No products in the cart.

- Latest

- Trending

ADVERTISEMENT

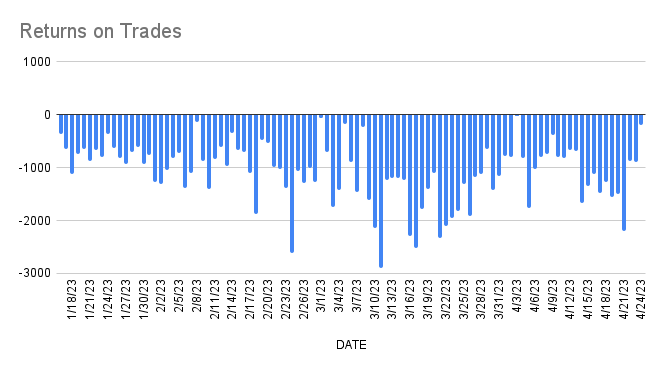

Non-fungible token (NFT) holders are selling at a loss traders lose an average of 1000 ETH daily.

according to data co-owner NFT statistics, the return of trades over the last 3 months showed that the trader lost as much as 3000 ETH in a few days. This chart focuses only on secondary sales of NFTs and not on those selling mints for the first time.

This is in contrast to what happened in the market in 2021. At the time, NFT trading profits peaked in August 2021, with traders averaging around 30,000 ETH in profits each day.

The positive momentum continued until May 2022, when the market took another turn. Since then, traders have mostly sold digital assets at a loss.

Based on available data, the lowest prices for some NFT collections have dropped significantly from previous highs.

For context, the Bored Ape Yacht Club has fallen 11.73% to 51.2 ETH over the past 30 days, down significantly from the 77.9 ETH recorded in mid-February. The drop is even more significant given that the peak floor price was 153.7 ETH as of May 2022.

Another popular NFT collection, Cryptopunks, has also dropped 18.27% to 49.9 ETH at the time of writing.

Mutant Ape, CloneX, RTFKT, Doodles and Meebits have had their base prices significantly reduced. Most of these projects have seen their lowest prices drop by double digits in the last 30 days.

The only exception is adzuki beans, which rose more than 13% over the period.

Meanwhile, President Trump’s relatively new “Series 2” NFT collection is also more than 10% below its $99 purchase price, according to OpenSea. data.

Data available from other NFT aggregators such as coin geckoand nft price floor It also shows the same trend with the price floors of these assets dropping significantly.

Post NFT traders with an average loss of 1,000 ETH per day the lowest price tank of top quality NFTs first appeared on CryptoSlate.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024