No products in the cart.

- Latest

- Trending

ADVERTISEMENT

It’s been almost a year since Facebook CEO and mime villain Mark Zuckerberg announced he was rebranding his company to Meta.

It was a big statement about the direction of the Metaverse, and many were beginning to declare that it would encompass everything from socializing to trading, from work to entertainment.

As I wrote last week, it’s a bet that’s gone against billionaires.

But are we seeing the same pattern across markets? Is interest in the metaverse waning?

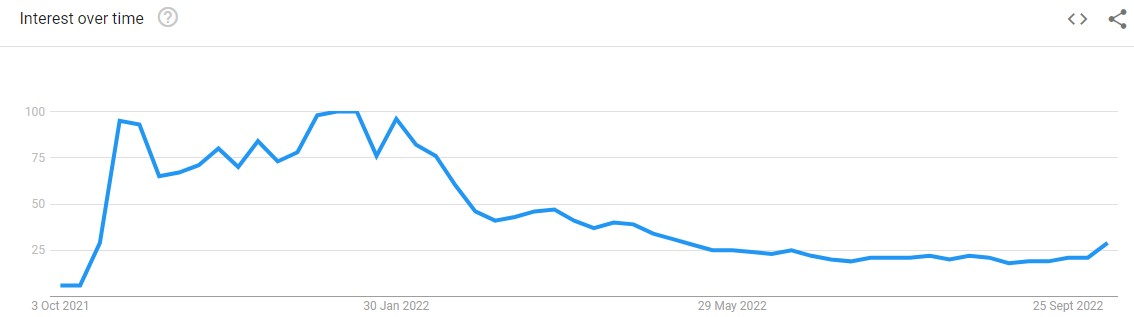

My first stop was at Google, where I saw a spike in interest in the term “metaverse” in search analytics after Zuck went all-in last October. Shortly thereafter, a steady downtrend.

Definitely a terrible chart. But how much of this is due to the concept of the metaverse itself, and how much is merely a result of the broader macro bear environment?

It’s hard to say, but there’s no question that many metaverse projects have been grossly overrated. Even if you believe in the metaverse, you may at the same time hold the opinion that many tokens in the space are overvalued, offer minimal utility, or both.

One of the things I still don’t understand is that so many investors are going to remote locations related to the metaverse, regardless of whether the investment has a verifiable plan to gain market share in the eventual metaverse. This is why we are willing to invest in

Admittedly, this blind punt is falling off a cliff at a time when the market is so brutal right now, but many of these companies still hold huge valuations after dropping more than 80%.

Remember, the Internet has changed the world immeasurably and exceeded even the most bullish expectations. But think of the number of companies that went bankrupt when the dot-com bubble burst.

An inspiring reference is Priceline.com. You may not recognize the name today, but it was once used by the largest internet companies. The paper was fascinating. With 500,000 unsold airline tickets every day, customers can use his Priceline to enter the prices they are willing to pay.

In this way, airlines let go of excess inventory, customers got cheaper seats, and a market equilibrium was found. It kind of makes sense, right? And all the while, Priceline was making cuts on each trade.

A business plan that makes sense. gaps in the market; and something at a party where people would have said, “Hmm, that’s so clever.”

It launched in 1998 and sold 100,000 tickets in 7 months. Just 13 months after launch, it went public at $16 per share. On day one he surged to $88 and settled at $69. There were also plans to expand further. Why doesn’t this system work equally well in areas like hotel rooms, train tickets, and even mortgages?

It closed at $69 on IPO day, giving Priceline a valuation of nearly $10 billion. It was the most valuable company in the short history of the Internet.

And it went down 94%.

Of course, this story is nothing special. After peaking in April 2000, the Nasdaq lost more than a third of its value in just one month.

That brings me to my point. You don’t have to believe every company that claims to be an “Internet company” to believe in the Internet. These companies were notoriously loss-making, with a concept of profit unheard of in the dot-com era. Priceline, for example, lost $142.5 million in the first few quarters.

Yet the Internet has clearly changed the world.

There are many pricelines today. “Profit” in the dot-com era may be “utility” in the metaverse era. Before investing in these tokens, ask yourself what they actually do. Is there a clear roadmap for leveraging the metaverse to create something of tangible value? Most importantly, is there utility here?

Those seem like basic questions. And that’s kind of the point. They are really basic, but so many coins can’t answer them. You can technically create it with a simple copy and paste. Combine this with the fact that so much cash was pouring into the space from both investors and VCs, and it’s no surprise that so many tokens have completely collapsed.

Every Amazon has 10 price lines.

Another thing that needs to be mentioned here is that there is (obviously) no guarantee that the metaverse will remotely affect society as much as the Internet. Even if the internet hits every imaginable target, there are still many price lines. Imagine how many it would be if the internet flopped.

Don’t blindly punt anything with the name “metaverse” just because you believe in it.

Of course, for as long as we can foresee, every single crypto (metaverse or otherwise) will continue to follow the current macro environment, the stock market. So even something that offers utility and can be otherwise great will not benefit investors as long as the wider market continues to lag behind.

But even if the market recovers, the Metaverse Token will have to prove that it has really achieved something. So, as always in investing, it’s important to do your due diligence on the coin in question, block out the noise, and ask yourself the basic questions outlined above.

Don’t let the Metaverse seduce you with sweet words whispered in your ear. A utopian dream is not to pay the bills at the end of the day. As proof of that, there’s his dotcom bubble.

Copyright © Pbird Media | Copyright © All rights reserved 2024

Copyright © Pbird Media | Copyright © All rights reserved 2024