No products in the cart.

- Latest

- Trending

ADVERTISEMENT

The cryptocurrency market has historically been cyclical based on Bitcoin halving events. Bitcoin halving occurs every 210,000 blocks mined, or roughly every 4 years. The last half-lives occurred in 2012, 2016 and 2020.

During each halving, a bull market is followed by a bear market. Given the transparent nature of most blockchain networks, it is possible to review on-chain data to identify patterns and similarities from previous cycles.

of crypto slate The research team scrutinized the data from Glassnode and identified several potential bear market bottom signals.

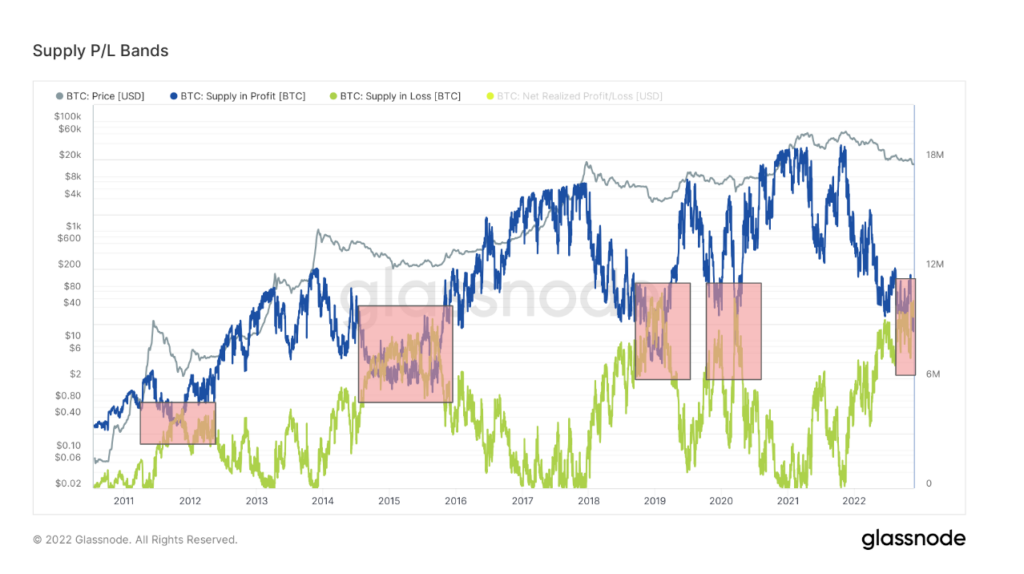

The Supply P/L Band shows the total supply of Bitcoin in profit or loss. The blue line shows the total number of profitable Bitcoins. The green line shows the numbers that are currently losing money.

The data tracks the value from the price when the coin was obtained through trading or mining, so the value represents unrealized gains and losses.

The blue and green lines recently converged for the fifth time in Bitcoin history. The previous event was bearish and close to the lows of the cycle.

The outlier was during the global COVID market crash in May 2020. Convergence occurred in 2012, 2014 and 2019, barring the COVID Black Swan. The overlap lasted from six months to a year, but each time Bitcoin’s price recovered, it found a new all-time high within three years.

The supply P/L band is not a guaranteed indicator of a bear market bottom, but history doesn’t always repeat itself, but it often rhymes.

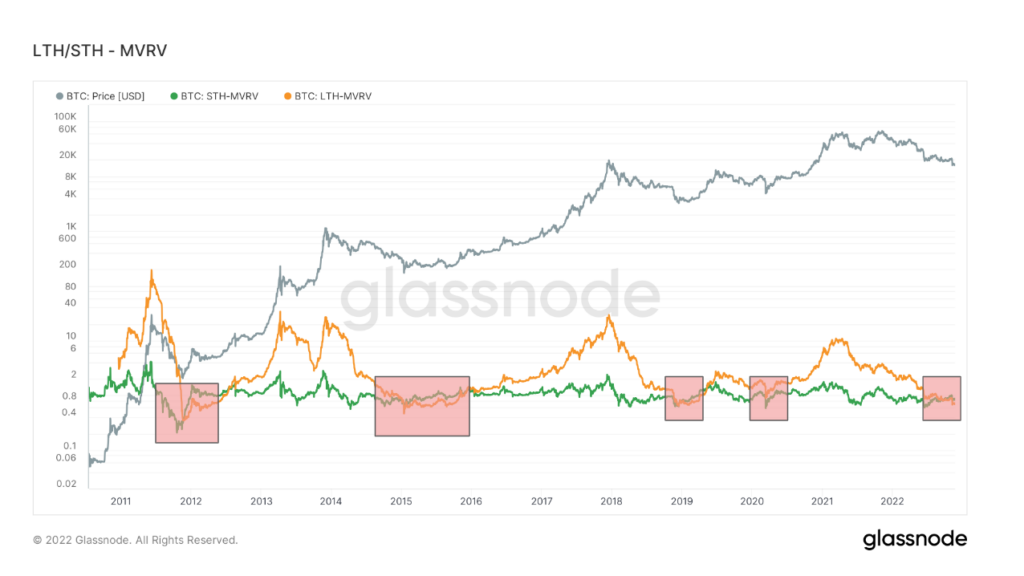

MVRV is a term related to the ratio of Bitcoin’s realized market capitalization to market capitalization. MVRV considers only his UTXOs with a lifespan of at least 155 days and serves as a metric to assess long-term investor behavior.

Similar to the Supply P/L Bands, the MVRV for long-term holders was only 5 times lower than for short-term holders. The time period is roughly the same as the supply charts displayed during past bear markets and COVID crashes respectively.

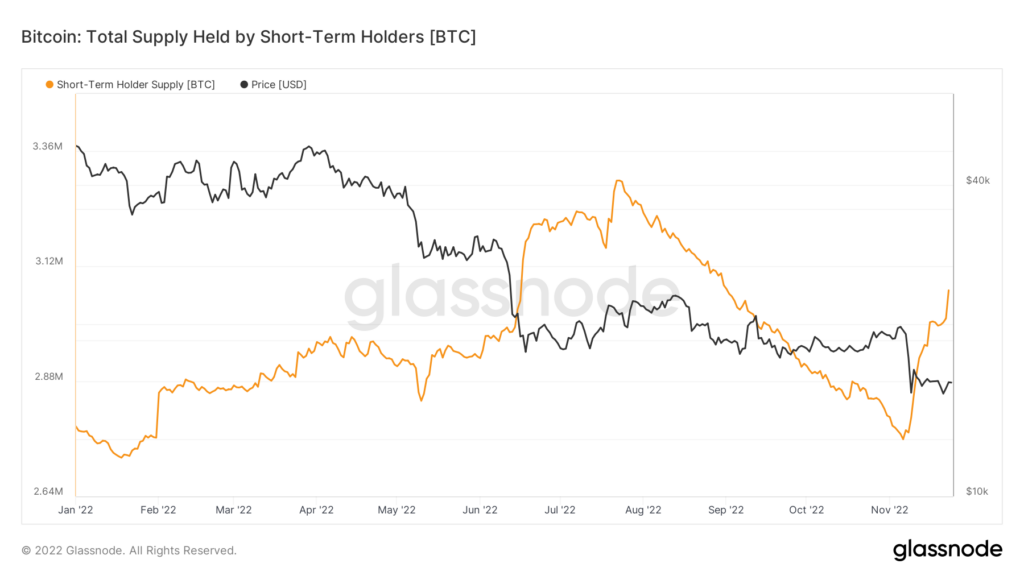

The total supply of Bitcoin held by short-term holders has surpassed 3 million coins since the cycle low. Short-term holders are often the most sensitive to price volatility, and the number of coins they hold historically bottoms out at cycle bottoms.

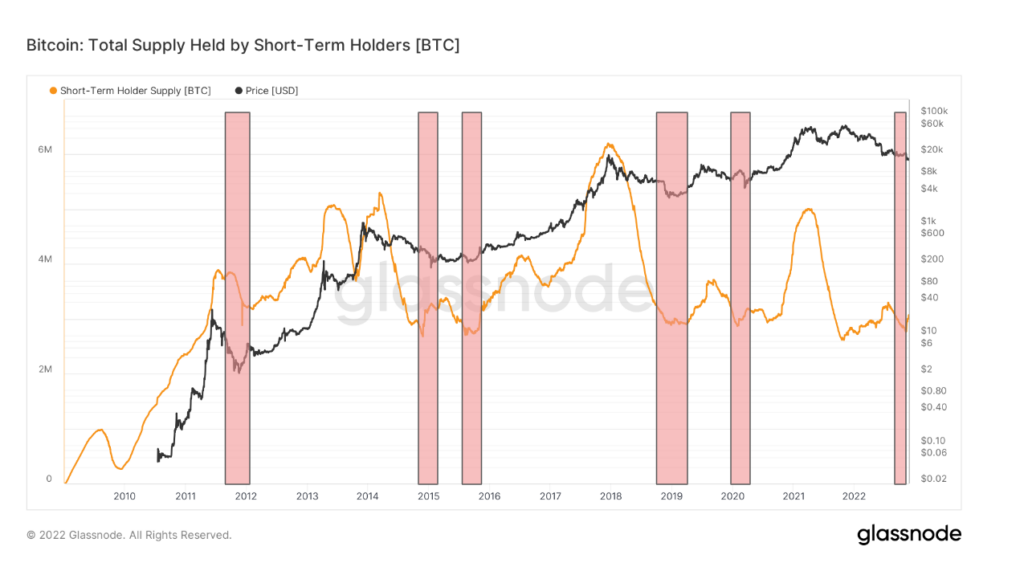

Zooming out shows other times when short-term holder supply reached similar levels. However, unlike other indicators, this phenomenon has happened to him six times since 2011. Four times in line with other data, the short-term holder he bottomed out in 2016 and 2021.

Off-chain signals indicating bear market troughs have also appeared in recent weeks. When bitcoin fell from its all-time high, it famously marked the bottom of the market when major publications declared that cryptocurrencies are dead.

Bitcoin declared in 2018 death 90 times in major publications, 125 times in 2017, according to 99 Bitcoin. Currently, the cryptocurrency has received only 22 obituaries in 2022, so it’s a bit far from this signal, adding weight to market bottom theory.

Only two weeks ago, Sam Bankman-Fried was in the stratosphere. But FTX’s rapid demise has devastated an industry with a history of failures and scandals. Is this the end of crypto? https://t.co/bwynnCeCZ3 pic.twitter.com/NWyqHCZzXm

The Economist (@TheEconomist) November 17, 2022

Become a member of CryptoSlate Edge to access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

price snapshot

more context

Register now for $19 per month Explore all benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024