No products in the cart.

- Latest

- Trending

ADVERTISEMENT

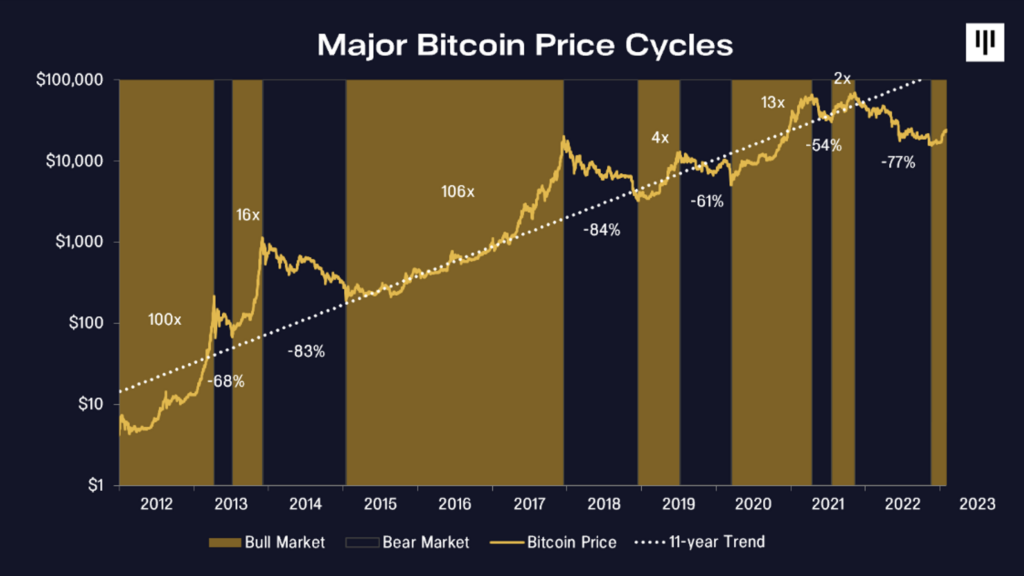

A previous report from CryptoSlate delved deep into Bitcoin bottom signals. According to our analysis, most on-chain indicators suggest that a bottom has formed, despite widespread macro uncertainty.

However, identifying the bottom is only the first step in predicting future market movements. A strong bottom only indicates the potential for the market to move higher. We need other on-chain indicators to further confirm the end of the bear market.

This report takes a deep dive into on-chain indicators that indicate another bull market is currently underway.

The number of users interacting with a network is one of the best indicators of its performance. The early bull market of the last decade all started with increasing daily user numbers, increasing transaction throughput, and increasing demand for block space.

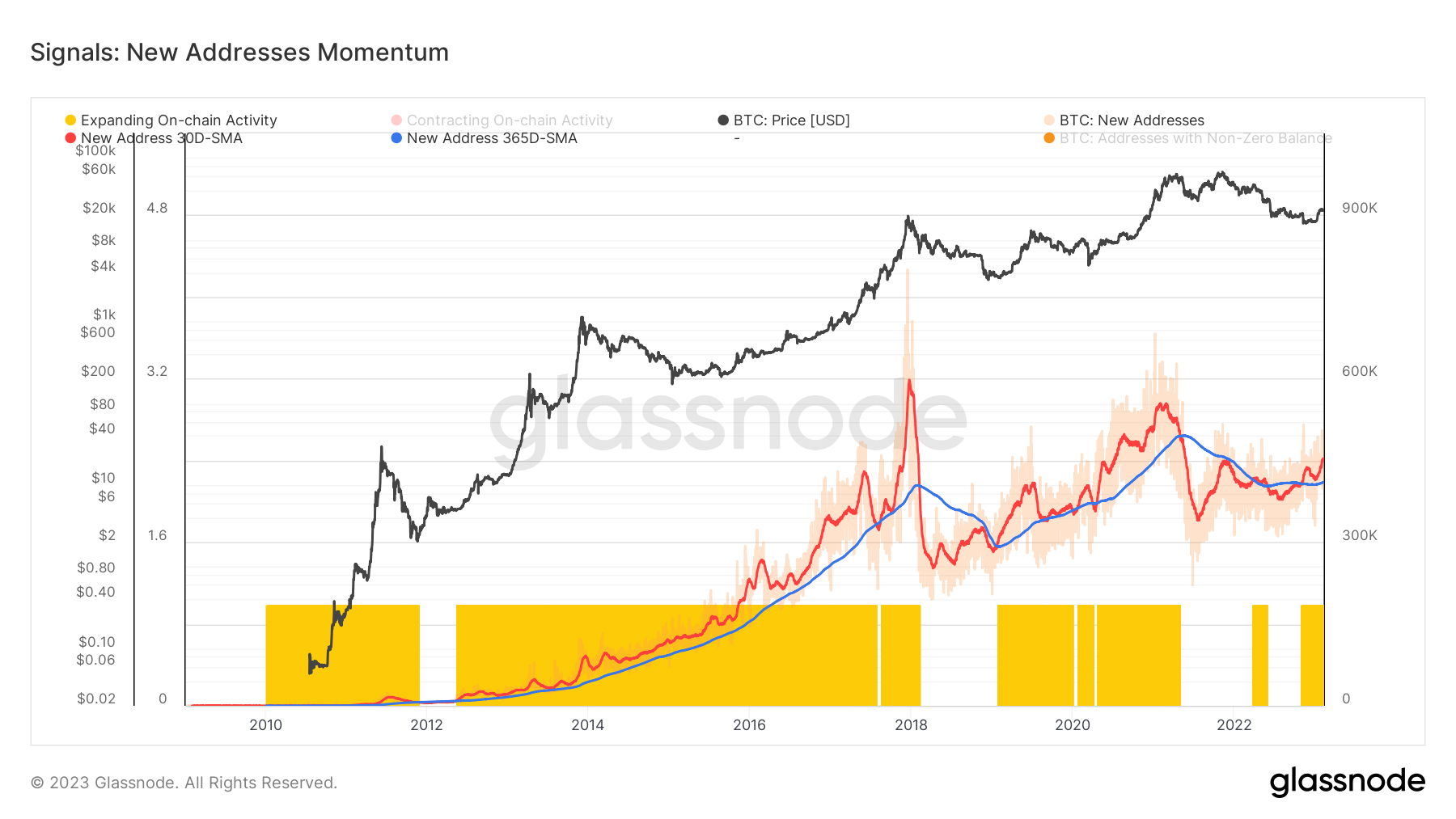

We can see this in the momentum of new addresses on the Bitcoin network. When the 30-day Simple Moving Average (SMA) of new address momentum exceeds the 365-day SMA, the network enters a period of expansion. Simply put, the percentage of new addresses created in the last 30 days is higher than the percentage created in the last year.

Data analyzed by CryptoSlate shows that the fundamentals of the Bitcoin network are improving. The 30-day SMA exceeds the 365-day SMA, as shown in the chart below. The duration of this trend has been correlated with a bull market, gradually increasing the price of Bitcoin.

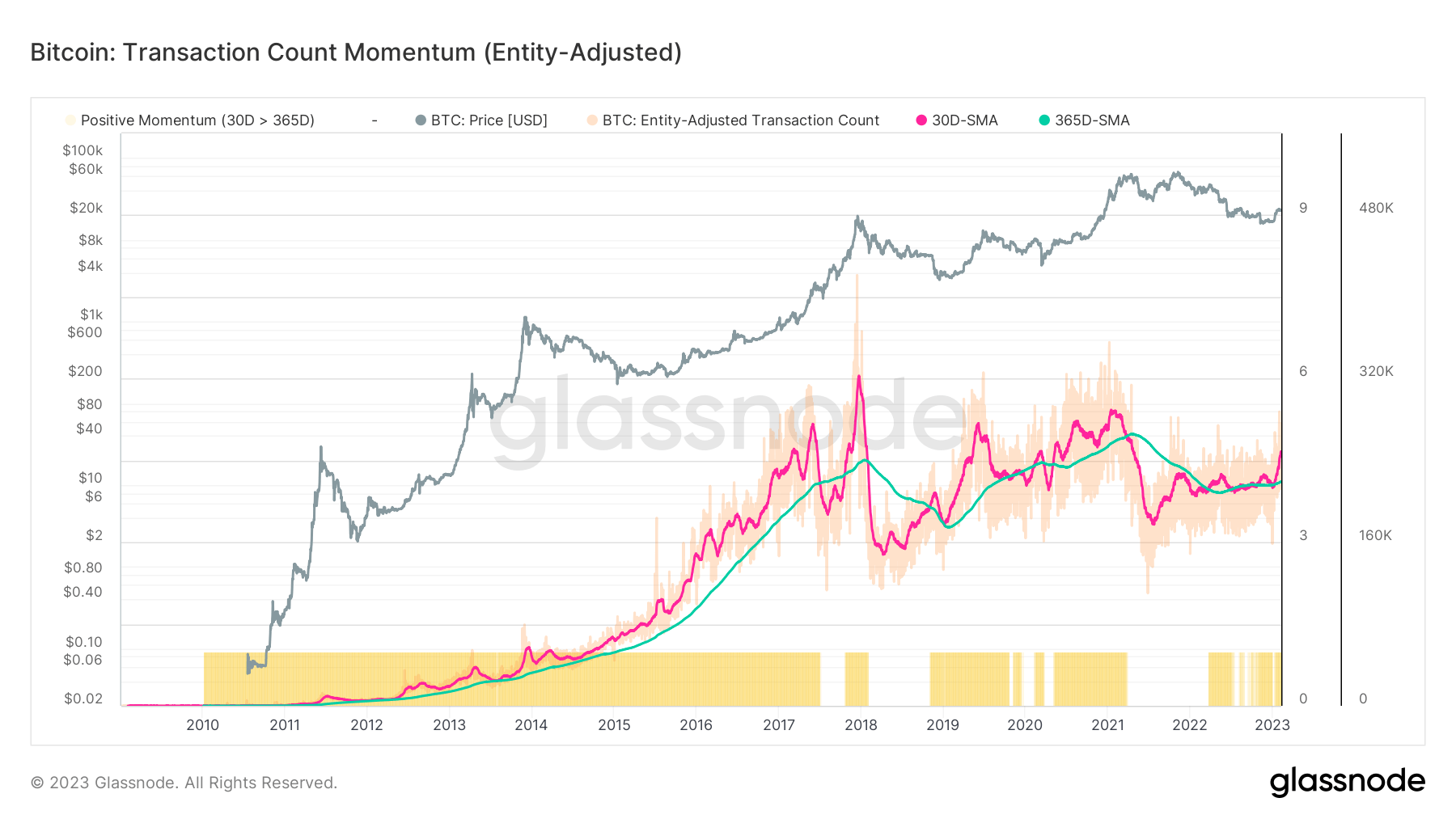

The same trend can be seen in transaction volume momentum, with the 30-day SMA jumping significantly year-to-date, surpassing the 365-day SMA.

Both leading indicators of market profit have been flashing green since the beginning of the year.

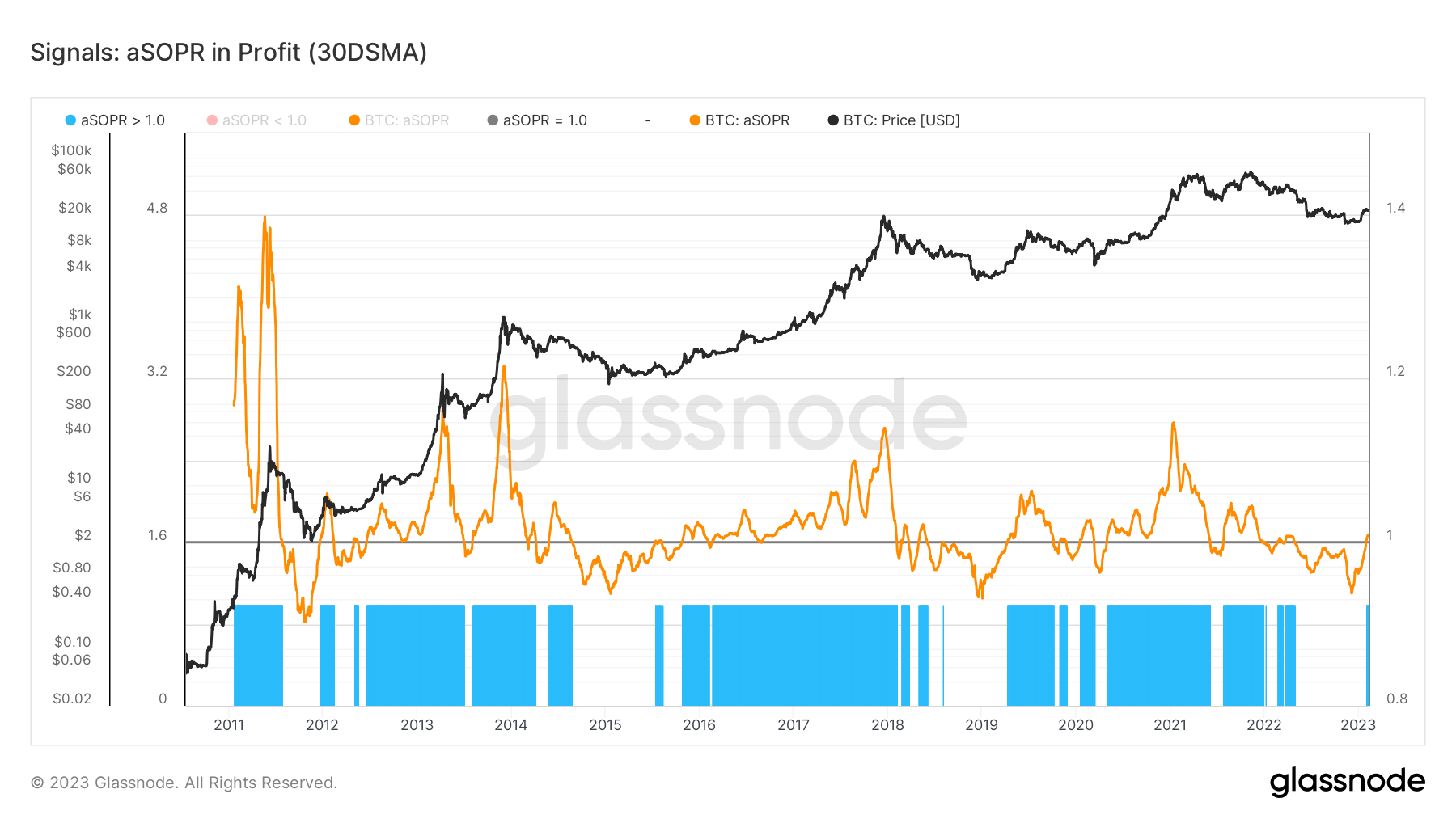

Spent Output Profit Ratio (SOPR) is a metric that indicates whether coins on the Bitcoin network are moving between wallets in gross profit or loss. This metric is the ratio of the value of Bitcoin UTXO at time of creation to the value of Bitcoin UTXO at time of use.

SOPR also assumes that all coins moving from one wallet to another have been sold, which is still a solid indicator of potential profits on the network.

A SOPR score of 1 or higher indicates that the market has realized profits. Historically, the collapse and maintenance of SOPR has shown a healthy increase in demand for Bitcoin.

The last time SOPR was above 1 was in April 2022, just before Terra (LUNA) collapsed. However, the April peak was only a temporary break in his SOPR’s overall downward trend that began in November 2021. A similar downward spiral was seen each time Bitcoin hit new all-time highs, as shown in the chart below.

Nonetheless, the current SOPR score points to a recovery in the market. The current peak is a positive sign, although the market could dip below 1 a few more times before entering a true bull market.

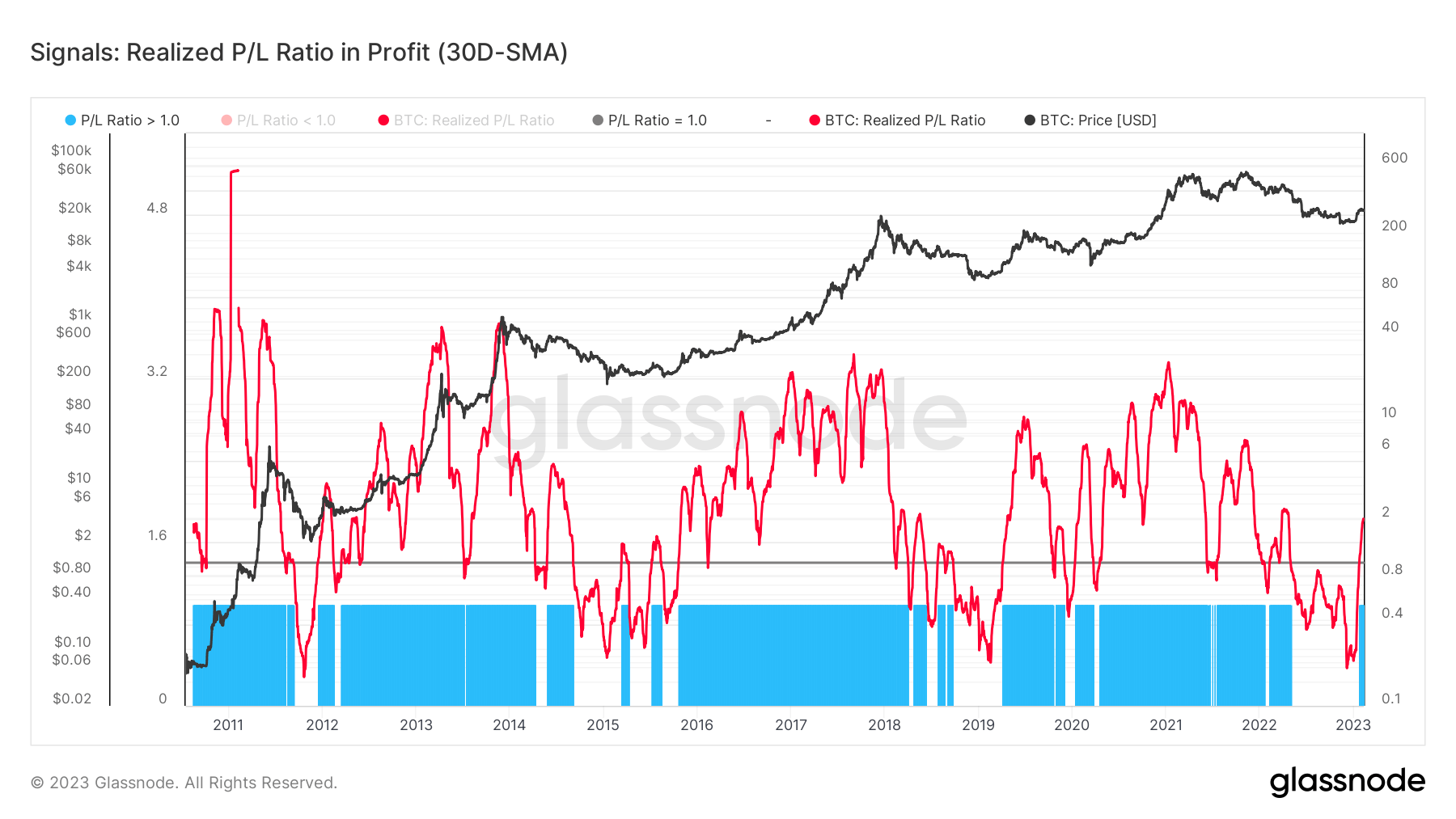

The trend suggested by the SOPR is further supported by the realized profit/loss ratio. This metric represents the profit-loss ratio for all coins and is another solid indicator of market health.

Similar to SOPR, a P/L ratio greater than 1 indicates a greater share of gains in US dollars than losses on the network. Data analyzed by CryptoSlate shows his P/L ratio to be 2, suggesting that sellers with unrealized losses are exhausted and Bitcoin demand is flowing in healthy. .

It is important to note that the PnL ratio is highly volatile and can be tested many times in early bull markets. The sharp rise we see in 2023 could provide resistance and support in the coming months.

Following the expansion of the Bitcoin network, the demand for Bitcoin block space is increasing. Due to the high number of transactions on the network over the past three months, Bitcoin miners have seen a significant increase in fee income.

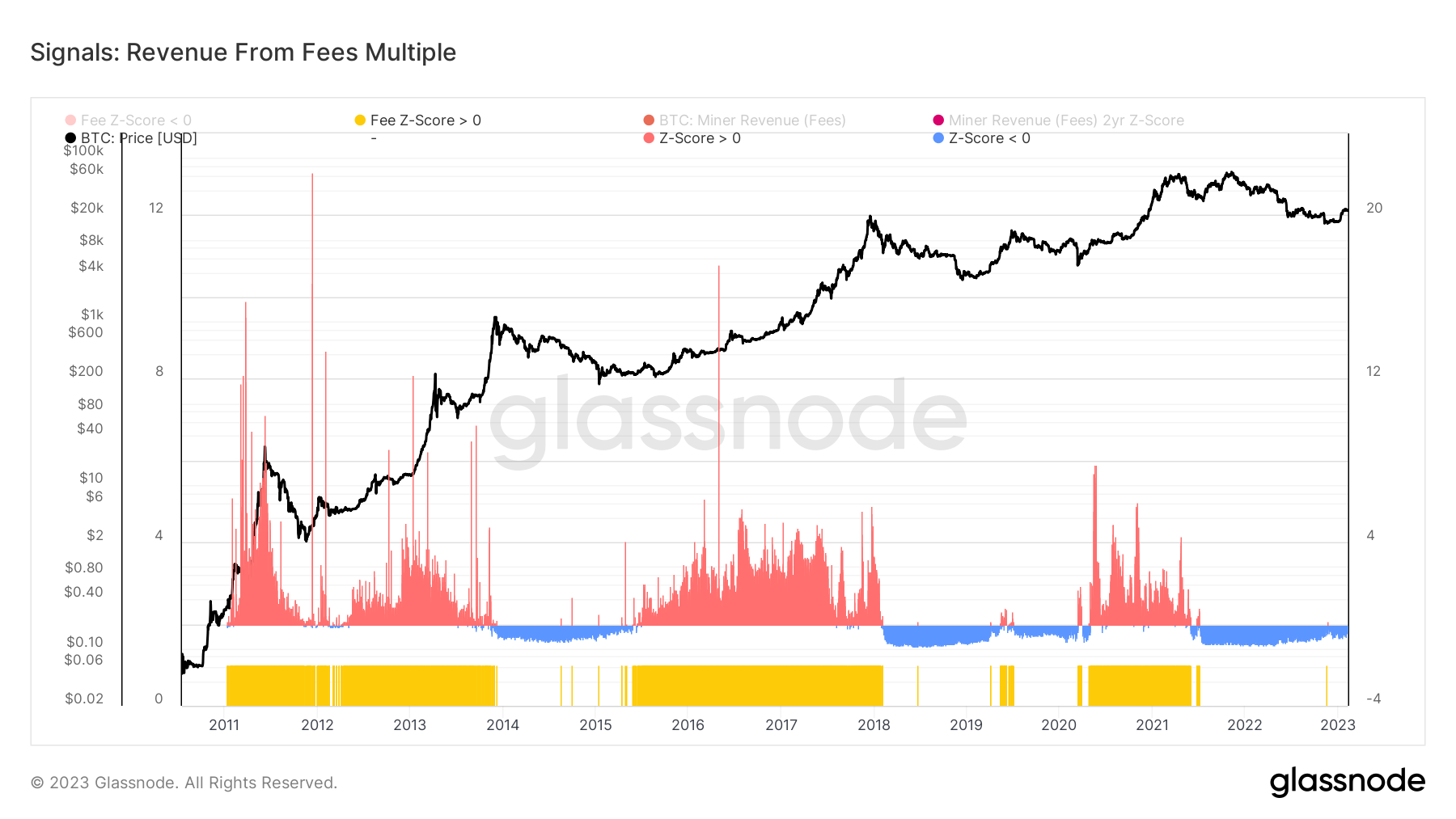

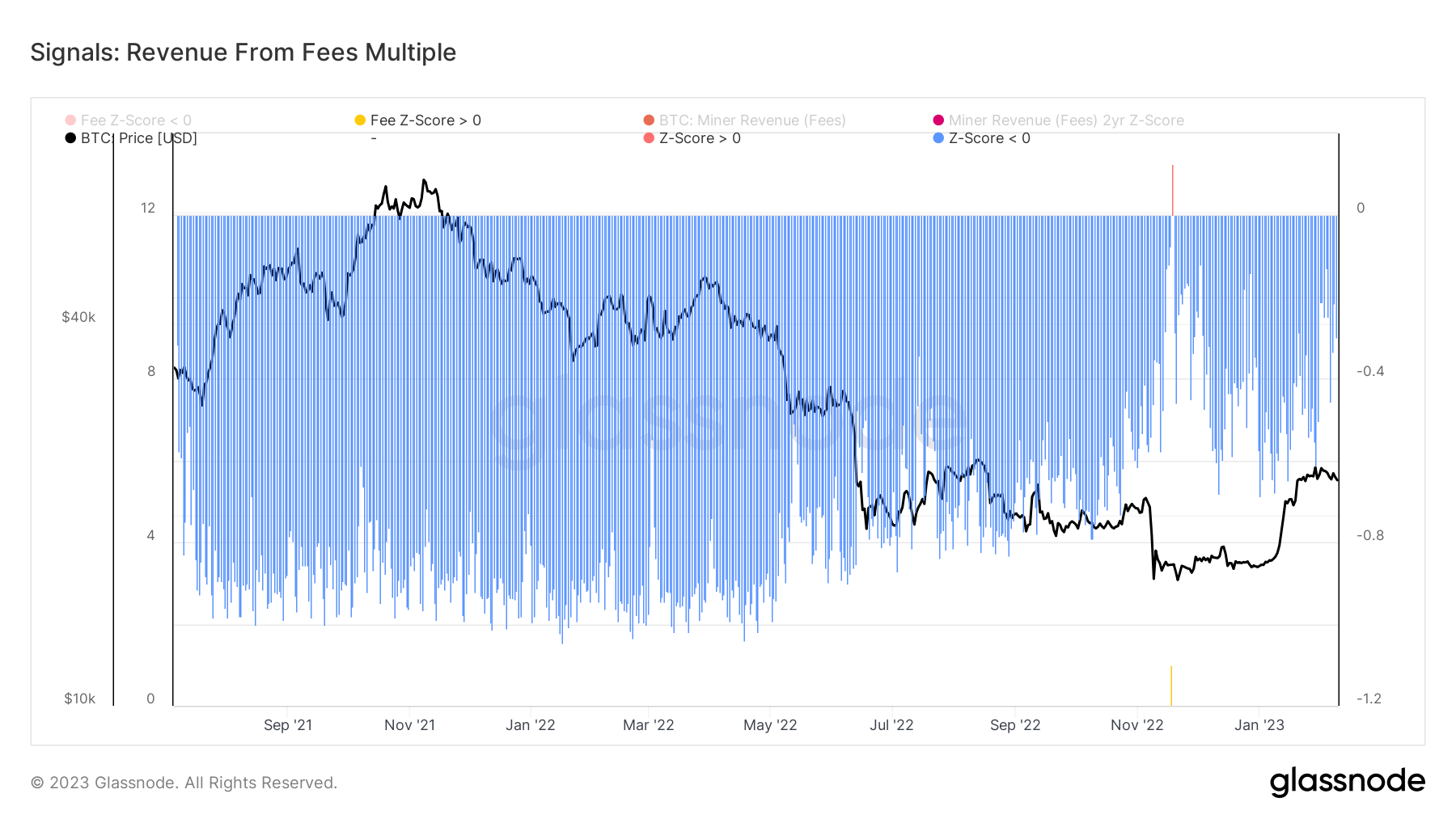

This can be seen in the Z-score of commission income. This indicates the number of standard deviations above or below the average commission earnings. During bull markets, Z-scores are higher than 0, indicating increased demand for block space and higher fees. Higher fees paid by users lead to increased fee income for miners. In a bear market, demand for blockspace will decrease, leading to lower fee income. The graph below shows positive z-scores in red and negative z-scores in blue.

The Z-score spike seen in November 2022 shows that the collapse of FTX has triggered an unprecedented demand for block space. Some of this demand may be due to aggressive accumulation, but most is due to panic selling.

Digging deeper into the Z-score confirms previous findings that the bull market has stopped in mid-2021. The second half of 2021 saw a significant drop in block space demand. This is evident in the consistently low Z-scores.

But 2023 has created a new appetite for block space. The Z-score has been slowly but steadily increasing and he peaked in late January with the start of the Bitcoin Ordinals. Z-scores clearly increased in February, and this trend is likely to continue throughout the quarter as the number of transactions increases.

As covered in our previous CryptoSlate market report, Bitcoin has broken through multiple resistance levels over the past three months.

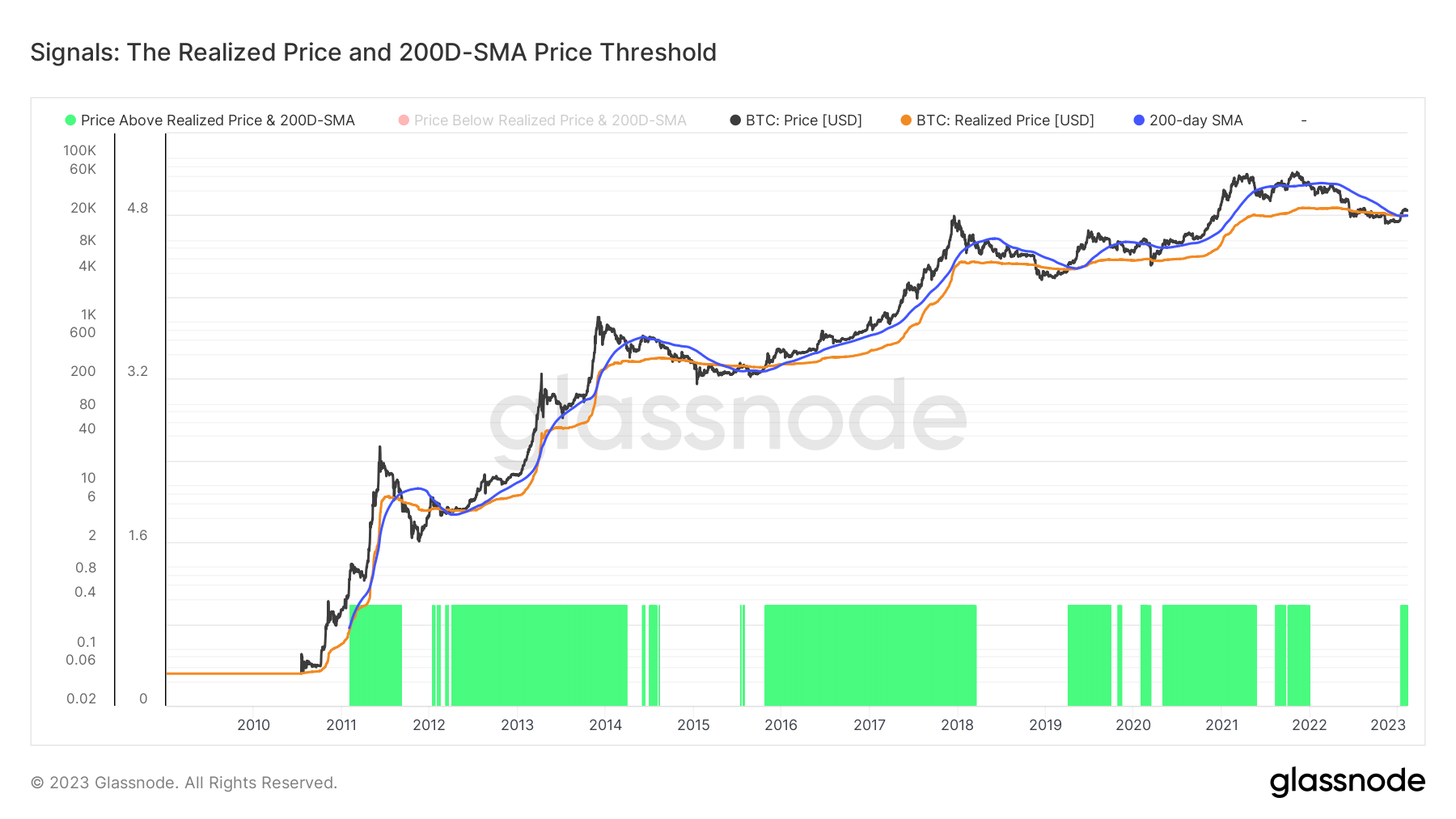

Since the beginning of the year, Bitcoin’s price has risen above the realized price and the 200-day SMA. The 200-day SMA is a key indicator of Bitcoin’s price movement and when crossed, it marks the beginning of a bullish trend.

Realized price is also a solid measure of the value held in the market. Trading above realized price allows you to identify total profitability and recognize unrealized gains.

The last time this happened was in December 2021, but the trend was short-lived. Prior to that, it broke above the realized price and his 200-day SMA around April 2020, sparking a bull market that will last until late 2021.

With Bitcoin currently trading above both indicators, the market may be gearing up for a bullish reversal. The emergence of unrealized gains lost in this winter’s bear market could bring a new wave of demand to the market, pushing Bitcoin’s price higher.

An increase in the number of addresses and transactions clearly indicates an increase in network activity.

This increased network activity has increased the demand for block space, increased the cost of transactions, and increased miner revenues through fees.

In turn, a healthier and more active network will attract even more new users, creating additional demand and creating significant purchasing pressure.

Combined with other technical pricing models such as SOPR and P/L ratio, these trends suggest that Bitcoin may be emerging from a late bear market and gearing up for a bull market. suggests.

Pantera Capital, one of the biggest VCs in the crypto space, also seems to be aware of this trend, pointing out that the 7th bull market cycle has started in its latest report.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024