No products in the cart.

- Latest

- Trending

ADVERTISEMENT

The market turmoil caused by the collapse of FTX has seen record amounts of bitcoin drain from global exchanges.

Bitcoin Magazine Senior Analyst Dylan LeClair point out 136,992 BTC has been withdrawn in the past 30 days, adding that the event was “historic.” This figure equates to his 0.7% of the circulating supply.

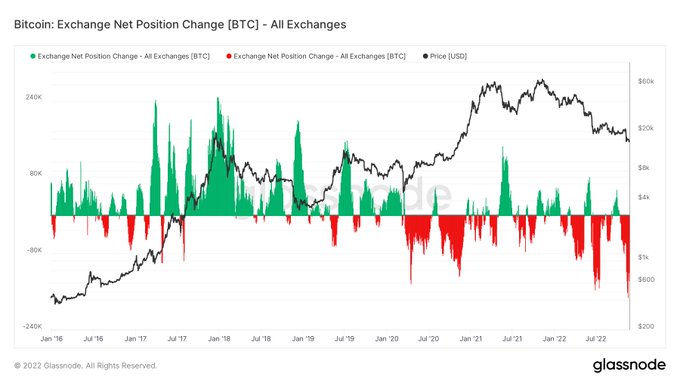

Along with the message, LeClair included an Exchange Net Position chart showing the size of Exodus. The chart below shows the highest net outflows from global exchanges since 2016.

The previous outflow peak was around June, at the height of the Terra implosion, when around 120,000 tokens were expelled from the exchange.

Commenting on the outflow trend, LeClair further commented:drain. they. all.

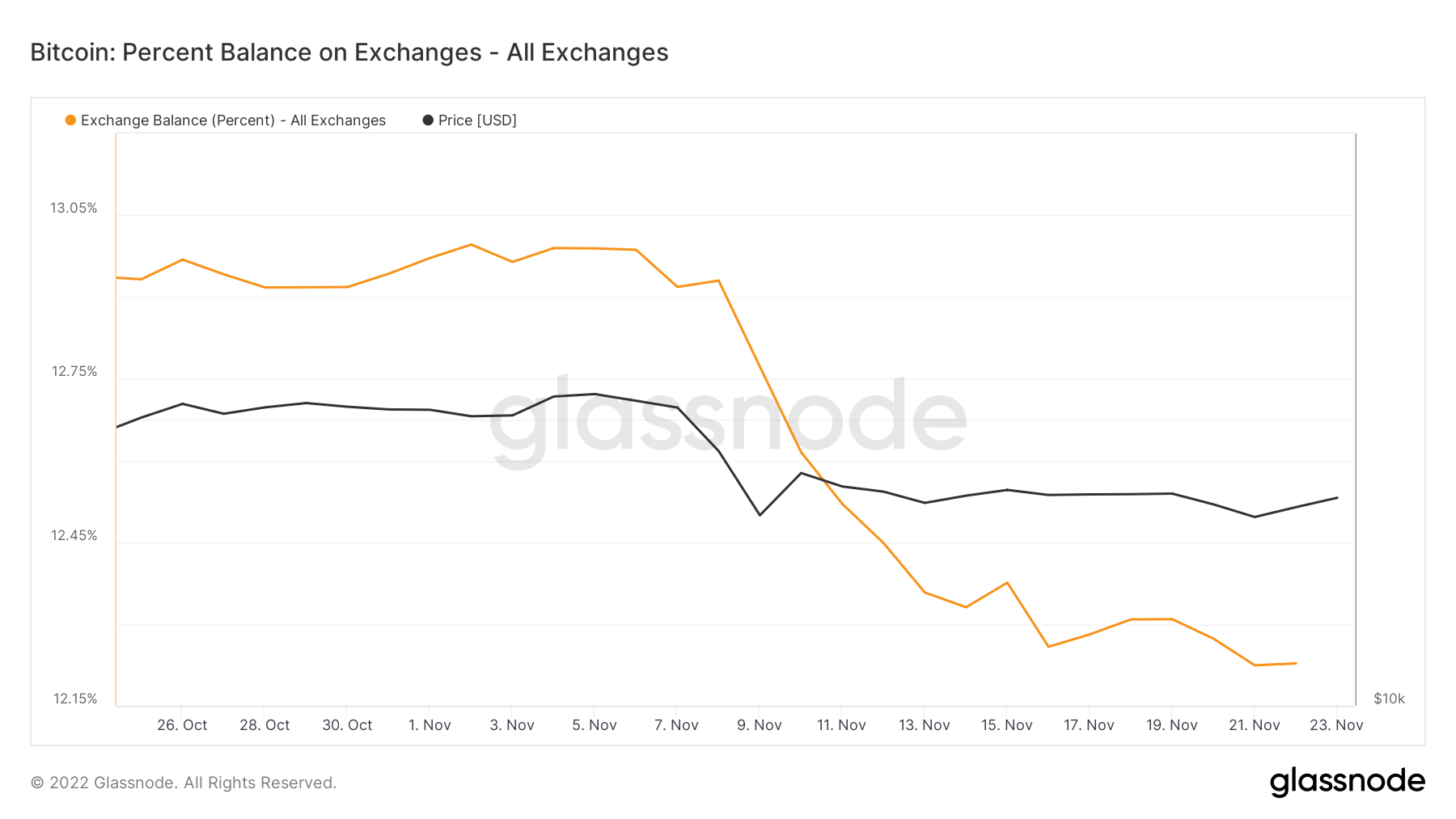

Data per Glassnode show holders heeding the warning as the percentage of Bitcoin held on the exchange dropped from 13% to 12.2% since rumors first circulated that FTX had a problem. indicates that

As news of FTX’s mismanagement made its way into the public domain, Bitcoin’s price dropped sharply in response to the allegations.

The peak-to-trough movement saw a 28% drawdown for major cryptocurrencies with a local bottom at $15,500 on Nov. 21.

After bottoming out, there were signs of price recovery, closing 3.8% higher on Tuesday. At the same time, buying pressure continued today as he grew 5% in the last 24 hours when BTC pressed.

However, the macro picture remains unchanged, meaning the bulls are unlikely to build on the current price action and make a meaningful counterattack above $20,000.

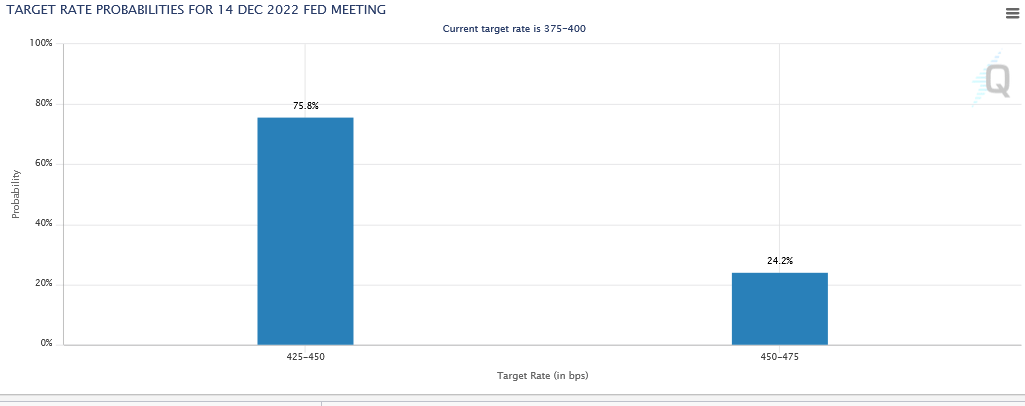

Investors are now poised to reverse the Fed’s policy of rate hikes before injecting capital. Federal Reserve Chairman Jerome Powell said on November 2 that he will raise interest rates by 75 basis points for the fourth time in a row, raising the federal fund rate to 3.75-4%.

The market is now in favor of the next 50 basis points rate hike and is optimistic about the Fed slowing its rate hike pace.

The FOMC will announce the results of its next meeting. December 14th.

Amid the FTX contagion, cryptocurrency broker Genesis warned it needed $1 billion in capital to stave off bankruptcy. The company is considered an important Bitcoin OTC desk.

so far we have come close binance and apollo Asking for help, the struggling brokerage has yet to raise the funding it said it needed to remain solvent.

The full outline of what went wrong is currently unknown. but, Lee DrogenThe CIO of investment management firm Starkiller Capital said Genesis’ problems stemmed from a financing deal with parent company Digital Capital Group (DCG).

What we basically hear from Genesis clients is that Barry did something similar with Sam. He has a related loan between Genesis and his DCG and he’s now falling into a big hole.

Lee Drogen (@LDrogen) November 21, 2022

Nonetheless, DCG CEO Barry Silbert recently downplayed the extent of the liquidity crisis, stating that Genesis will pay out $575 million from DCG in May 2023, bringing the group’s earnings to 8% this year. We expect it to be a billion dollars.

Become a member of CryptoSlate Edge to access our exclusive Discord community, more exclusive content and analytics.

On-chain analysis

price snapshot

more context

Register now for $19 per month Explore all benefits

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024