No products in the cart.

- Latest

- Trending

ADVERTISEMENT

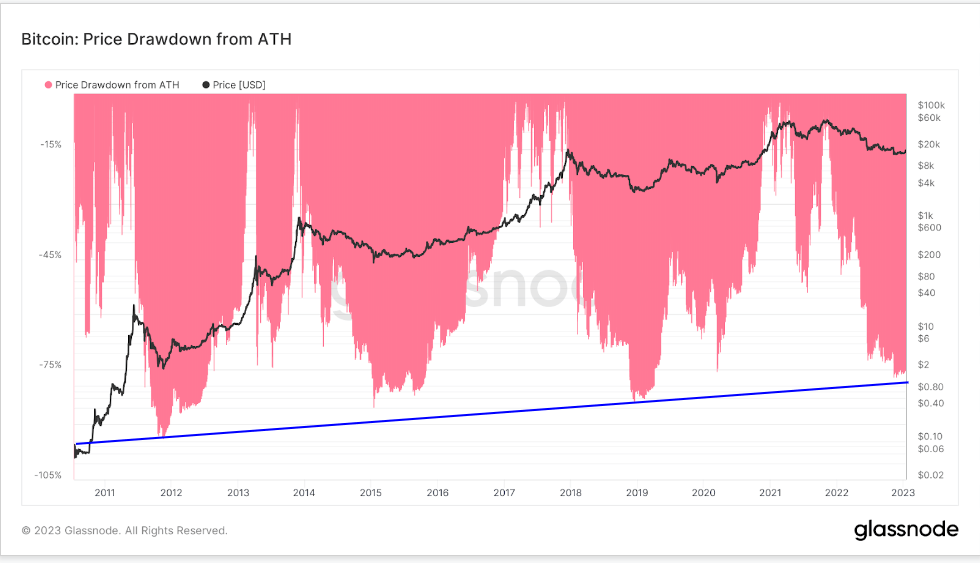

2022 has been an unprecedented year of demand collapse and wealth collapse across financial asset classes. Bitcoin has fallen 75% from its all-time high. However, this is his fourth-worst drawdown, and he continues to pull highs down cycle after cycle.

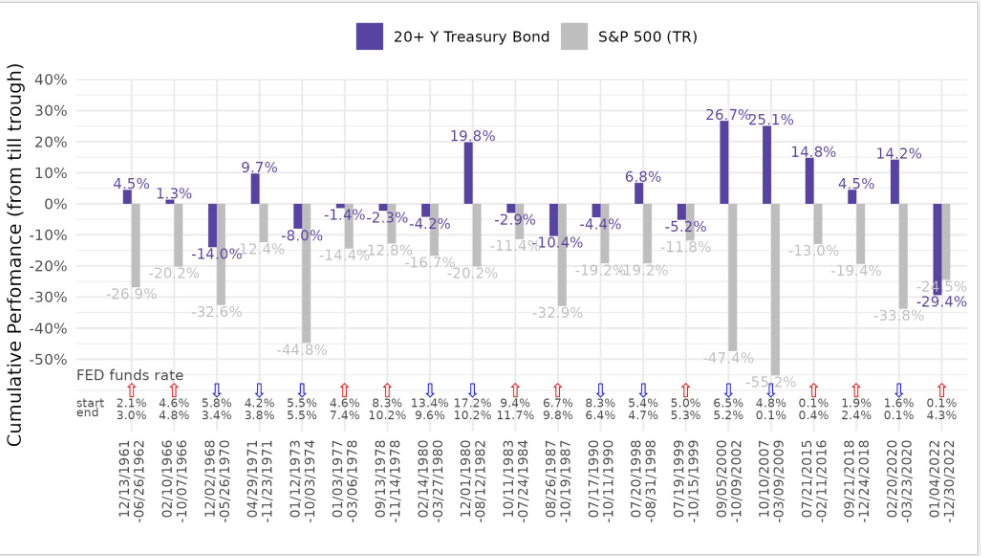

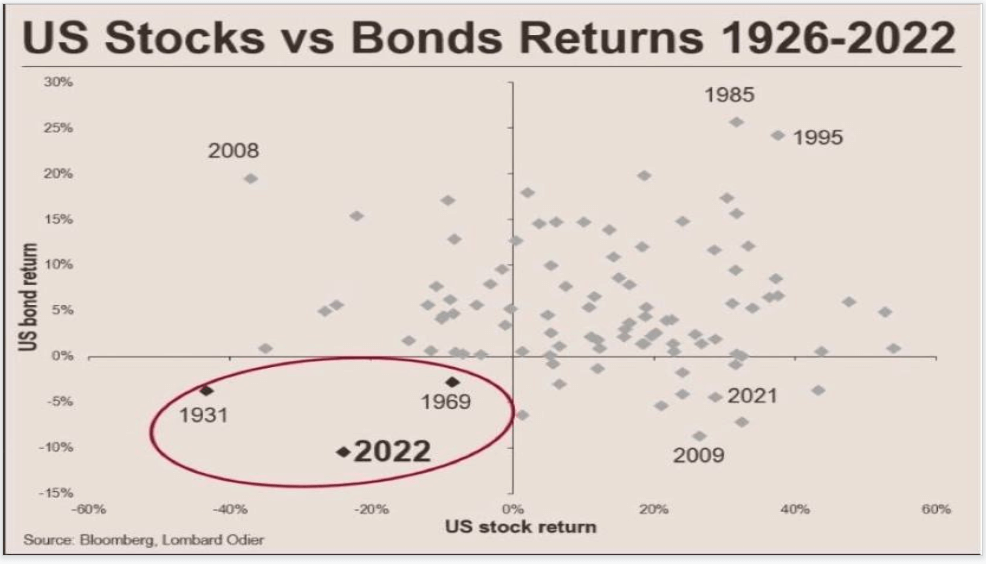

For over a decade, a 60/40 portfolio of stocks and bonds has protected investors in the worst of times. This is because the Treasury has been able to hedge downside volatility in equities. But Treasuries have performed worse than stocks, a feat not seen until the ’60s.

Moreover, US stock and bond returns were as bad as they were in 1931 and 1969. Then from 1931 and 1969 he was issued Executive Order 6102 two years later and the gold was confiscated (this is also where the difficulty adjustments regarding the 2016 block were made). ), and in 1971 when the United States moved off the gold standard. By its very nature, all eyes are on his 2024.

For more information, check out our recent BitTalk episode.

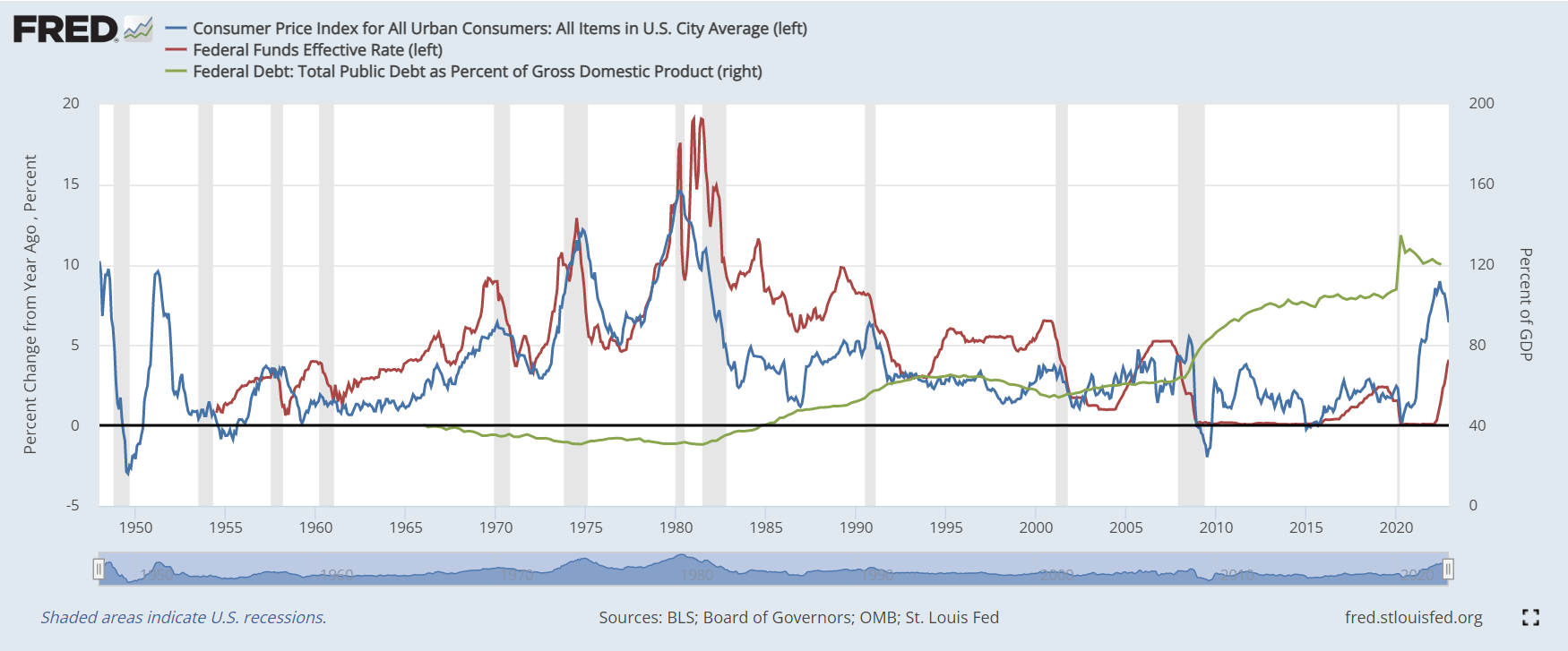

Since 1977, the Federal Reserve has operated under mandate from Congress.Effectively promote the goals of maximum employment, stable prices and moderate long-term interest rates is now known as double mandate.

With interest rates stuck at the 0 lower bound for over a decade, we can confidently say that this has not been achieved. His CPI inflation this week was 6.5%, down from 7.1% with the maximum employment rate as a lagging indicator. But notable layoffs have begun, especially in the technology and banking sectors.

As a result, central banks around the world have tightened over the past year, with some more aggressive than others as the likelihood of stagflation, a repeat of the 1970s, continues to rise. Stagflation, a combination of high inflation and economic stagnation, especially high unemployment, has yet to occur.

Due to the exponential debt problem in the western economy, where the US has a debt to GDP of 120%, setting interest rates above CPI inflation would destroy the economy and force the government to choose austerity. is not a method advocated by citizens. for.

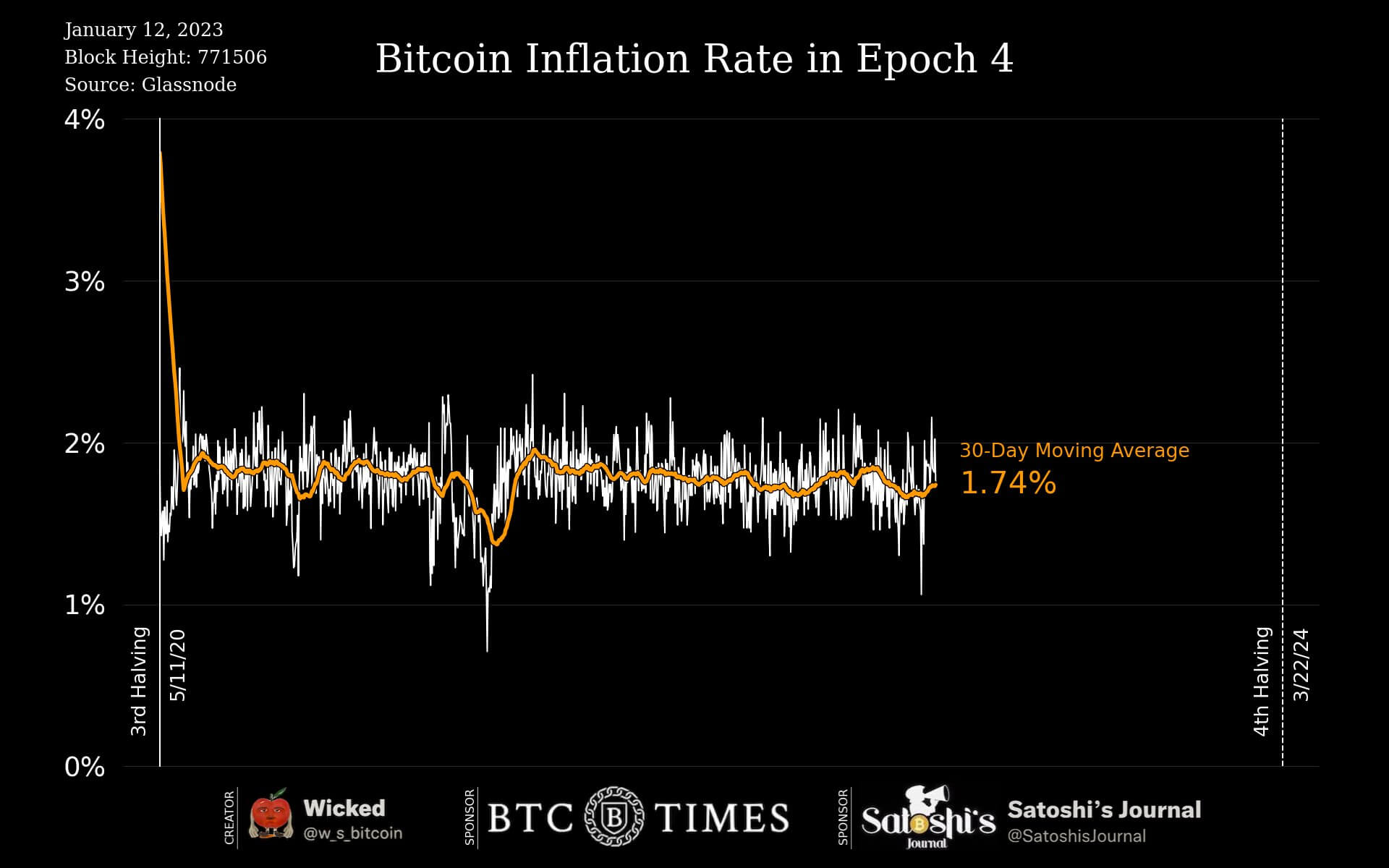

The funny side of this is that Bitcoin’s current inflation rate is below 2%, 1.78% to be exact, well below the central bank’s target during this time. Bitcoin inflation is the percentage of new coins issued divided by the current supply. Bitcoin has a predictable currency schedule, with 6.25 Bitcoins mined approximately every 10 minutes.

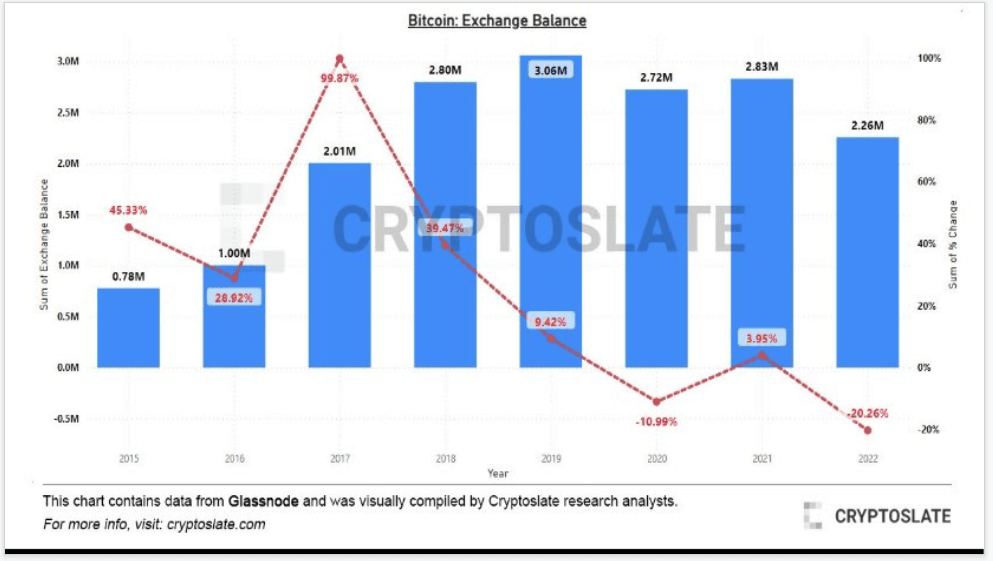

In 2022, the highest volume of Bitcoin withdrawn from exchanges was over 20%. This is ahead of his 2020, when more than 10% left the exchange.

There are currently 2.26 million bitcoins on exchanges, leaving around 11-12% of the bitcoin supply on exchanges. Many events triggered Exodus, including the collapse of Luna and FTX.

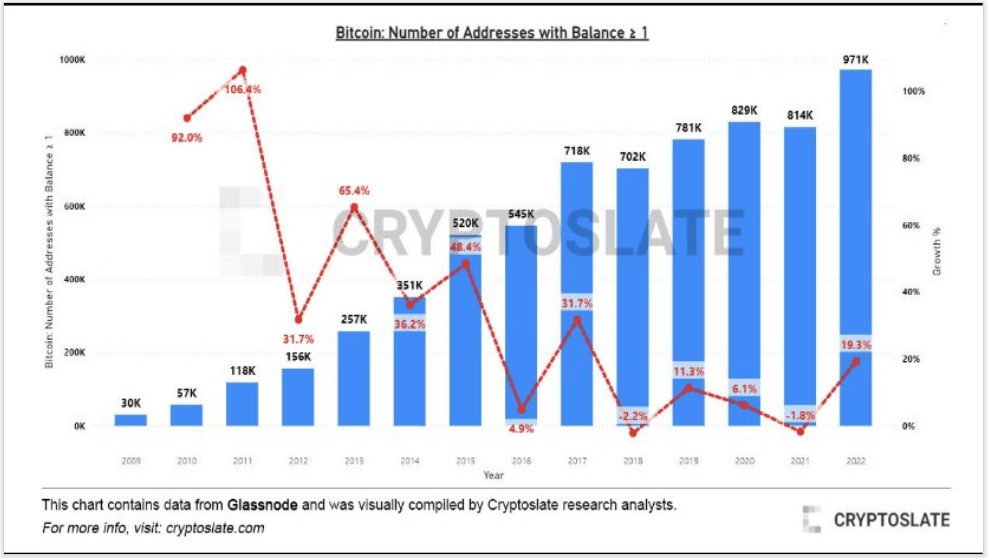

As Bitcoin continues to move away from exchanges in 2022, the number of addresses holding Bitcoin has increased. We are approaching 1,000,000 unique addresses holding at least 1 bitcoin.

It will increase by 19% in 2022, marking the largest year-over-year growth rate since 2017.

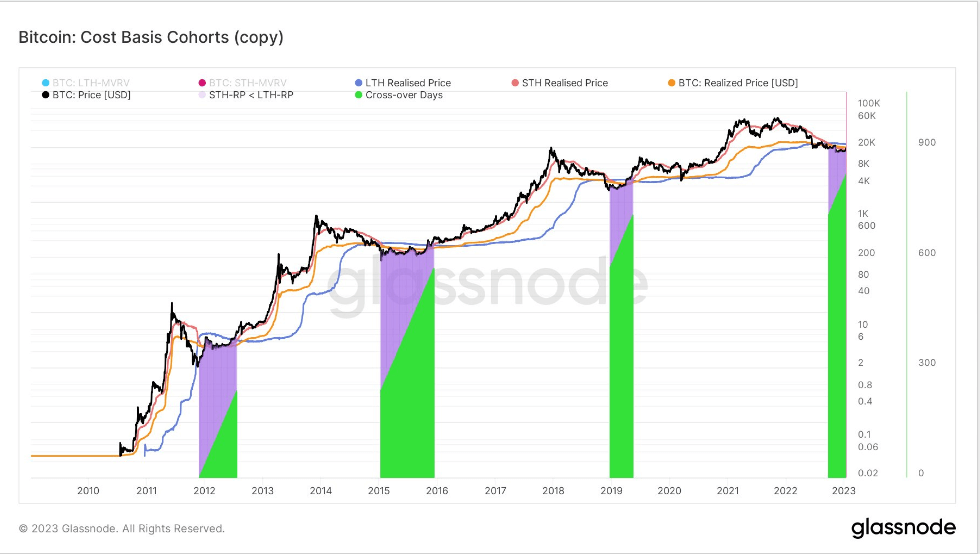

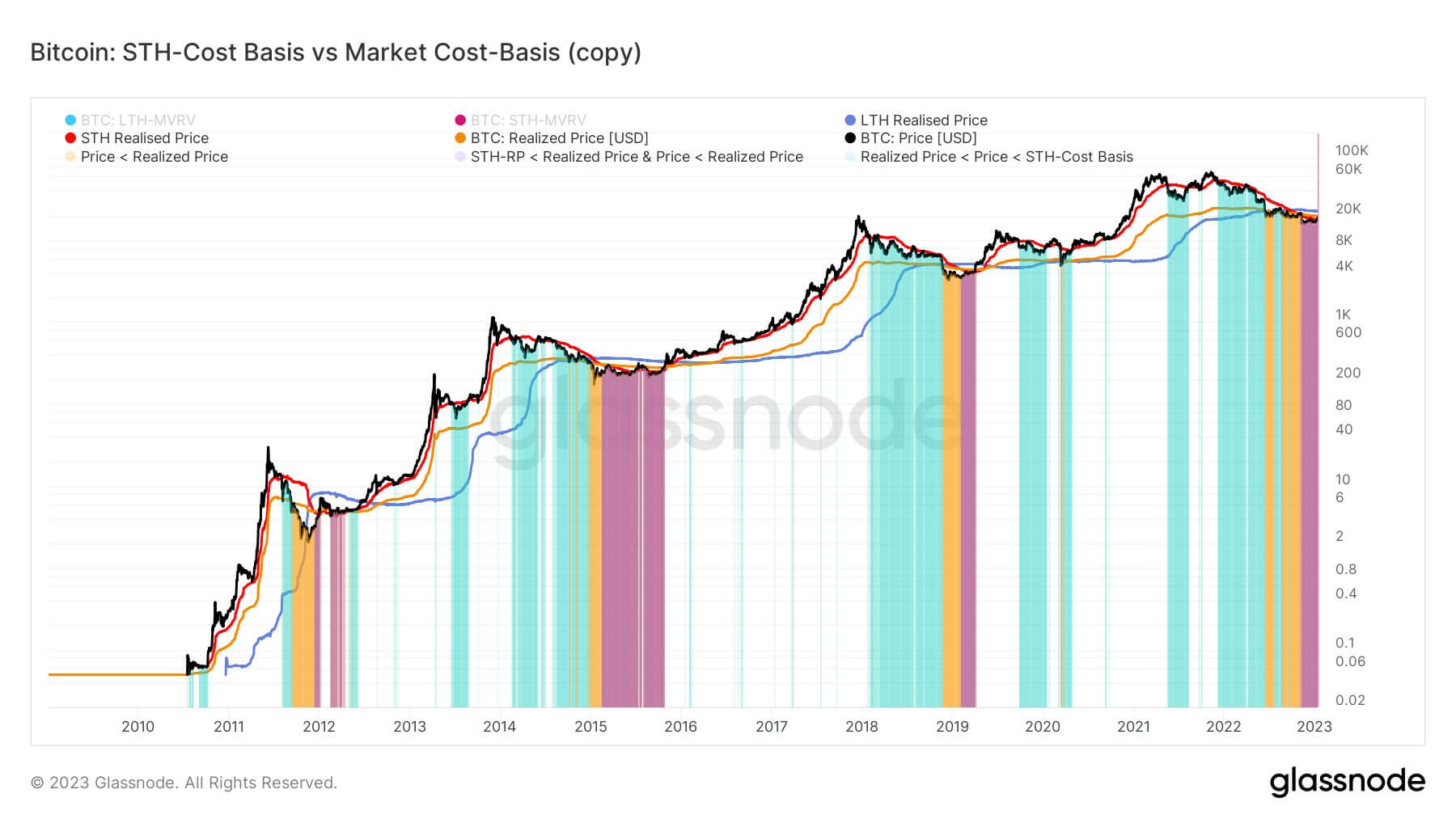

The realized price reflects the total price of each coin when it was last used on the chain.

Cohorts of short-term and long-term holders can be used to calculate realized prices that reflect each group’s total cost basis.

The LTH-STH cost basis ratio is then calculated as the ratio of the LTH and STH realized prices.

This is a classic example of bear market accumulation, as STH has realized losses at a higher rate than LTH.

Bitcoin had 4 periods The history of crossing STH, LTH and realized prices is 829 days. Now on day 110, the shortest of all four periods, he needs to break through $22.5k to exit the crossover.

During the depth of the bear market, Bitcoin only entered the realization zone, with STH and LTH falling below realization on only a handful of occasions, all of which are late bear markets that look similar to this cycle. Occurs in

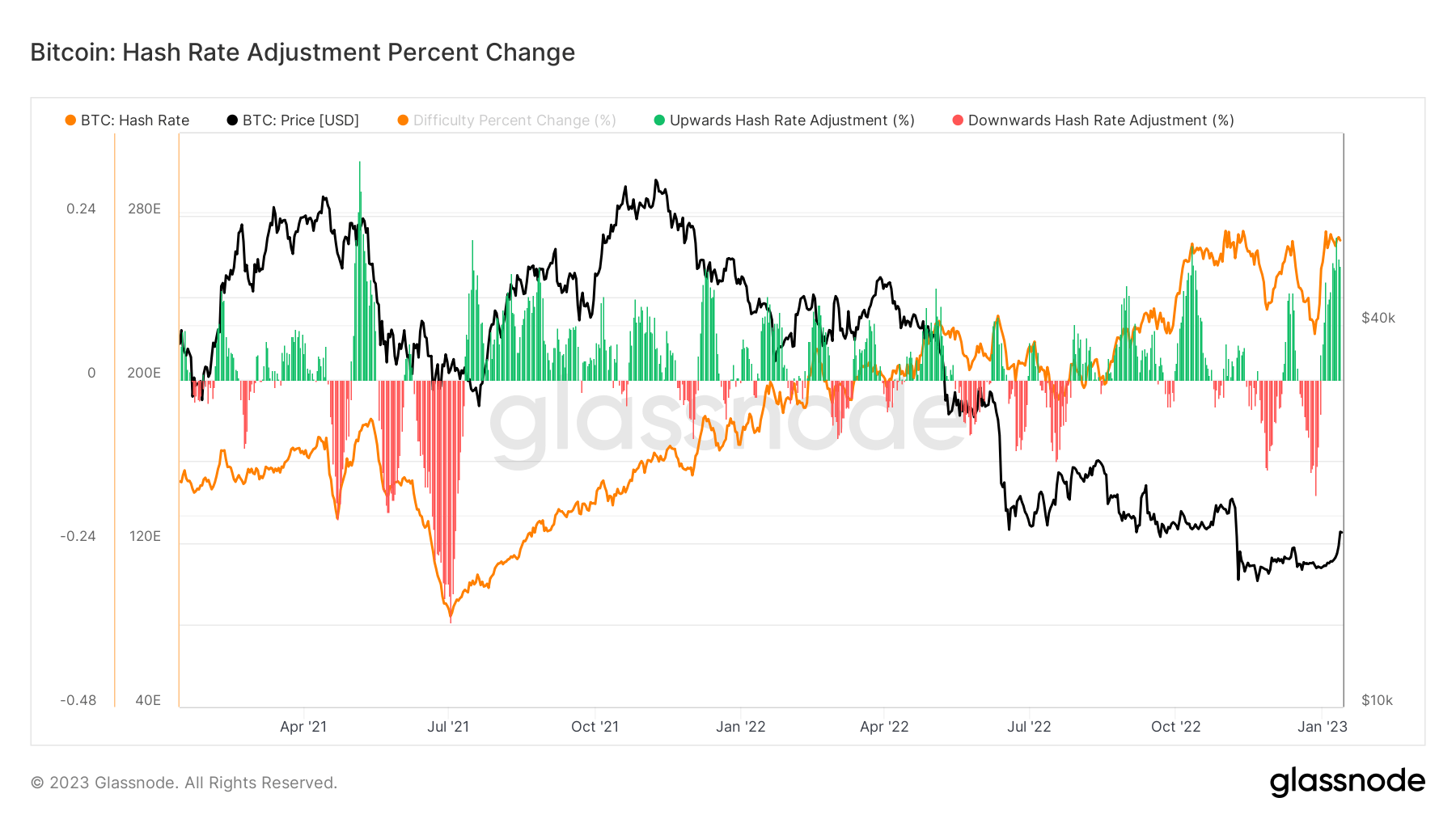

The hash rate surpassed 300 TH/s at the beginning of January, a record high.

With cheap debt acquired in 2021, miners are plugging in and companies that have filed for Chapter 11 bankruptcy haven’t unplugged their machines. This could be the reason why hashrate hasn’t dropped much in other bear markets.

Hashrate then jumped 20% in a single day, one of the largest daily % changes in years.

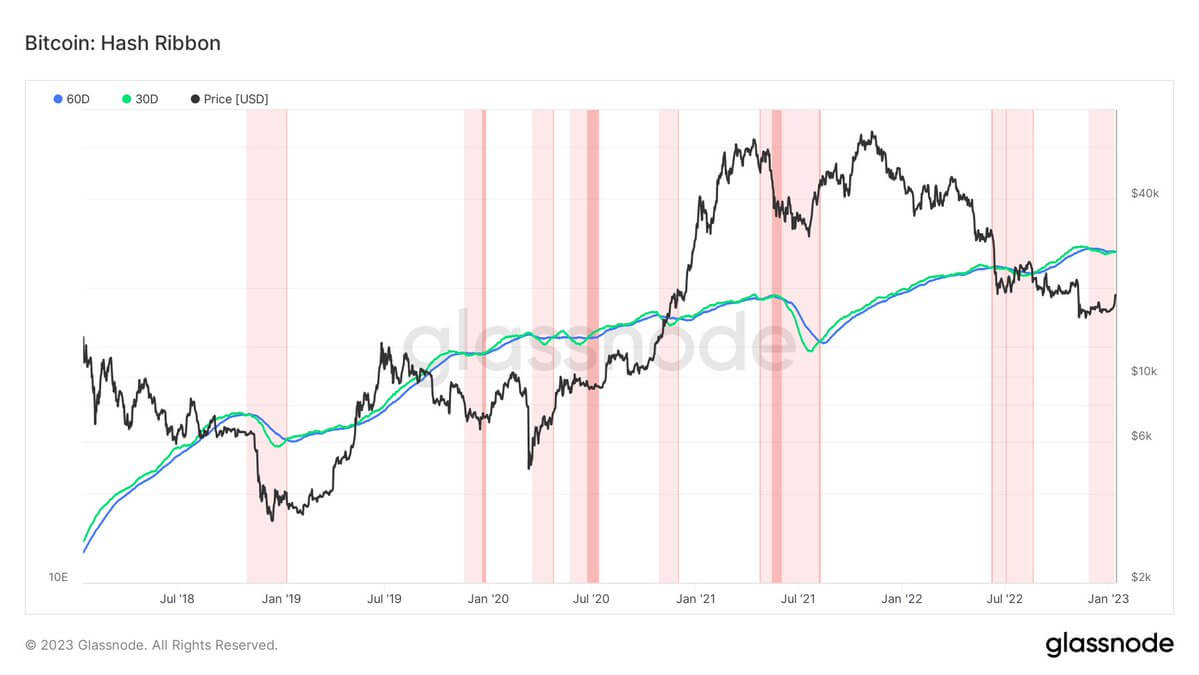

The hash ribbon is about to end its reversal as a result of the hash rate surge, signaling the end of miner capitulation. Bitcoin is too expensive to mine, so it tends to bottom out when miners surrender, and the price tends to rise after miners surrender.

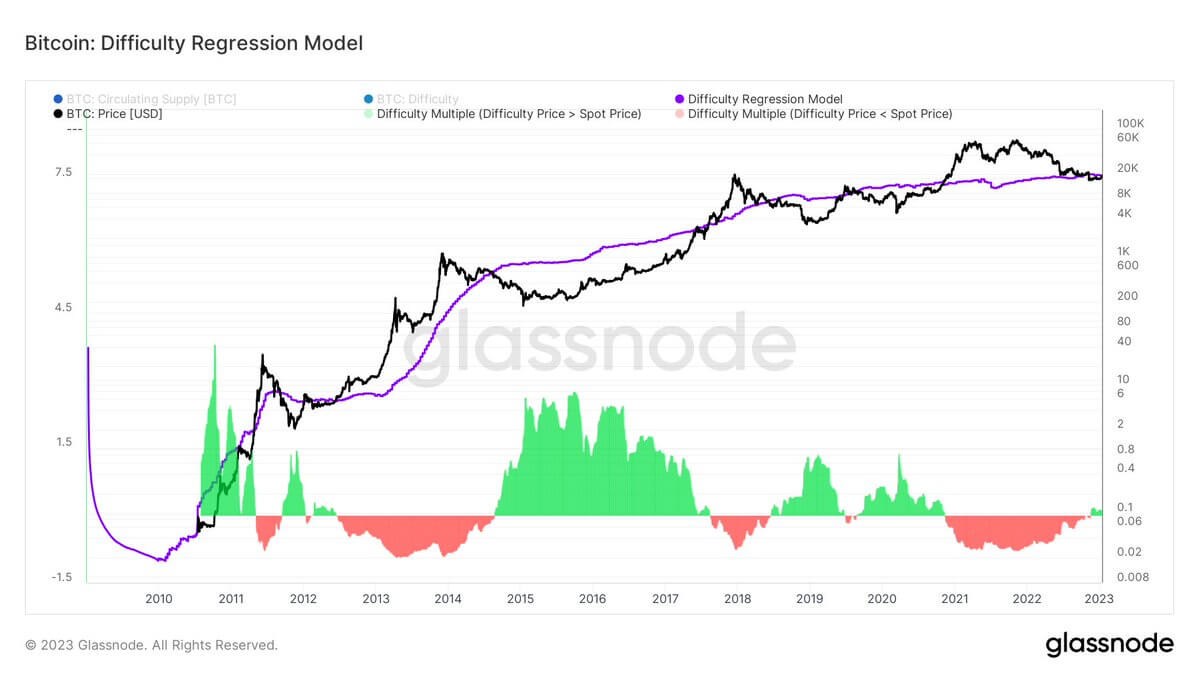

Finally, the difficulty regression model shows that we are on the fringes of bitcoin mining and trying to be profitable again.

The difficulty regression model is an estimate of Bitcoin’s total cost of production. Current estimated costs are based on difficulty and market cap. For a miner to be profitable on average, BTC needs to exceed his $19,000.

As you can see, during a bear market, the price of Bitcoin falls below the total cost of production, making it unprofitable. This is why miners have to pull the plug, thus hashing his rate down. As I said above, this bear market is different from all other bear markets.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024