No products in the cart.

Bitcoin short liquidations continue to pile up as BTC rises.

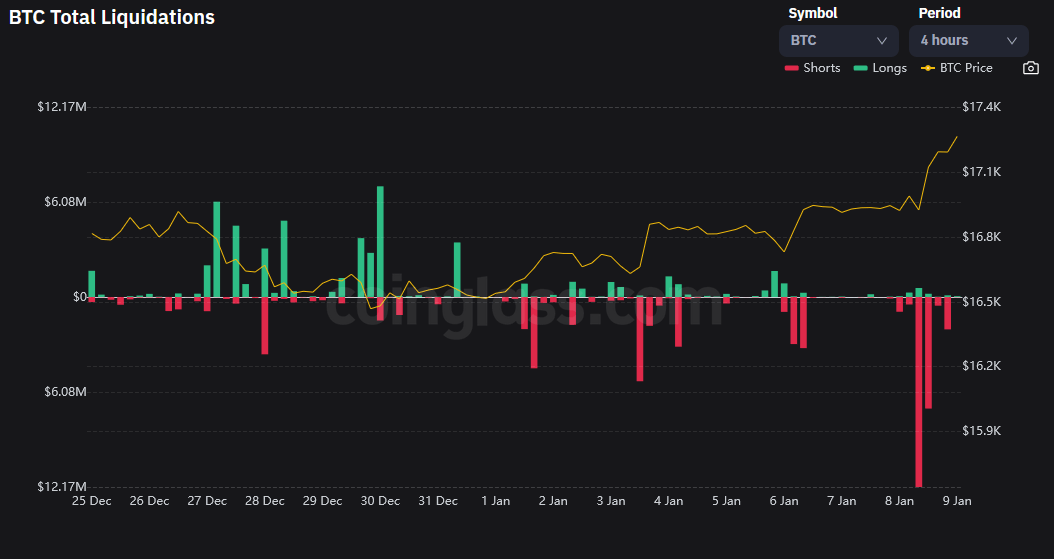

Coinglass showed that $53.24 million of shorts have been liquidated since the turn of the year. In contrast, during the same period he had $11.98 million long liquidated.

The 4-hour chart showed that the short-long divergence took effect mostly on Jan. 8-9 as Bitcoin rejected at $17,000 and definitively broke this level a few hours later.

Is the bull market back?

Over the past week, total market capitalization inflows reached approximately $46.6 billion, an increase of 5.8%. A previous example of similar inflows was before the FTX scandal, when his one-week market cap inflows starting Oct. 24, 2022 totaled $82.8 billion.

Some have speculated that the bull market may be back as new appetite for cryptocurrency investments appears to be rekindled. However, some have called it a sucker rally, given the pervasive macro uncertainty and the apparent lack of underpinnings.

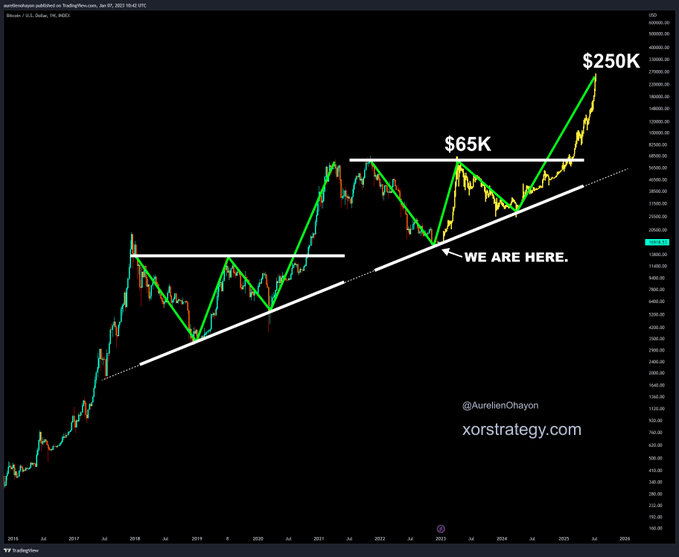

Nonetheless, some technical analysts were bullish optimists even before the weekend’s surge in capital inflows. for example, @AurelienOhayon Posting a chart showing BTC respecting the 2019 trendline, we predict it will jump to $65,000 by this summer.

youtuber as well @rovercrc Posted analysis showing Bitcoin is in a falling wedge.This usually breaks almost upwards 90% At the time. The tweet was accompanied by the following words:

“next #bitcoin Bull Run can start anytime!

Bitcoin’s dominance collapses

Interestingly, Bitcoin’s 24-hour gain was only 1.6%. Gala and Zilliqa, by contrast, currently lead the top 100, rising a staggering 62.8% and 49.3%, respectively, over the same period.

Since January 8, Bitcoin’s dominance has declined due to capital inflows into altcoins, dropping from 41.72% to 40.8% on Monday.

Posted In: Bitcoin, Bear Market