No products in the cart.

- Latest

- Trending

ADVERTISEMENT

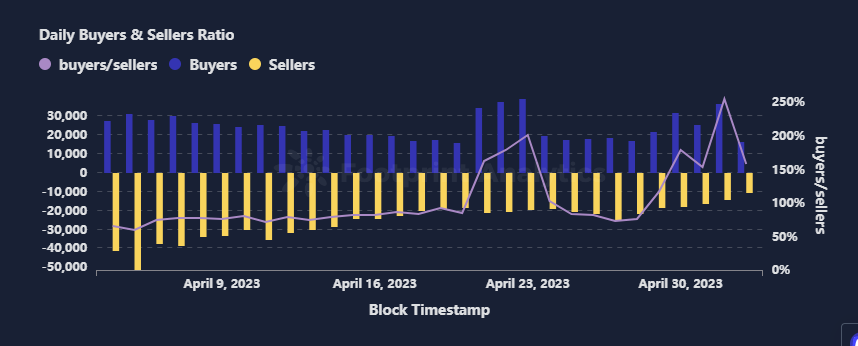

Last month, the NFT market experienced a spike in trading volume on April 5th, followed by a massive 50% decline by the end of the month. The number of NFT sellers outnumbers the number of buyers, indicating a potential oversupply in the market.

As these markets evolve and grow, investors and traders need to stay abreast of the latest developments and trends. Examining the key factors driving the cryptocurrency and NFT markets will give us a deeper understanding of the opportunities and risks associated with these emerging trends.

The data for this report is taken from Footprint’s NFT research page. Click through to find all the latest deals, projects, fundraising and more with our easy-to-use dashboard updated in real time with the most important stats and metrics to understand the NFT industry. here.

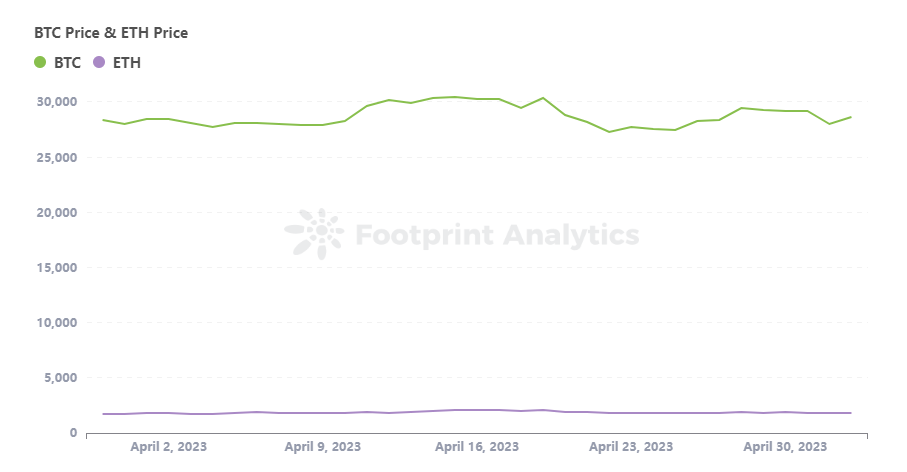

In April, the cryptocurrency market experienced its ups and downs. On April 14th, most cryptocurrencies surged following better-than-expected U.S. economic data, with Bitcoin rising to $30,506 and ETH breaking $2,100 on April 16th.

On the macro front, the official inflation rate rose to 5% in March, just below the consensus 5.1%. But since the banking crisis exposed the fragility of the market’s financial system, investors’ focus has shifted to potential recession risks. Recent data also point to a macroeconomic slowdown, with the ISM Purchasing Managers Index dropping to its lowest level since May 2020.

Despite the volatility, Bitcoin was pushed back to $30,000 in late April with positive sentiment across the cryptocurrency market.

The NFT market has received a lot of attention in early 2021 as many projects have launched their own NFT collections. However, the NFT market is showing signs of weakness this year.

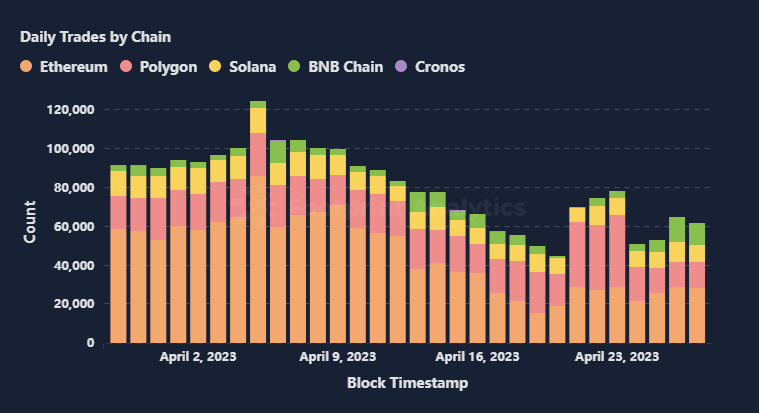

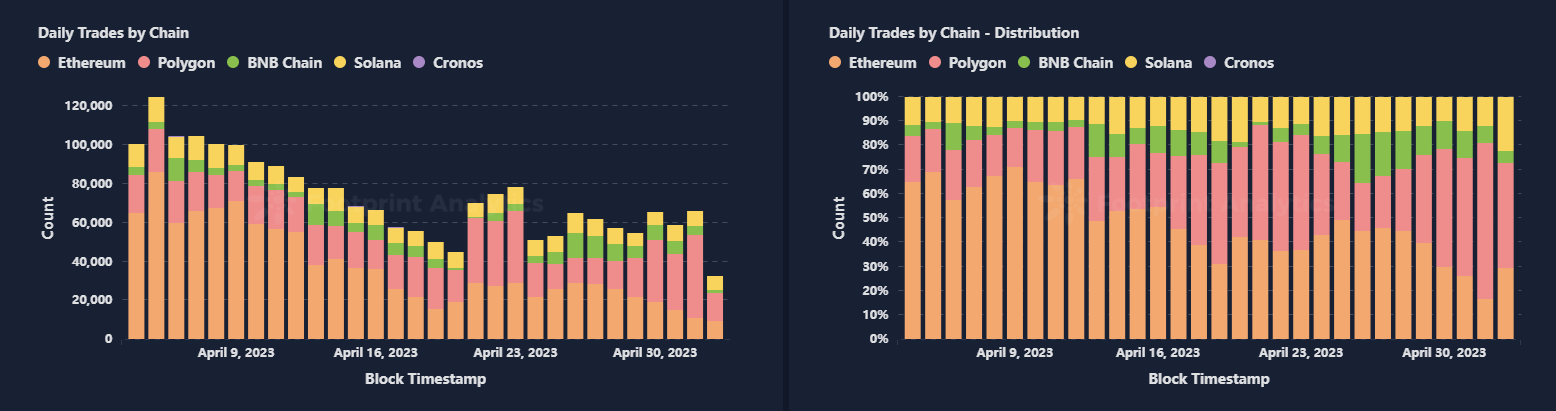

according to footprint analysis, the number of NFT market transactions peaked on April 5, but daily trading fell by 50% by the end of the month. This drop in trading activity suggests a heightened sense of caution among investors as initial enthusiasm for the NFT market appears to be waning.

Additionally, according to Footprint Analytics, the number of NFT sellers in the market continues to outstrip the number of buyers, suggesting that potential demand may be inadequate.

The initial hype about the NFT market was sparked by the cryptocurrency market and celebrity endorsements, leading to a flood of people into the market. However, relatively few people understand NFTs, leading to oversupply. Whether NFT fundamentals can ultimately support market growth and open up new opportunities remains to be seen.

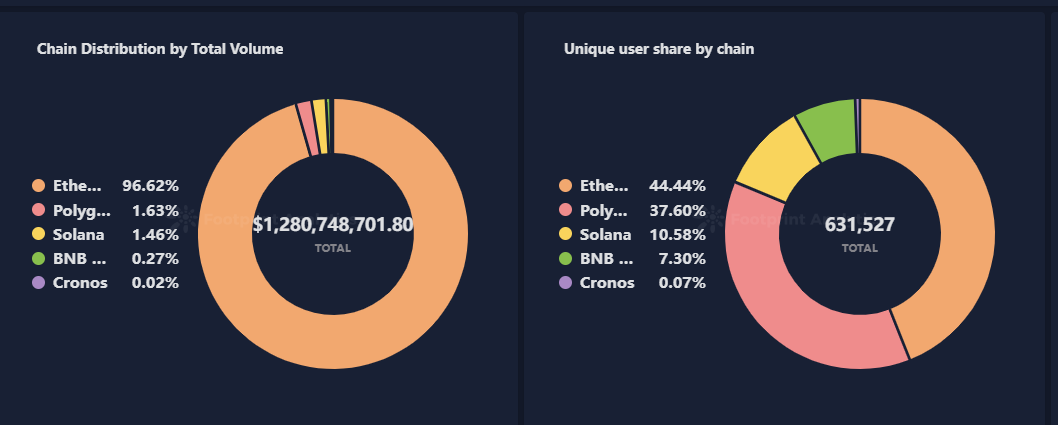

according to footprint analysisEthereum accounts for the majority of NFT trading volume with a huge 96% market share. However, in terms of active users, Ethereum has only 44%, followed by Polygon’s active user base at 37%.

Ethereum remains the platform of choice for most mainstream NFT projects, but network congestion and high transaction fees may cause some users to move to alternative platforms. As a result, Ethereum may face challenges in maintaining its dominant position in the NFT market.

Polygon Daily Trading It is catching up with Ethereum, but the transaction volume is not as high. Still, the number of trades is comparable, indicating that the barriers to entry are low, making it suitable for smaller traders. Polygon’s low barriers to entry make it suitable for small transactions and asset exchanges. This means that Polygon’s marketplace could become more decentralized and multi-domain. However, collecting high-value, high-quality NFT projects and assets is also more difficult. So building a good ecosystem and accumulating assets takes time.

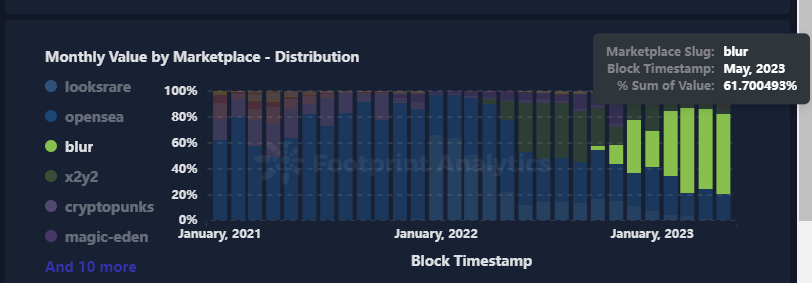

from market From a perspective, Blur still has the absolute edge when it comes to transaction volume. However, OpenSea still has the edge in terms of transaction numbers. Blur’s dominant position suggests that it is better suited for professional users with high-value assets and large transaction volumes. On the other hand, OpenSea’s transactions are more gradual and distributed, with smaller transaction sizes, making it more suitable for retail users and small everyday transactions.

Blur and OpenSea represent high-end and small-scale traders respectively. However, with the development of the overall market, both sides are encroaching on each other’s territory and competition is intensifying. The future trend is that the high-end and small markets will become more integrated, creating a certain synergistic effect. To predict future development, we need to continuously monitor the performance of both platforms.

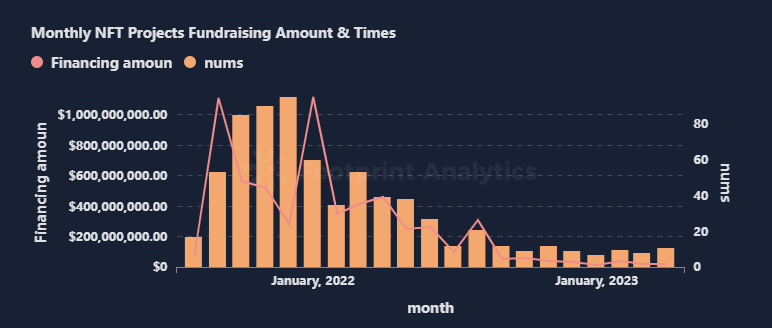

The number of NFT-funded projects increased slightly from 8 to 11 compared to last month, but the amount of funding decreased, indicating a more cautious approach by investors.

Many builders are working on the NFT Marketplace. Flow, which has secured $3 million in seed funding to build his rollup-centric NFT ecosystem, highlights the growing need for Layer 2 and scalability solutions to address Ethereum network challenges . Also, the entry of large companies such as Amazon into the NFT market is expected to increase the popularity and size of the market, but it is also expected to increase the risks for the industry.

Additionally, as Muverse and Daniel Allan Entertainment funded this month show, the music and entertainment industries are exploring NFTs, opening up new opportunities for NFT applications.

Once Chatgpt became famous, people started talking about the integration of AI and NFTs because NFTs are a good example of creative economy in the crypto world.

Col 6529 provided a representative discussion on this topic. On the other hand, as the amount of AI-generated content increases, the importance of NFT provenance technology is further emphasized. NFT provenance distinguishes the source and ownership of content and helps protect the copyrights of content creators.

Conversely, the proliferation of AI-generated content will increase the value of original human content. The uniqueness of human creations is difficult to completely replace with AI, increasing the rarity and value of original works. Therefore, in an age of digital content overload, a creator’s ability to build a reputation is especially important. Only by getting more people to understand and recognize their work can creators stand out in the fierce competition for content.

Commercial content creation is easily replaced by AI, but artistic creation is difficult. Commercial content is typically completed around constant demand and can be efficiently generated by AI technology, making it easily replaceable by machines. In contrast, the value of a work of art lies in the thoughts and emotional expressions of its creator, which is difficult to achieve with AI and requires the perspective and creativity of a human artist.

AI creations are on the rise, but human creativity remains irreplaceable in the form of artistic expression. Striking a balance between copyright protection, creative tools, and human expression is key to the sustainable development of NFTs and cryptography.

The world of NFTs is evolving rapidly, with new trends and developments appearing every month. April was no exception as the market for these digital assets experienced significant volatility and new developments. The spike in trading volume at the beginning of the month eased towards the end of the month, but the NFT market remains a dynamic and promising sector.

As the NFT market grows and matures, it is important to keep abreast of the latest trends and developments. By understanding the opportunities and risks associated with this emerging technology, investors and traders can make informed decisions and leverage the potential of NFTs.

This work was contributed by footprint analysis community,

We are happy to invite institutions and projects to build custom research pages like this. With our support, it’s easy to own a research data website without any coding experience or technical input.simply type this shape Get on the waiting list and get started today.

The Footprint Community is a place for data and cryptocurrency enthusiasts around the world to help each other and gain insight into Web3, the Metaverse, DeFi, GameFi, or other areas of the emerging blockchain world. Here you will find active and diverse voices supporting each other and moving the community forward.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024