No products in the cart.

- Latest

- Trending

ADVERTISEMENT

The Ronin bridge, an Ethereum sidechain designed to fuel the growth of the Axie Infinity universe, has a mountain to climb after it was massively exploited in April and hundreds of millions of dollars were stolen by hackers. was.

report from Nansen Exclusively Shared Alpha crypto slate We have identified the state of the ecosystem and whether attempts to return funds to the bridge have been successful and allow Axie to thrive again.

Ronin was designed as a gaming-first Layer 1 blockchain with a focus on instant transactions with low gas fees. It connects to Ethereum through the Ronin Bridge, but otherwise operates independently for optimal gaming performance.

However, according to Nansen’s report, the devastating impact of the Ronin hack has crippled the ecosystem. The total amount locked was revealed to have decreased from $318.71 million in the first quarter to $55.11 million in the second quarter. The 82.7% drop in $RON locked up lowered his overall TVL of the Ethereum ecosystem from $159.83 billion at the end of March to $55.15 billion at the end of June. Exceeded.

As part of an attempt to rebuild trust in the Ronin Bridge, there was an attempt in Q2 to get more independent validators during the attack, bringing the total to 21 nodes from the 9 active validators. did. Being more decentralized will reduce the risk of similar attacks in the future.

However, Nansen revealed that there were only 14 active validator nodes on the network at the end of Q2. This shows that Ronin fell short of his target of 21 nodes.

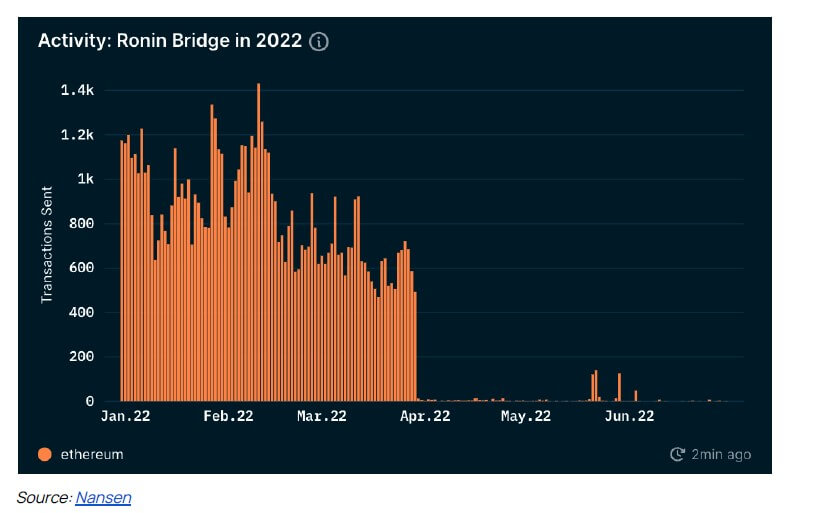

Additionally, Nansen data shows that even after the Ronin Bridge reopened on June 28, activity on the network remained at an all-time low.

However, Ronin-based DEX Katana kept transactions on the network relatively stable throughout Q2. Native Axie token $SLP issuance remained at an average of $20 million daily throughout Q2. Still, according to Nansen, $SLP burn has been reduced to almost zero.

Still, Axie co-founder Jeff Zirlin tweeted in June that nature is healing, and Nansen ended his report with similarly strong sentiment.

22,000 Axies sold in the last 24 hours. A few weeks ago he was 7,000.

Origin is growing fast with the new alpha season. We had 4,600 downloads yesterday.

A bridge is standing. Land (90% stake) is releasing AXS.

Nature is healing. pic.twitter.com/AdNzi8x4cb

The Jiho.eth (@Jihoz_Axie) July 7, 2022

According to Nansen, land stakes, Origin downloads, bridges reopening, and a clear increase in players returning to the game bode well for the Axie Infinity universe.

Additionally, the report highlights Axiecon, the Axie Infinity convention, and the Lunacia SDK Alpha, which allows developers to build games on top of Axie Land, as two core features that could point to a bullish future for gaming. It has been.

data from Defilama indicates that Q3 has yet to signal a bullish reversal in the Ronin ecosystem. TVL is down 22% since his August and is now at $54.98 million. However, Nansen’s research analyst Mega Septiandara said Nansen remains bullish.

Despite the bear market conditions affecting the entire cryptocurrency ecosystem, both Fantom and Ronin networks showed exciting signs of dynamic growth that bodes well for Q3 results.

The current state of the Ronin network can be seen using Nansen’s analytics tools, as shown in the graph below.

Full report available via Nansen website.

Become a member of CryptoSlate Edge to access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

price snapshot

more context

Register now for $19 per month Explore all benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024