS) ordered Paxos, which issues and operates BUSD in partnership with Binance, to freeze production.

The activity at Curve Finance appears to be related to traders shifting their capital to different stablecoin pools due to the uncertainty surrounding BUSD.

Curve Finance is also working on its own USD-pegged stablecoin known as crvUSD, white paper It was released late last year, but no release date has been given.

Curve Finance’s governance token, CRV, also turned green on the last day and is currently trading at $1.07, up 6% over the past 24 hours.

Don’t Miss a Beat Subscribe to get encrypted email alerts delivered straight to your inbox

Price action confirmation

Please follow us twitter, Facebook and telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Tina Ji/Plasteed

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024