No products in the cart.

- Latest

- Trending

ADVERTISEMENT

Gas tariff refers to the cost of conducting a transaction or executing a contract. For example, this could take the form of exchanging for stablecoins or issuing NFTs.

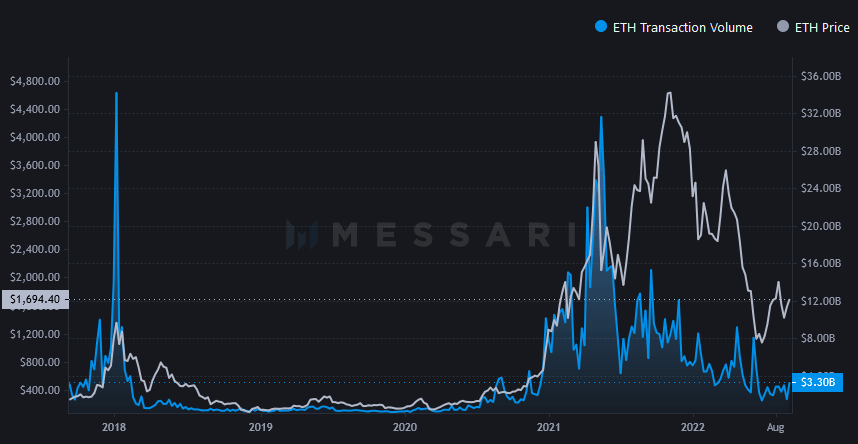

Since the summer of 2020, Ethereum gas prices have risen, largely due to the explosive growth of DeFi usage on the chain. Although network activity has decreased significantly since then, May 2021the Ethereum maxim of being an expensive chain to use is still prevalent.

Ethereum gas prices are priced in Gwei. One billionth of 1 ETH.Accurate gas prices depend on network Congestion during transactions. During peak times, you will need higher gas rates to move your transactions forward.

The current average petrol price is $13.28down sharply from local tops on May 1, when transactions cost an average of $474.57.

Stablecoins are cryptocurrencies designed to minimize price volatility by maintaining a fixed value regardless of the price of Ethereum.

The market offers different types of stablecoins, including asset-backed types that include fiat, cryptocurrency, or precious metal assets, and algorithmic types that increase or decrease the supply of tokens in circulation to lock the price at a desired level. It offers.

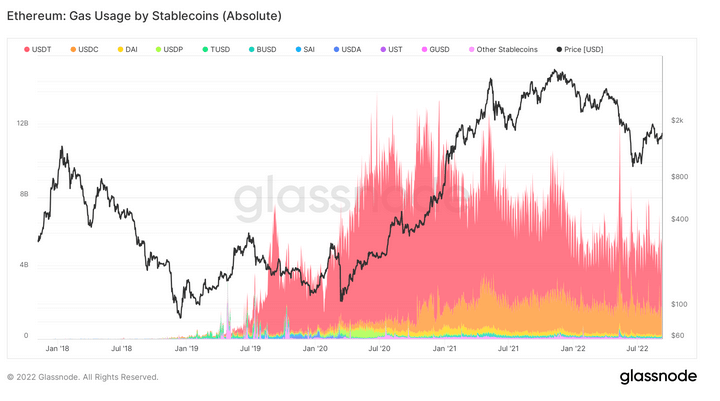

The chart below shows over 150 stablecoins, most notably USDT, USDC, UST, BUSD, and DAI. USDT is the largest stablecoin by trading volume and market cap, but USDC has closed the gap recently.

Apart from sporadic spikes, USDT gas usage has been trending downward since July 2020. Current usage corresponds roughly to the levels seen in January 2020.

USDC gas usage followed a slightly different pattern, peaking on April 21st. Except for an isolated spike since then, the overall trend has been downward since that point.

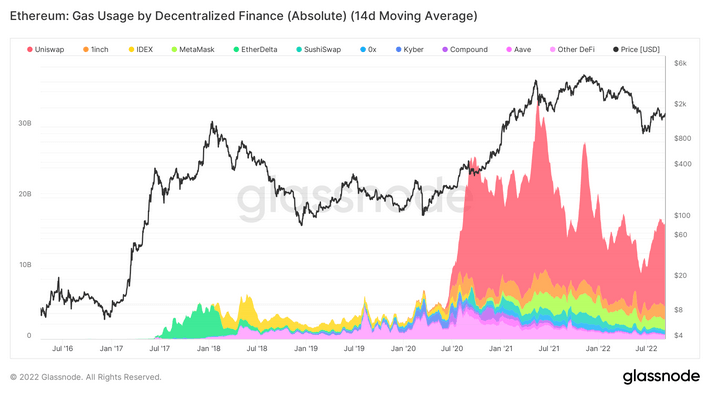

Decentralized finance (DeFi) is a new technology that decouples banks and financial institutions and connects users directly to financial products (usually lending, trading, borrowing, etc.).

DeFi protocols tend not to require KYC information, so using a peer-to-peer financial network instead of going through an intermediary gives users more control over their funds and privacy.

DeFi gas usage was relatively low through the summer of 2020.

Other important gas-hungry DeFi protocols include 1 Inch, IDEX, and MetaMask, all of which have followed a similar path to Uniswap. Starting around April 2021, MetaMask was able to increase its gas usage and maintain that percentage over time.

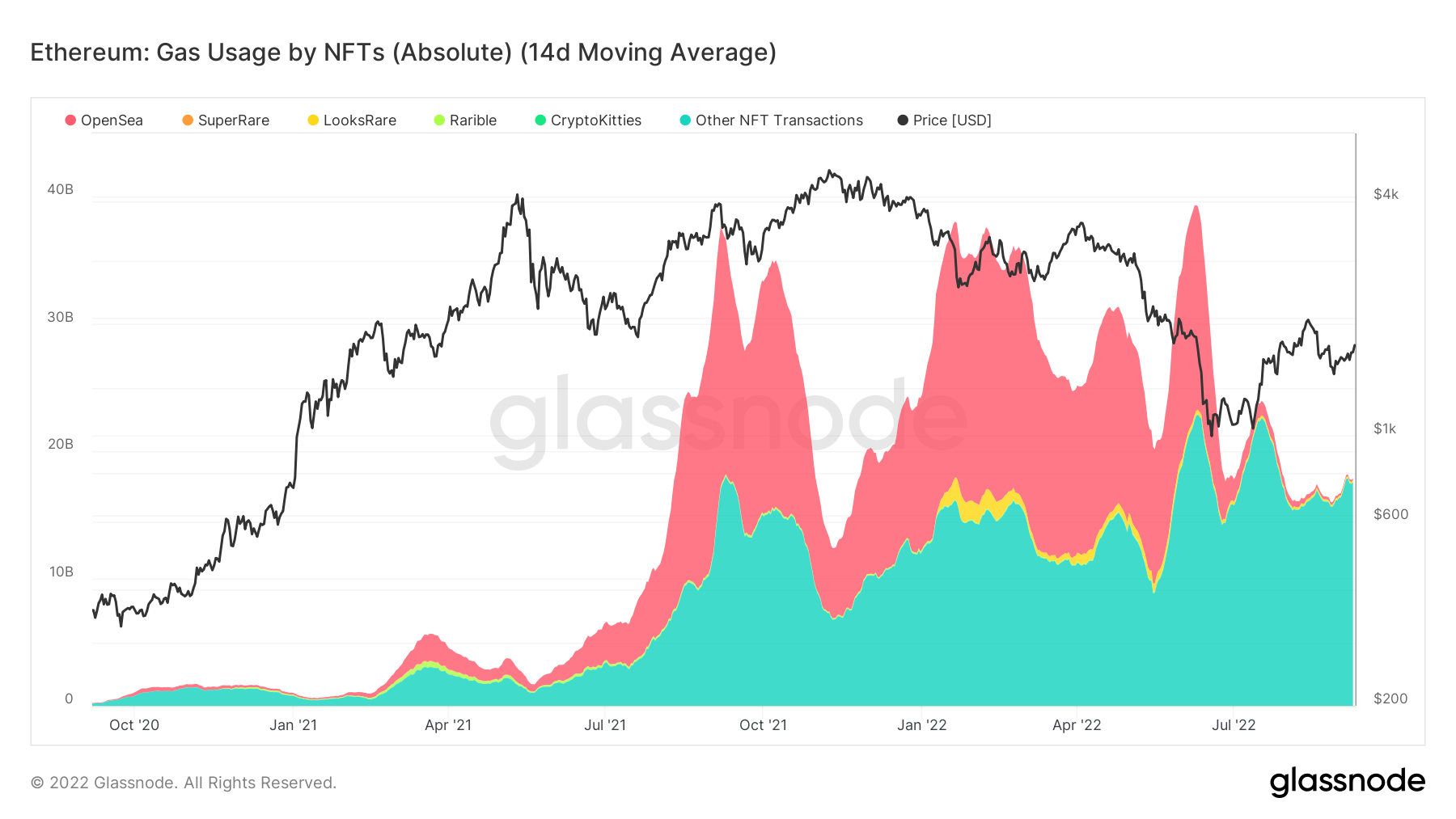

This category includes both ERC721 and ERC1151 token standards as well as gas usage from the OpenSea, LooksRare, Rarible, and SuperRare NFT marketplaces.

During the 2021 bull market, OpenSea saw the biggest surge in gas usage due to NFT demand. However, after June 2022, demand has cooled significantly, although it remains slightly higher than usual.

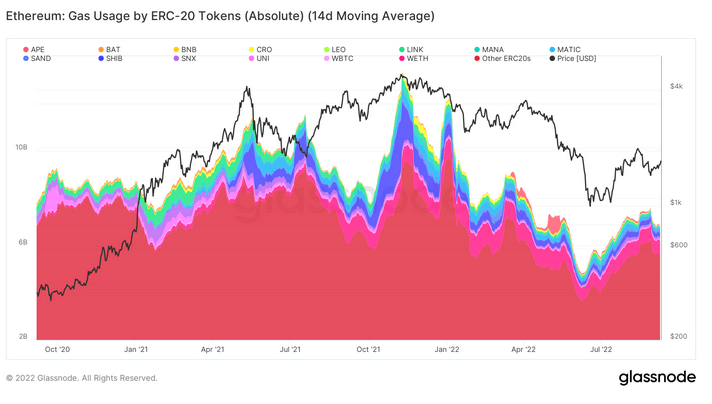

ERC-20 is the technical standard used to run fungible tokens in all smart contracts on the Ethereum chain. The chart below excludes gas usage from stablecoin contracts.

Overall gas consumed on ERC-20 contracts peaked around November 2021, leading to a downward trend that bottomed out in June 2022. Since then, ERC-20 gas usage has rebounded, bucking his previous three-category macro trend.

No outstanding ERC-20 contract consistently outperforms gas usage.

Become a member of CryptoSlate Edge to access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

price snapshot

more context

Register now for $19 per month Explore all benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024